The News

The nightmare scenario for elite universities is here. The flood of White House actions aimed at private colleges can be hard to follow. But think of these universities as companies, and the math gets simpler — and the dangers become stark.

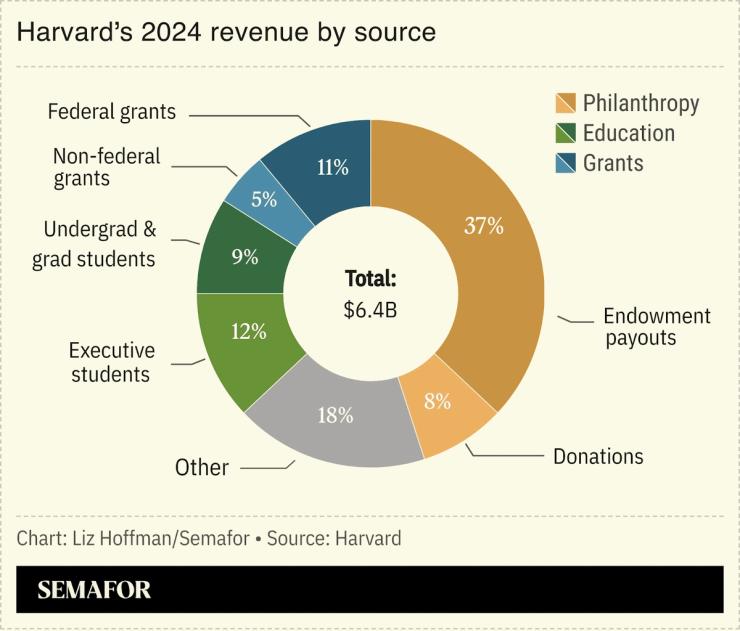

Top universities are financial titans, generating investment profits that mirror those of Wall Street firms. They are health care companies; the University of Pennsylvania gets half its revenue from the hospitals it runs. They commercialize the inventions that spring from their labs. They sell four-year subscriptions for rent and classes to their students and lifelong memberships in an elite club to their donors (posthumous, if the checks are big enough).

By revenue, UPenn is bigger than BNY Mellon; Columbia is as big as Coinbase. But these universities operate on profit margins thinner than those of a grocery store. In short, they make a lot of money but spend almost all of it.

That leaves little wiggle room when any of their revenue streams is threatened, as they are all now by the Trump administration. Harvard has sued to block several of the president’s attacks. “They want to show how smart they are, and they’re getting their ass kicked,” Trump told reporters Wednesday.

Know More

Here’s how the administration’s pressure campaign could add up to an existential threat to university finances:

Loss of federal funding. The US government has yanked more than $3 billion in federal grants and contracts from Harvard since April. Other universities are even more exposed: MIT gets 48% of its revenue from the federal government, while Johns Hopkins gets 42%, according to the Urban Institute.

Higher taxes. Universities rely on their tax-exempt status in three ways. First, they pay low or no taxes on the investment profits generated by their endowments. Second, donors can write off the money they give to universities as a charitable expense. Third, universities can raise money more cheaply than for-profit companies by selling tax-exempt bonds. (Bondholders pay no taxes on the interest they receive, and so are willing to offer better terms.) Just over half of the $1.6 billion in bonds Harvard sold in 2024 were tax-exempt.

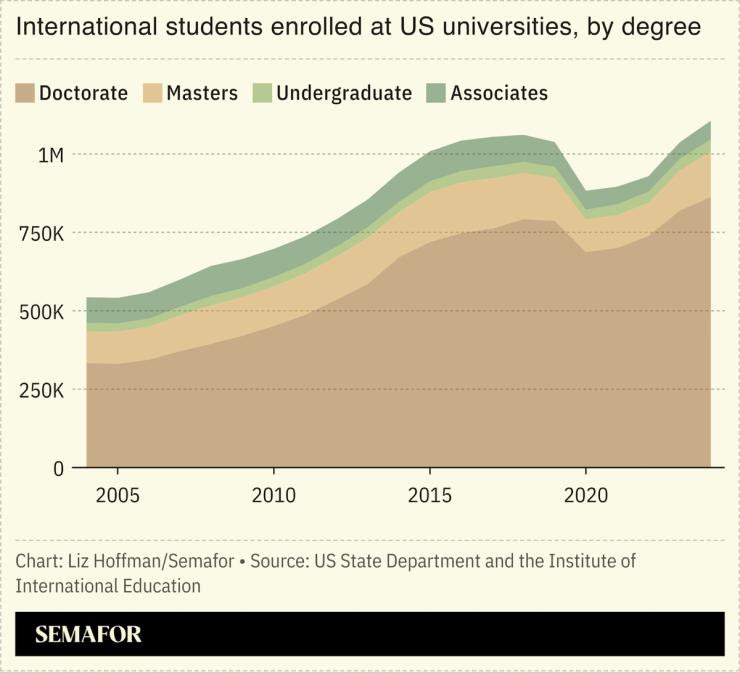

Bans on enrolling international students. Students from abroad make up as much as one-quarter of undergraduates at elite colleges and tend to pay sticker price, while American students get discounts, scholarships, and federal aid. The Trump administration’s efforts to ban them from campus — including a State Department memo this week telling US embassies to stop scheduling visa interviews and Secretary Marco Rubio targeting Chinese students — would rob universities of their best customers. That is especially true in graduate programs, which rely more heavily on foreign students paying full sticker price.

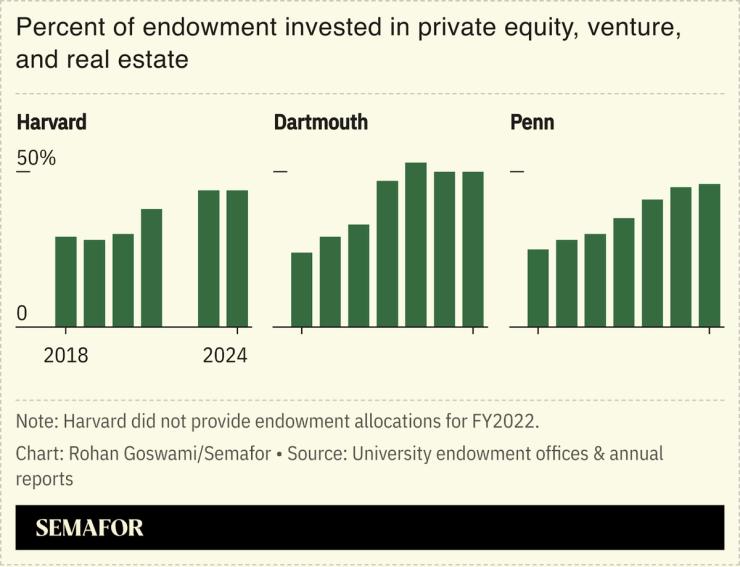

Forced sale of assets disfavored by the Trump administration. Semafor reported last month that Trump officials may scrutinize university endowments and potentially pressure them to sell holdings disfavored by the White House, like overseas investments or those made under an ESG framework. Forced fire sales would make it harder for endowments to fund operations, even before being asked to cut bigger checks to make up for shortfalls elsewhere.

And the biggie: University endowments have too much of their money tied up in assets that can’t be sold quickly. Inspired by Yale’s pioneering chief investment officer, David Swensen, they plowed into illiquid investments — private equity, private credit, real estate, and venture capital — assuming that they’d never be asked to contribute more than 5% or so of their university’s annual budgets. Wall Street investors are expecting endowments to look to sell portfolios of these stuck investments for cash in the coming weeks.

Summing up: The Trump administration’s across-the-front assault — if it survives legal challenges — could push universities into financial ruin. So far, universities have been borrowing to fill the gap, and my colleague Reed Albergotti recently highlighted some ways that Silicon Valley is stepping in to fund research, but neither source can fill the gap.

Step Back

The nightmare scenario outlined above would hit US banks, which have built a brisk business lending against the good name of university endowments.

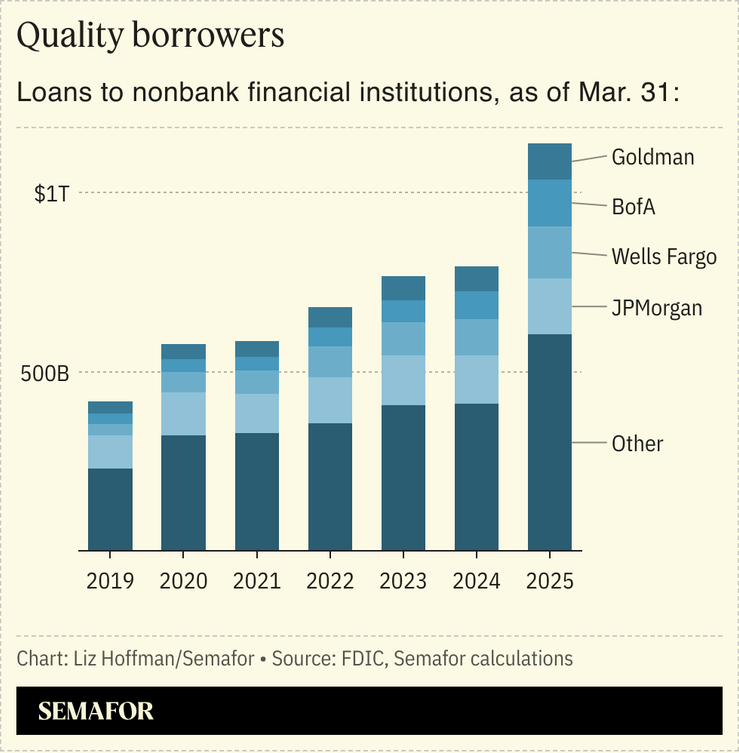

In recent years, banks have lent money to Wall Street investment firms, backed by the promises from Harvard and other university endowments to pony up money for their next funds. The total size of these “capital call” loans isn’t clear, but they belong to a fast-growing bucket of loans that has worried global regulators, which are watching the post-2008 financial reordering for signs of a spillover event.

Loans against fund commitments by university endowments are a big chunk of those loans, and they have been assumed to be safe, on that theory that big institutions wouldn’t renege on promises to invest in, for example, Blackstone’s next fund: “Our counterparty here is, like, Harvard,” one Goldman executive told me in early 2024.