The News

African startups raised a record sum in debt financing in 2025, as investment in the continent’s maturing tech scene rebounded with growing interest from financiers.

Startups in Africa raised $1.64 billion through debt last year, exceeding the mark in 2024 by more than 60% and surpassing the $1.55 billion raised two years earlier, according to a report by Dakar-based venture capital firm Partech Africa.

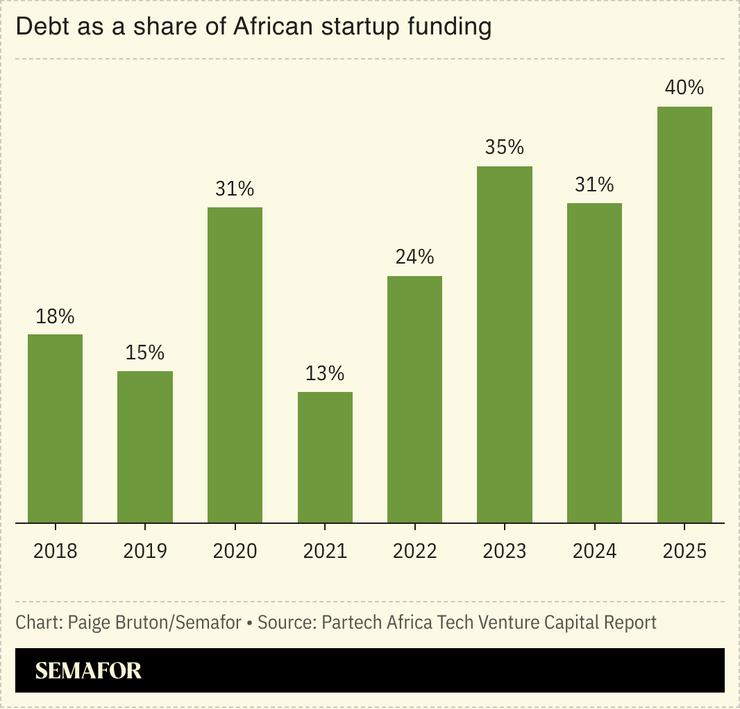

Debt as a share of annual VC investment into African startups reached 40% for the first time since Partech started tracking the data a decade ago. “It is a sign that African startups are getting more mature and predictable,” Tidjane Deme, Partech Africa’s general partner, told Semafor, noting that there is a higher eligibility bar for startups to raise capital through debt compared to equity.

The rise in debt financing comes as receipts through equity grew more slowly following a sharp fall from around $5 billion between 2021 and 2022 to $2.3 billion over the last three years. In the aftermath of the COVID-19 pandemic, African startup fundraising shot up to record highs as global investors massively ramped up the scale of capital deployment into the continent’s tech.

Startups that relied on equity capital to find their footing, but later grew to record regular cash flow, lean towards seeking out debt capital, especially for working capital needs. It allows the founders to retain greater ownership, unlike with equity investments. There is, however, the downside risk to their balance sheets that comes from having to make regular repayments.

Combined with the rise in debt capital, an 8% uptick in equity fundraising last year, after a slight dip in 2024, means that African tech seems back on a growth path overall. The market has “largely completed its correction phase and has entered a period of normalization,” Partech’s report said.

In this article:

Alexander’s view

Most investors in African startups focus on making equity investments, banking on a model that demands years-long patience with expectations for multifold returns should their portfolio companies become successful. Providers of debt capital, however, typically look to extract repayments within shorter tenures — and demand more guarantees for the capital they provide.

Development financiers have been the top sources of debt capital to African tech companies in the last two years, per Partech’s report, even though they also back startups through equity deals and invest in equity-focused venture capital funds. The UK’s British International Investment, the World Bank’s International Finance Corporation, and France’s Proparco each did three or more debt investment deals in African startups in 2024 and 2025.

But other types of debt investors — including African commercial banks — are rising to take advantage of the growing number of African tech companies that are operationally efficient, can demonstrate sustainable cash flow and are nearing profitability. When the Senegalese mobile money startup Wave raised $137 million in a debt round last July, it was led by Rand Merchant Bank, the investment banking unit of South Africa’s FirstRand Group.

Know More

As in previous years, Kenya is the main destination for debt capital into African startups while fintech and clean energy companies remain the favorite sectors.

African tech companies in both sectors and in markets with enabling policy environments are more likely than those in other industries to have the “proven cash flow visibility” that lenders of debt capital require, Partech’s report noted.

Step Back

Silicon Valley investors pulled back from Africa after the end of the US Fed’s zero interest rate policy era in mid 2022. African investors have stepped up to take up the vacated space but have yet to match the size of funding rounds during those peak years.

One consequence of the slower growth in equity deal-making is that fewer new startups are getting funded. “I’m actually concerned that we don’t have enough seed rounds happening to feed the pipeline,” said Deme. Fewer early-stage startups today will mean far fewer mature companies in the future, since most new startups fail.

Notable

- African startups raised $3.2 billion in 2025, a 40% increase from 2024, according to data from consultancy Africa: The Big Deal.