The News

Africa’s startup ecosystem needs a surge of “big exits” to help grow the pool of investors and capital available, a top official at the World Bank’s private investment arm told a summit of venture capitalists in Lagos.

If investors start realizing returns on their high-profile bets, it will create the “watershed moments” needed to accelerate the industry, said Shruti Chandrasekhar, head of the Africa private equity division at the International Finance Corporation.

The IFC official said the acquisition of Nigerian fintech Paystack by US payments company Stripe five years ago, for a reported $200 million, was one such moment in the West African country. And there had been a handful of big exits in South Africa and Kenya in recent years, but not enough. “You haven’t seen this realization of real capital within these markets for it to take off,” she said.

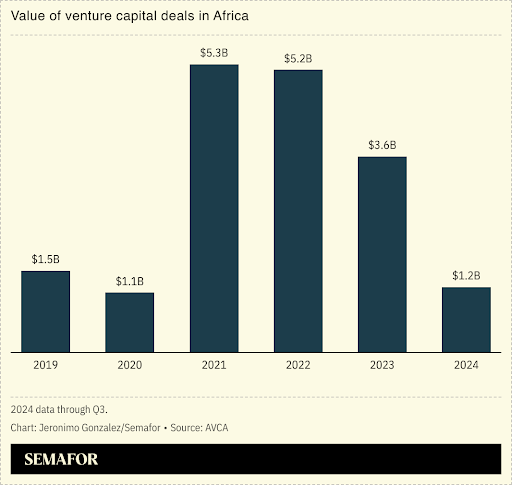

African startups raised $2.2 billion in 2024 across equity, debt, and grants, excluding exits, according to Africa: The Big Deal, a consultancy that tracks fundraising. A total of 188 ventures raised $1 million or more, while 22 exits were recorded.

Know More

Private equity in Africa has struggled to deliver competitive returns to investors due to currency devaluations across the continent. The technology sector has been a bright spot. Valuations for African startups have ballooned over the last decade but there have been few acquisitions or initial public offerings.

Chandrasekhar cited India as an example of an emerging market in which there had been a few “watershed” moment exits. “You had a lot of individuals and firms who made money through venture investing and then, because they had made money, they wanted to put it back in. That just kept the market growing,” she said.

Andrew Alli, a veteran investor and a non-executive director at British International Investment, the UK’s development finance institution, said the “earlier iterations of investments by funds may not have focused much on the exits.” He said investors should have an exit plan almost at the moment they made an investment.

“In the long-term, a discussion needs to be had about how to enhance our capital markets to allow for more local exits,” said Alli.

Room for Disagreement

“In the last two years we have had eight full exits, and returned [millions of dollars] of capital back to limited partners. Most of the exits were to global strategic players, like Saudi Telecom,” said Genevieve Sangudi, co-founder of pan-African private equity firm Alterra Capital.

“Looking back, the lesson is not every good company is a good private equity investment,” she said at the conference. “You can have a great company but if there’s no viable path to an exit, maybe it should just remain a family-owned business. There are places in the ecosystem for companies like that.”

The View From a venture capital firm

Kola Aina, founder and managing partner of Ventures Platform, an early-stage venture capital firm based in Lagos, said there have been some exits in the Nigerian ecosystem but they had been primarily strategic acquisitions, and more secondary exits — where an existing investor sells their stake in a company to another investor.

“In our case as early-stage investors, we’ve done quite a number of those secondaries-type exit transactions,” Aina said. “It’s not unique to Africa — across the world, you have funds that are dedicated to buying secondaries of companies that are largely derisked. The challenge to keep an eye on is if IPOs don’t open up in five to seven years down the road, then you have a bit of congestion at some point.”

Notable

- The CEO of Flutterwave, Africa’s most valuable unicorn, told Semafor he wouldn’t rule out the possibility of selling the fintech company to a larger player, though he stressed his focus was on reaching profitability this year.