The News

Card payments provider American Express rolled out four new credit cards in Nigeria this week, in its push to become a dominant player in Africa’s fledgling credit market.

The cards, which are dollar-denominated and target both individuals and businesses, are produced with O3 Capital, a decade-old card issuing company in Lagos, Nigeria.

Until now, O3 had provided credit cards in the naira currency alone. It will be the direct lender to Nigerian customers who take up the cards, determining eligibility, interest rates and other terms of service. American Express will provide its lending expertise, security and anti-fraud support, access to a global network of 89 million merchants, and membership benefits, both companies said.

American Express credit cards first became available in Nigeria last year through a partnership with Access Bank, Nigeria’s largest commercial bank by assets. The latest rollout with O3 underscores the US company’s perception of Nigeria as a large market with potential.

“Nigeria is a growing country on an upward trajectory, in terms of the resources it has and the industries it’s building,” Mohammed Badi, American Express’ president of Global Network Services, told Semafor Africa. “We want to be part of that growth story.”

Beyond credit cards, American Express also plans to extend the acceptance of all its cards in a dozen more sub-Saharan African countries “by some time next year,” taking the number of countries where it is accepted on the continent to 42, Badi said.

In this article:

Know More

Nigerian banks usually issue credit cards in partnership with leading global card networks. For example, Guaranty Trust Bank, and Standard Chartered issue naira credit cards with Visa, another US financial services multinational, while United Bank for Africa’s are issued with Mastercard.

Consumer lending in Nigeria is a $3 billion market, according to Lagos-based consultancy Stears. But with the exception of employed people who own bank accounts, borrowing in Nigeria happens outside the bank in informal channels.

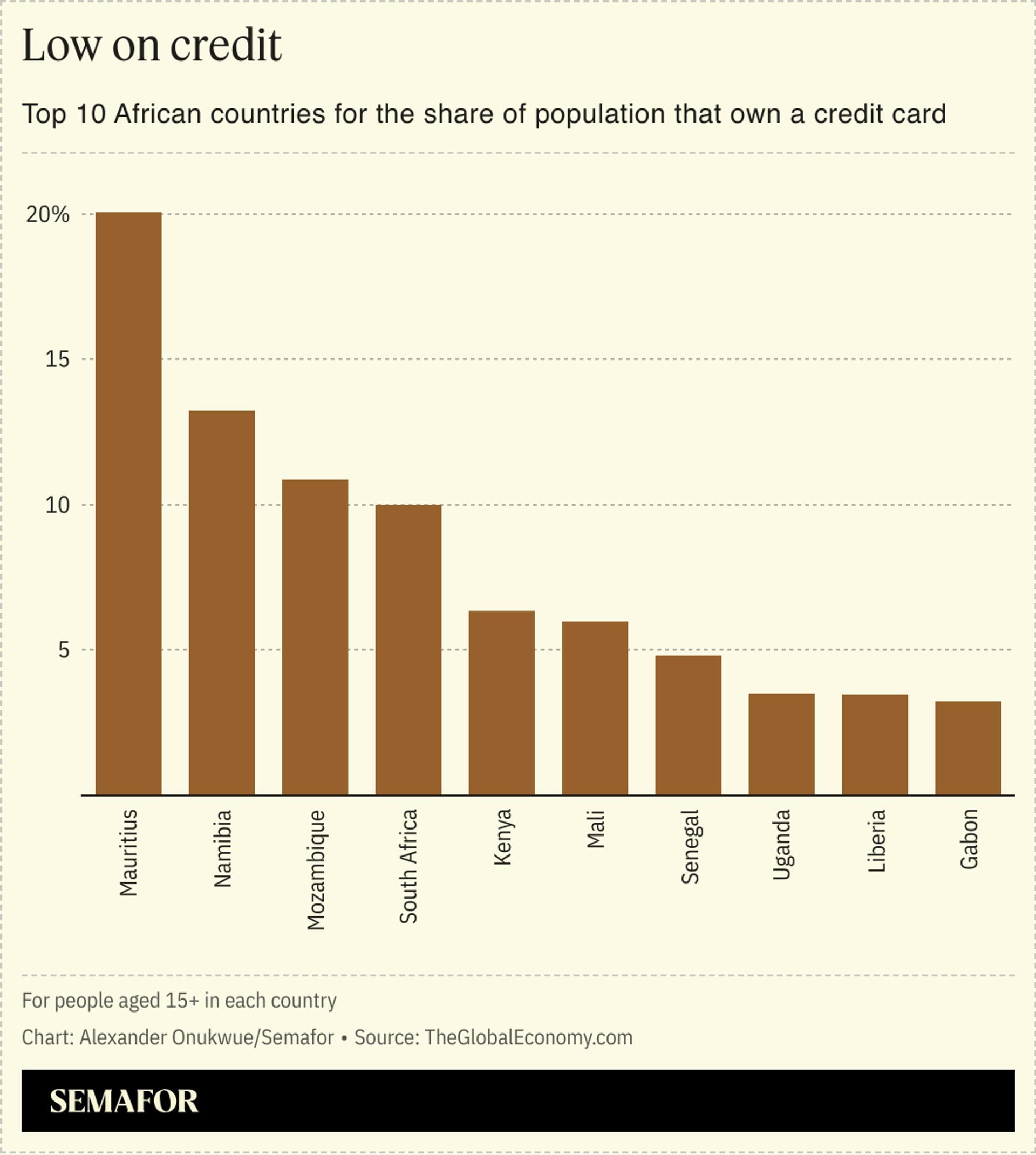

Only 6% of Nigerian adults borrowed money from a bank or non-bank financial institution in 2023, according to Enhancing Financial Innovation and Access (EFInA), a financial services research firm in Lagos. Credit card adoption in Nigeria is at 1.6%. That is in line with the average in Africa which is less than 4% according to 2021 data from TheGlobalEconomy.com.

Alexander’s view

It can be argued that a formal credit culture is developing in Nigeria, since only 3% of adults borrowed formally between 2010 and 2020. The Central Bank of Nigeria financial inclusion strategy’s target is to improve that share to 8% this year. With the rise of fintech, a number of Nigerian startups offer loans that can be approved within minutes on an app or website. But alleged instances of predatory practices have become widespread.

Growing credit adoption will encourage more actors into the business of lending in Nigeria, including American Express which plans to add more card issuing partners. Its approach is to seek out companies that are keen to “develop benefits that are most relevant to their particular market places,” said Briana Wilsey, general manager for the EMEA region.

That could mean issuing foreign currency cards, as is the case with O3, or in local currencies as is in Kenya and South Africa where Amex cards are issued by Equity Bank and Nedbank respectively. The issuing partner in each country decides “because they are the ones who know what their customers will want,” Wilsey said.

An expanding credit operation in Nigeria will not be without challenges, especially fraud. Nigeria’s financial sector lost 17.7 billion naira (about $15.5 million) to fraud in 2023, a 23% increase from the year before according to the Nigeria Interbank Settlement System.

Nigerian fintechs and banks have proposed some security initiatives but are yet to produce actual solutions. But this is not a problem unique to Nigeria or Africa, Badi said. “Fraud exists in every country around the world. There are bad actors literally everywhere.”

Room for Disagreement

“Much of the African population has low to moderate income, which doesn’t align with the income expectations for traditional credit card holders,” argued influential African venture capital firm CRE Ventures in an analysis of credit adoption on the continent. Nigeria is a low-to-middle income country, according to the World Bank, and has the second largest population of poor residents in the world, after India.

Notable

- Nigeria’s president Bola Tinubu floated a government company in April to increase lending to employed residents. Its agenda, among other things, is to “strengthen Nigeria’s credit reporting systems, ensuring every economically active citizen has a dependable credit score,” the president’s office said.