Mali’s gold output dropped 23% year-on-year in 2025 following the suspension of Barrick Mining, figures from the country’s mines ministry showed, underscoring the challenges faced by African governments trying to secure a greater share of mineral wealth.

The dispute between the Canadian miner and Bamako, one of Africa’s biggest gold producers, centered on new rules that give the military government a greater share of production revenues. The two-year dispute ended in November.

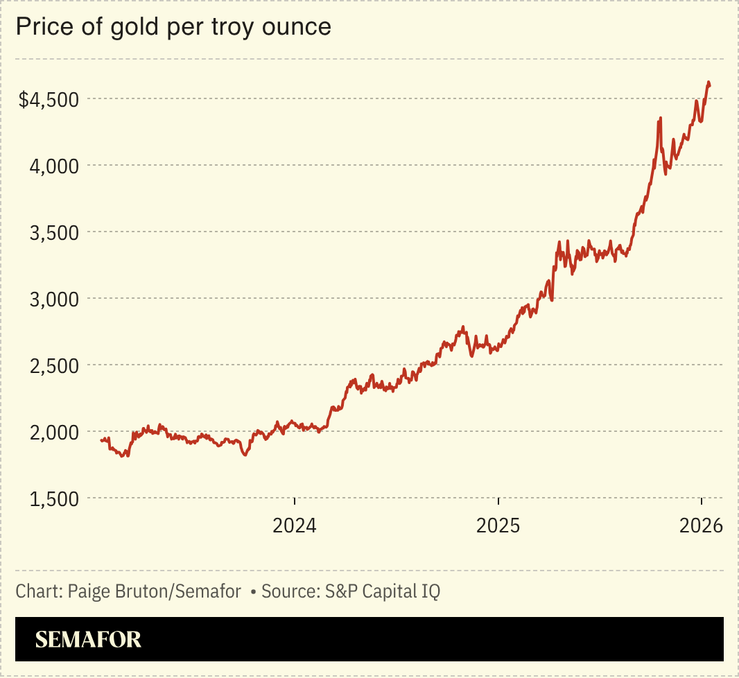

The standoff disrupted output across the industry. Investors were unnerved by Mali’s imposition of the new mining code, as well as punitive measures that included legal action against the company and the jailing of four of its employees. With gold prices soaring amid global uncertainty, other African policymakers are changing their approach to the sector. Egypt’s central bank signed an agreement with the African Export-Import Bank last month to establish a pan-African Gold Bank as part of efforts to formalize value chains.

Beyond gold, other nations — such as DR Congo and Zimbabwe — have imposed restrictions on access to cobalt and lithium respectively, to capture more value locally.