The News

African investment funds are starting to struggle to raise capital for women-led businesses because many previous backers do not want to be associated with a gender-driven ethos that goes against executive orders signed by US President Donald Trump.

Gender-lens investing, which incorporates considerations about the role of gender in achieving a financial return, has emerged in the last decade as an approach that can identify untapped opportunities ordinarily overlooked by funds. Women accounted for less than 5% of venture capital funding in Africa in the last decade.

Several leading investors told Semafor that the US president’s push against diversity, equity, and inclusion initiatives had caused institutional investors to back away from gender-lens financing. DEI initiatives have typically been aimed at redressing imbalances in workplace leadership roles and investment trends. Trump has issued executive orders restricting the use of the term “gender” in federal policies and ending government DEI programs to cut “waste” and push back against “gender ideology.”

“Investors are pulling back from anything explicitly tied to DEI or gender equity,” Gwera Kiwana, an investment committee member at the Launch Africa Ventures fund, told Semafor. Kiwana — co-founder of the Women Who Build Africa community for women in the continent’s tech sector — said “most of the pullback” had been from US institutional investors, such as development finance institutions, impact venture capitalists, and philanthropic capital, many of whom underwrite African investment funds.

Know More

US development finance has underpinned much of the capital that has flowed into businesses across Africa in various guises in recent years. USAID has been underwriting key funds and Washington maintains significant shareholding positions across major multilateral development banks, like the World Bank and African Development Bank, which gives it substantial influence over their decision-making processes.

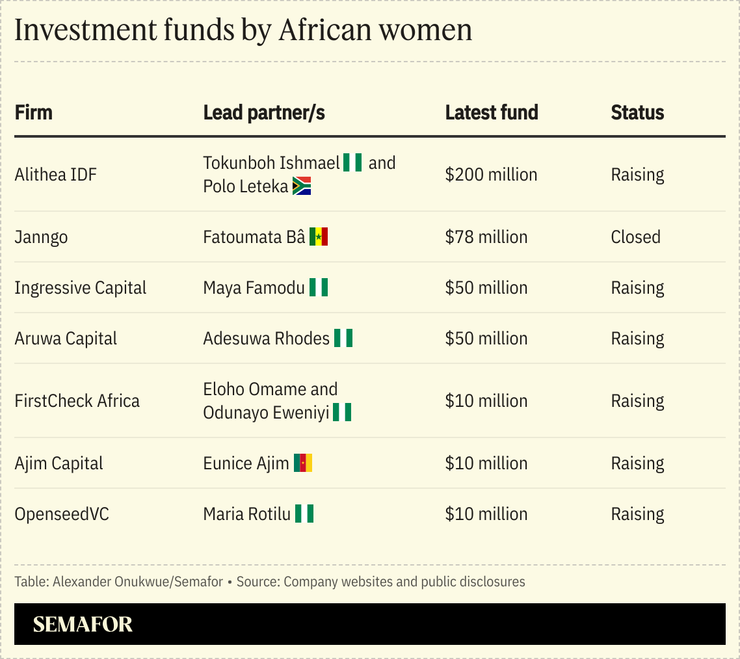

“There’s a reduction from a certain geography, but that is not universal for us,” said Tokunboh Ishmael, managing director of Alitheia Capital, which is raising a $200 million fund focused on the intersection of climate, digital transformation, and gender.

“The assets in the US are humongous, but the assets in the US are not just public finances, so you’ve got other sources of US capital that still care about these key areas of gender and climate,” Ishmael told Semafor on the sidelines of a private equity conference in Lagos. She added that investors in other parts of the world were doubling down on their commitment to gender investments and that the “tourists,” for whom gender was a passing fad, had “gone home.”

Elena Haba, a senior official at the 2X Global membership organization that seeks to unlock gender-focused capital, told Semafor the Trump administration’s dismantling of USAID had contributed to the drying up of capital streams that supported gender-based investments.

Step Back

Trump’s executive orders mark a major shift from the approach taken by previous administrations that supported gender-lens investing. Former US President Joe Biden supported initiatives such as the Gender Equity and Equality Action Fund, a joint USAID and State Department initiative launched in 2023 with initial funding of $300 million to support projects that economically empower women around the world.

The US International Development Finance Corporation — the country’s development finance institution — in 2021 announced that it had targeted mobilizing $12 billion within four years as part of the agency’s commitment to invest in businesses that advance gender equity in emerging markets.

Alexis’s view

Women-led businesses across Africa are likely to find they have fewer options when seeking investment in the next few years. This is just the start. The change in direction is already being felt and the Trump 2.0 administration only recently hit 100 days in office.

It’s not all doom and gloom. A number of investors told me capital will still flow but the language used is likely to change so that explicit references to “gender lens” are swapped for other terms that don’t carry the same political baggage, such as “overlooked” sectors and founders. They believe those who see the financial opportunities in investing in female-led businesses will adapt their language to subtly continue backing certain funds. And predicted that money will continue to flow from other sources, particularly Europe.

But the reality is that the rapid pullback from gender-lens investing, within months of Trump taking office, has exposed the extent to which development finance in Africa is influenced by Washington. The combined impact of the White House’s anti-DEI push and the hollowing out of USAID will have a profound impact for years to come.

Room for Disagreement

Aruwa Capital, a Lagos-based investor, hopes to carve a niche by tapping into “a very strong arbitrage opportunity,” taking advantage of the limited investor competition in Africa’s women, Adesuwa Okunbo Rhodes, Aruwa Capital’s founder, told Semafor.

The firm, which writes checks of up to $3 million per investment, raised $35 million for a fund aimed at increasing bets on African businesses founded and run by women, it announced last month.

Rhodes said funding African businesses remains compelling and appealing for global investors with “relatively cheap valuations compared to other markets.”

Notable

- Women entrepreneurs are contributing to the transformation of Africa’s energy landscape, reported Tech In Africa, spotlighting 10 renewables startups making an impact.

- The Trump administration plans to slash $555 million in funding for the African Development Bank’s main development fund as part of sweeping cuts to foreign aid.