The Scoop

US regulators’ price-fixing case against an oil executive focuses on comments he made in the early days of the pandemic, when the industry was reeling from cratering demand, people familiar with the investigation said.

Scott Sheffield, the longtime CEO of Pioneer Natural Resources who stepped down last year, was barred earlier this month from serving on the board of Exxon Mobil while antitrust regulators investigate whether he conspired with rival oil executives to curb production, potentially leading to higher prices at the pump.

Exxon bought Pioneer for $60 billion on May 3, after the Federal Trade Commission signed off with that condition. The FTC has referred the matter to the Justice Department, which has the ability to pursue criminal actions, Semafor previously reported.

Previewing its case, the government referenced text conversations between Sheffield and other oil executives and representatives of OPEC, the cartel of major oil-producing countries that includes Saudi Arabia, the United Arab Emirates, and Venezuela. People familiar with the investigation say much of the agency’s evidence so far comes from Sheffield’s formal efforts in the spring of 2020 to lobby a Texas regulator empowered to limit drilling during times of market turmoil, and whether those official channels gave way to backroom dealings that broke the law.

As factories went dark, and cars and trucks sat idle during early Covid lockdowns, energy demand tanked. Saudi Arabia chose that moment to start a price war with Russia, which had rejected a Saudi-led plan to curb production in response to falling oil demand in China, and opened its spigots.

There was more oil coming out of wells than there were places to store it, and as a result, prices briefly went negative — an unthinkable market quirk for the world’s most crucial and ubiquitous commodity.

The Railroad Commission of Texas can legally cap oil production in the state that exceeds demand and will lead to “waste,” and in March 2020, Sheffield was a leading voice in the industry urging it to do so. Pioneer and another shale producer, Parsley, run at the time by Sheffield’s son, filed a petition to the commission citing “unprecedented disruption resulting from simultaneous, opposing shocks to both supply and demand.”

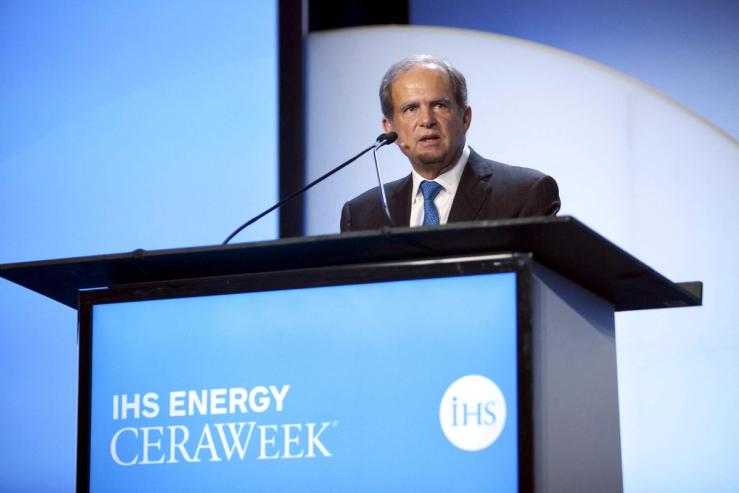

The FTC complaint also cites a text Sheffield sent to his son in June 2020, saying he “just got off the phone with UAE oil minister” who was complaining about Parsley’s comments at the time about ramping production back up as lockdowns eased. Sheffield now says that phone call was an online meeting organized by CERA, an energy industry group, whose widely attended annual conference, like many in the spring of 2020, had been replaced by a Zoom. (Pioneer bought Parsley six months later.)

In this article:

Liz’s view

We don’t know exactly what the FTC has in its heavily redacted complaint, which it feels warrants referring the case to federal prosecutors who might pursue criminal charges against Sheffield. But a focus on official comments he made in the spring of 2020 puts the case in a different light.

There are times when we want industries to set competitive dynamics aside and pull together for the national good. The pandemic was one of them.

Sometimes companies can get there without coordinating: Airlines, more or less independently, decided to pare back their flights to China in early 2020 and then eventually ground most of their flights. But the Detroit automakers were a tougher crowd: An agreement among General Motors, Ford, and Stellantis to shut their factories in March 2020 was delayed in part because the companies were reluctant to put their executives on a joint conference call with the United Auto Workers for fear of being accused of colluding on production schedules, I reported in my book.

The government has repeatedly encouraged companies to share details of their cybersecurity defense plans and promised not to treat those discussions, “unstructured or very structured, human-to-human or automated, or somewhere in between,” as collusive. It has praised coordinated efforts by social media firms to aggressively police terrorist content and gathered their executives together to devise industry-wide plans.

As the definition of national security continues to expand, it’s not hard to see oil production fitting the bill, especially with the Middle East and Russia both embroiled in wars. Indeed, that Exxon’s deal for Pioneer was approved at all by antitrust regulators that have been challenging almost every big new corporate merger — and relitigating some old ones — suggests that energy policy considerations outweighed antitrust ones.

In his own defense, Sheffield doesn’t really make that argument. He focuses on free-speech arguments, which he says protect his ability to say — publicly or privately — what he thinks is best for his company and his industry. “Publicly and unjustifiably vilifying me will have a chilling effect on the ability of business leaders in any sector of our economy to address shareholder demands and to exercise their constitutionally protected right to advocate for their industries,” he said this week, when he submitted his response to the FTC allegations.

In 2020, his comments to the Texas commission and to the press weren’t about national security but about Pioneer’s own bottom line. “Our industry has created so much economic waste that nobody will buy our stocks,” Sheffield said in a live-streamed meeting, according to Texas Monthly. “If the Texas Railroad Commission doesn’t regulate long-term, we will disappear like the coal industry.”

Room for Disagreement

Senate Democrats led by Majority Leader Chuck Schumer today asked the Justice Department for a broader review of the oil industry and possible antitrust violations. The FTC’s claims against Sheffield “lend credence to the fear that corporate avarice is keeping prices artificially high,” they wrote.

Notable

- What capital discipline? The number of US oil rigs is nearly back to pre-pandemic levels — Policy Tensor

- OPEC Plus extended its production cuts through next month — NYT