The News

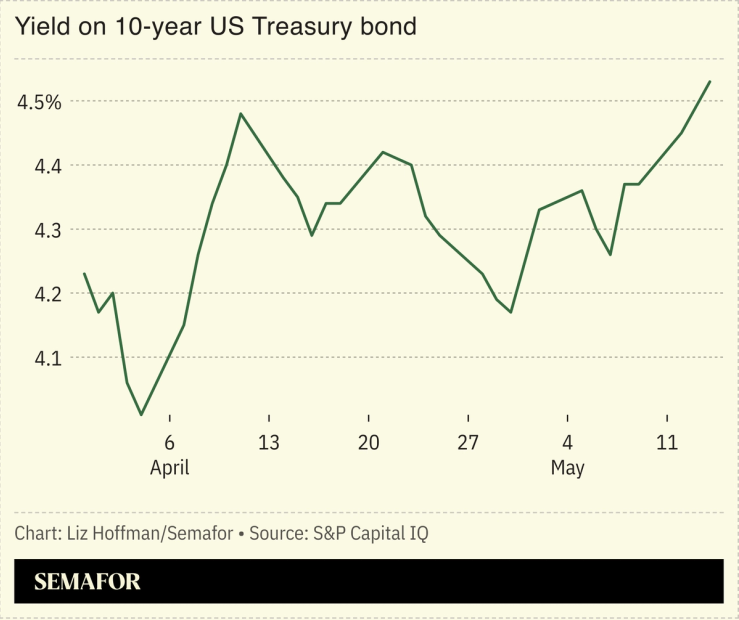

US government borrowing costs rose to levels above the selloff that followed President Donald Trump’s “Liberation Day” tariffs last month, driven by traders worried by Republicans’ “big beautiful bill” that promises tax cuts far deeper than spending curbs.

Yields on 10-year Treasury bonds topped 4.5% on Wednesday — higher even than the borrowing costs that partly drove Trump to suspend his tariffs — on fears that higher inflation will delay interest-rate cuts and that growing deficits will force a new round of borrowing, ballooning the already worrisome national debt.

In this article:

Liz’s view

Bond investors are mutinous again. US government bonds sold off sharply in response to Trump’s tax and spending bill, raising fears that the US is in for its own “Liz Truss moment.” The UK prime minister was bounced from office in 2022 after proposing a budget that cut taxes far more than it cut spending — sowing fears that the government would have to borrow heavily to close the gap. Investors dumped their bonds and (aided by poor risk management in an arcane corner of the pension system) set off a gilt crisis.

Republicans’ “Big, Beautiful Bill” likewise cuts taxes more deeply than spending, and nonpartisan congressional accountants expect it to add $3.3 trillion to the national debt by 2034.

Bondholders don’t want to be bagholders, and there were already worries about declining demand for Treasury bonds. One market veteran told Bloomberg that “it may be necessary to have a repeat” of the UK crisis “to force everyone to do the right thing” and get serious about fiscal discipline.

As Semafor’s politics team has reported, the bill faces opposition from enough Republicans to sink it. “I’d be really seriously concerned on what the actual Plan B is, because I haven’t heard about it,” said Rep. Cory Mills, R-Fla.

The long-term fallout of a Truss-like episode shouldn’t be underestimated, though: UK government bonds have underperformed rich-country peers since 2022, Goldman Sachs said in a note to clients yesterday. “The experience of Gilts after the mini-crisis offers important lessons… as the US economy now exhibits a worse trade-off with low growth and high inflation,” the bank’s economists wrote.

The View From China

The US isn’t the only major economy where borrowing is in the spotlight: China’s net new issuance of government bonds is expanding at its fastest rate in a year, according to central bank data. The China-focused research firm Trivium noted that much of that growth was down to the government refinancing loans issued by local-government financing vehicles, which sit at the epicenter of what many analysts fear is a mountain of opaque borrowing. (The flip side is all this refinancing also “obscures whether firms’ demand for credit is rising or falling,” Trivium analysts added.)

Notable

- Bloomberg’s John Authers buys the theory that “Trump has given up on a certain kind of 2.0 radicalism, and will now follow his 1.0 model,” meaning tax cuts and appeasing the stock market.