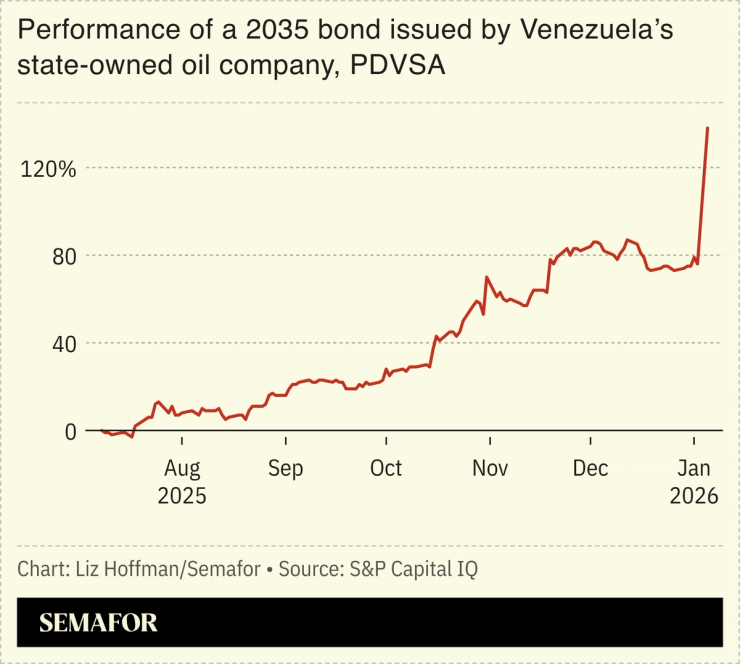

Venezuelan government bonds surged 30% on Monday, with investors betting the US’ strong hand will clear the way for a grand-bargain restructuring.

Venezuela’s bonds have traded at steep discounts since a 2017 default, but rose after Trump upped the pressure on the strongman last year, Reuters noted. The latest bounce in bond prices and other Venezuelan assets rewards investors who held on for years out of conviction — Michael Burry of “The Big Short” fame is in that camp today — or because they were tethered to an index that still includes Venezuelan exposure.

The country has to restructure anywhere from $150 billion to $170 billion of sovereign debt, analysts say, and the next steps remain unclear. (Proof of how quickly things can change: Barclays downgraded Venezuela’s bonds Saturday, putting long odds on Maduro leaving office. On Monday, it noted its call was “quickly overtaken by events” and reversed course.)