Semafor Business’ signature interview series, On The Record, brings you conversations with the people running, shaping, and changing our economy. Read our earlier conversations with Mattel CEO Ynon Kreiz on Hollywood’s golden age of IP, Washington Post CEO Will Lewis on the media doom cycle, and Delta CEO Ed Bastian on the 2020 airlines bailout.

Three years ago, an army of bored, stimulus-rich day traders upended the stock market. They may have rallied on Reddit and Twitter, but they traded on Robinhood, which became the face of the meme-stock craze and was nearly brought down by it when it ran out of cash to cover its customers’ trading.

That moment is over. SPACs are dead. Memelords couldn’t save Bed Bath & Beyond. The index fund that tracked meme stocks, built to “capture a zeitgeist,” shut down in November. What froth remains has been funneled into AI stocks, which at least carry the promise of profits.

Robinhood is still here, trying to thrive beyond the moment that launched it. Trading volumes on its app have fallen by half since early 2021; stocks and cryptocurrencies don’t hold the same appeal when Treasury bonds pay 5%. The company’s shares are down more than 70% from their peak.

Regulators are taking aim at the gamified investing that Robinhood pioneered, which has brought newcomers to the markets — a good thing in a country where the vast majority of wealth-creating assets are owned by already wealthy people, but one that encouraged, through smartphone confetti, engagement beyond what is perhaps wise.

I talked with Vlad Tenev, the company’s 37-year-old CEO, about the way forward. In the sunlit penthouse of Robinhood’s surprisingly anonymous Manhattan headquarters, he sipped bottled green tea and described a Robinhood that looks more like the legacy firms it set out a decade ago to unseat. (Credit cards are coming; check back in on mortgages in a few years.) It must also keep the loyalty of its most active customers, while fending off competitors that are courting Gen Z investors.

This interview was condensed and edited for clarity.

We’re three years out from the meme-stock craze. What did you learn?

The importance of clear communication. I wish I’d been more patient. I was very keen to get out there and start talking right away, and I was dealing with lots of issues internally, trying to make sure everything was stable, and I just wasn’t really sleeping. So I was not as compelling as I could have been in explaining exactly what happened.

That said, the way these risks were accounted for, the regulations behind it, were introduced to deal with the global financial crisis. They never anticipated something like GameStop. So introducing real-time settlement and some of the other initiatives [Robinhood is] advocating for would be very positive improvements.

You’ve been a staunch defender of payment for order flow. It’s banned in the EU and the U.K., where you just announced Robinhood is expanding into, and pretty controversial here. What do you think people get wrong about it?

I remember the days when people were paying commissions for every trade. Robinhood helped eliminate that. And if you look at the business models of the legacy brokerages in the BC era — ‘before commissions’ were eliminated — it was something like $11 per trade. So the elimination of commissions undoubtedly put more money back in customers’ pockets. You saw that reflected in the stock prices of the legacy brokers back in 2019. They all had to consolidate.

There’s a combination of a lack of understanding and the fact that the issue has been politicized by actors that probably don’t really want Robinhood to exist.

But basically the narrative is that Ken Griffin is trading in front of retail investors and that you’re helping him do it.

We’ve done a lot of work to [educate users]. The problem is not too many people want to parse overly complicated technical language. It’s much easier to just retweet the one-sentence version.

Okay. But Robinhood customers are handing over some valuable things and, in exchange, they get free stock trades. The rule in business is that if you’re not paying for the product, you are the product.

I disagree with that.

Why?

I just don’t think people are products.

What does your business look like in the UK without payment for order flow?

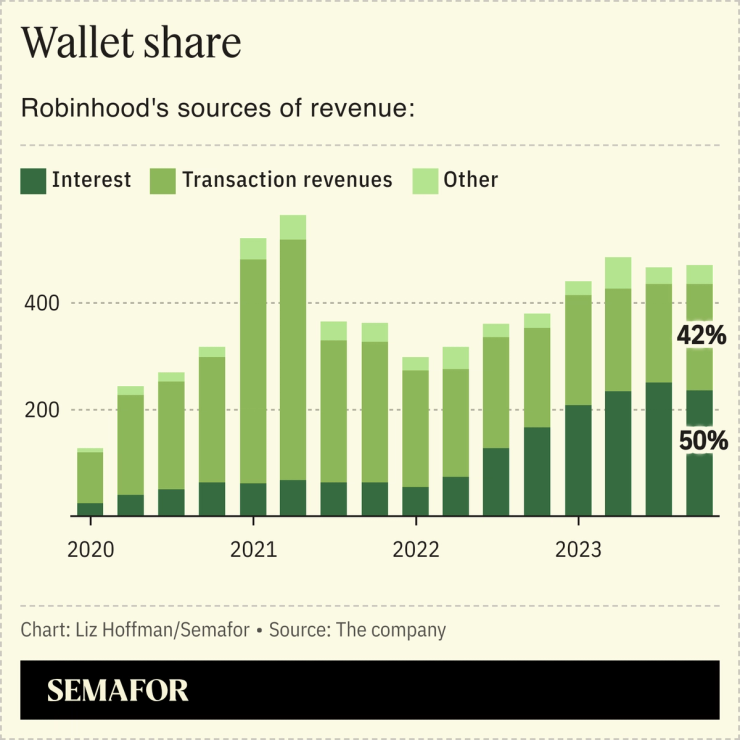

It would have mattered quite a bit when Robinhood was just a trading app. But it matters less now. If you look at the business model in the U.S. as a guide, it’s diversified quite a bit. Equities payment for order flow is something like 5% of our revenue. More than half of our revenue is net interest margin.

That’s gone up with interest rates, right?

For sure. But we’ve also rolled out products that have improved that mix. Robinhood Gold offers 5% APY. We still make a little bit of a spread, but the lion’s share of that rate increase is going back in customers pockets. Stock lending is another place where we can generate a yield that we share with customers.

What’s your priority for 2024?

We’re focused on becoming number one in active traders in the U.S. Right now we’re number two behind a combined Schwab-TD Ameritrade. We’re winning on mobile, but on the web we’re a little bit behind.

We rolled out a product called 24 Hour Market a couple months ago. Things happen on the weekends, and if a stock is going to go up 30% or down 30% at the open on Monday, that doesn’t seem super optimal. Take crypto — that’s always trading somewhere. Robinhood is one of the only places where you can track [and trade] some of these assets.

But then aren’t you just exposing yourself to the craziest corners of the market? That also doesn’t seem super optimal.

It goes both ways, right? At the Monday open, you see a stock open up or down 30%. You’d love to be able to manage your risk more continuously over time.

During the OpenAI drama, people were using Robinhood to track the price of Microsoft as things were unfolding that night and over the weekend. In a couple of years, if you’re not offering that capability to customers, I think you’ll be irrelevant.

Something I was thinking about last spring, when regional banks were failing, is that some friction in the financial system is probably not a bad thing. If it were a little harder to pull deposits out of Silicon Valley Bank, it probably would have survived. If people have to wait until Monday morning to trade, maybe they calm down. Should finance be totally frictionless?

I’m skeptical of maintaining the status quo. Technology, on average, makes things a lot better and leads to more wealth across the board. It has to be managed appropriately, but I don’t think it should be stopped.

Robinhood was such a creature of a moment in time. What does the company look like in five or 10 years?

Our customers are getting older and they’re growing with us, depositing more of their funds with us. We think we can be a great home for that customer that has $50,000. You see our retirement product, things like [financial] advisory, the credit card.

Do you want to be your customers’ primary financial institution?

Yes.

Okay, then at some point, you’re going to need mortgages, real checking accounts, lots of other products. Can you do that without being a bank?

Certainly we’re not ideologically opposed. It’s just a question of what the tradeoffs are at any given point. We’re not doing a ton of lending, yet. But credit cards will be live in the near future and as we get more and more into lending, obviously, the calculus behind the business changes.

One of the reasons why we decided against becoming a bank in 2019 was that the government does not want banks to grow quickly. Banks growing quickly and taking on a lot of deposits and a lot of business is a risk.

Silicon Valley Bank doubled its assets in a year and that didn’t end well.

And too much product innovation can be viewed with skepticism. So that’s why you look at a lot of these banks and they don’t tend to move super fast.

In the middle of a brutal stretch for media businesses, you’ve launched a media business — Sherwood. Why?

I think there is room for an authoritative and cool brand, and I do believe we can make it a great economic business. We’re already seeing that with Robinhood Snacks [now run by Sherwood], which is one of the most read financial newsletters in the world. We believe that what Bloomberg did, we can recreate for a new generation.

Retail investors became less important as index funds became massive. But they mattered a lot during the meme craze. Will that stay?

We’re seeing an increasing number of companies adopting retail channels for IPO distributions. Companies like Tesla, Coinbase, and obviously Robinhood have retail as a key constituency. I don’t think that’s going away. [After this interview, Reddit announced that it would reserve some of its IPO shares for individual investors.]

I think you will see more and more people deciding to self-manage their finances and understand that it’s not as complicated as these advisors and hedge funds are making it seem. Information is more and more freely available, so you can see what [professional investors] are doing. You can see that maybe their strategies aren’t that sophisticated.

Did you see Dumb Money?

A few clips. With my daughter, actually, who was not impressed. She was like, “it doesn’t look like you.”

I do think that it was a moment that should have been captured. But it doesn’t resonate with me to call it ‘dumb money.’ If you watch the movie closely, you understand that it’s being used somewhat ironically, but at first glance, the message that’s conveyed is that retail investors are dumb money, and I don’t think they are.