| In today’s edition, we look ahead to 2024 on everything from dealmaking to banks to the commercial r͏ ͏ ͏ ͏ ͏ ͏ |

| Liz Hoffman |

|

Hi and welcome back to Semafor Business.

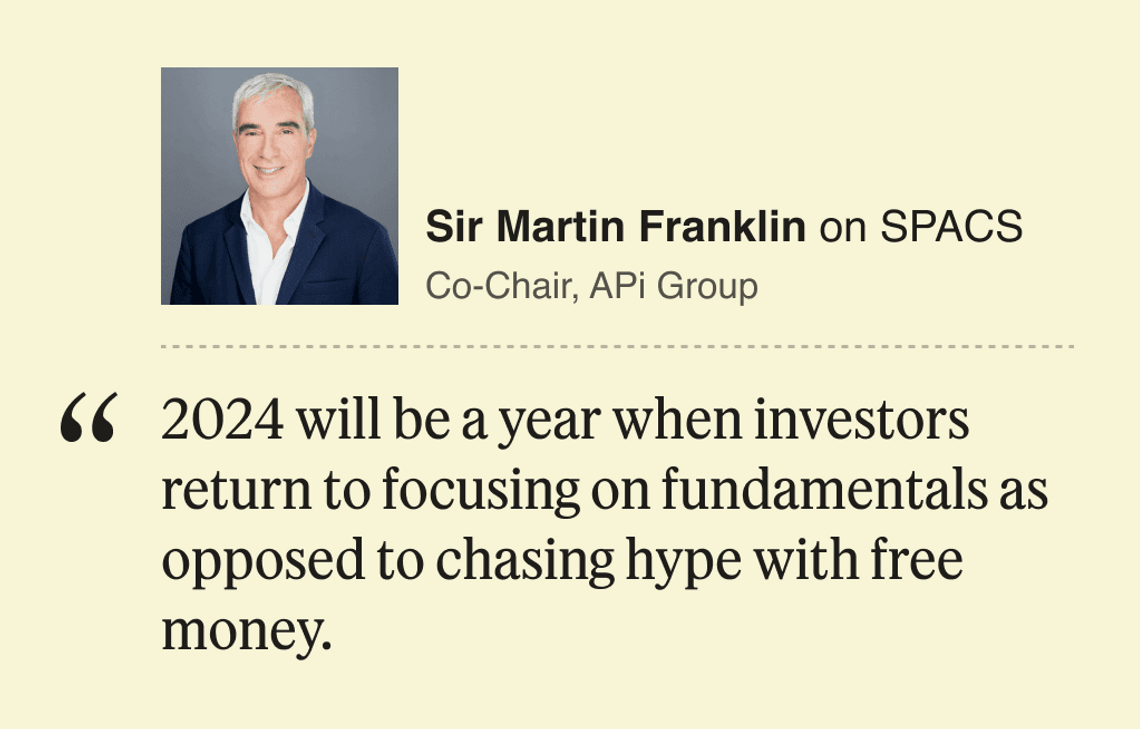

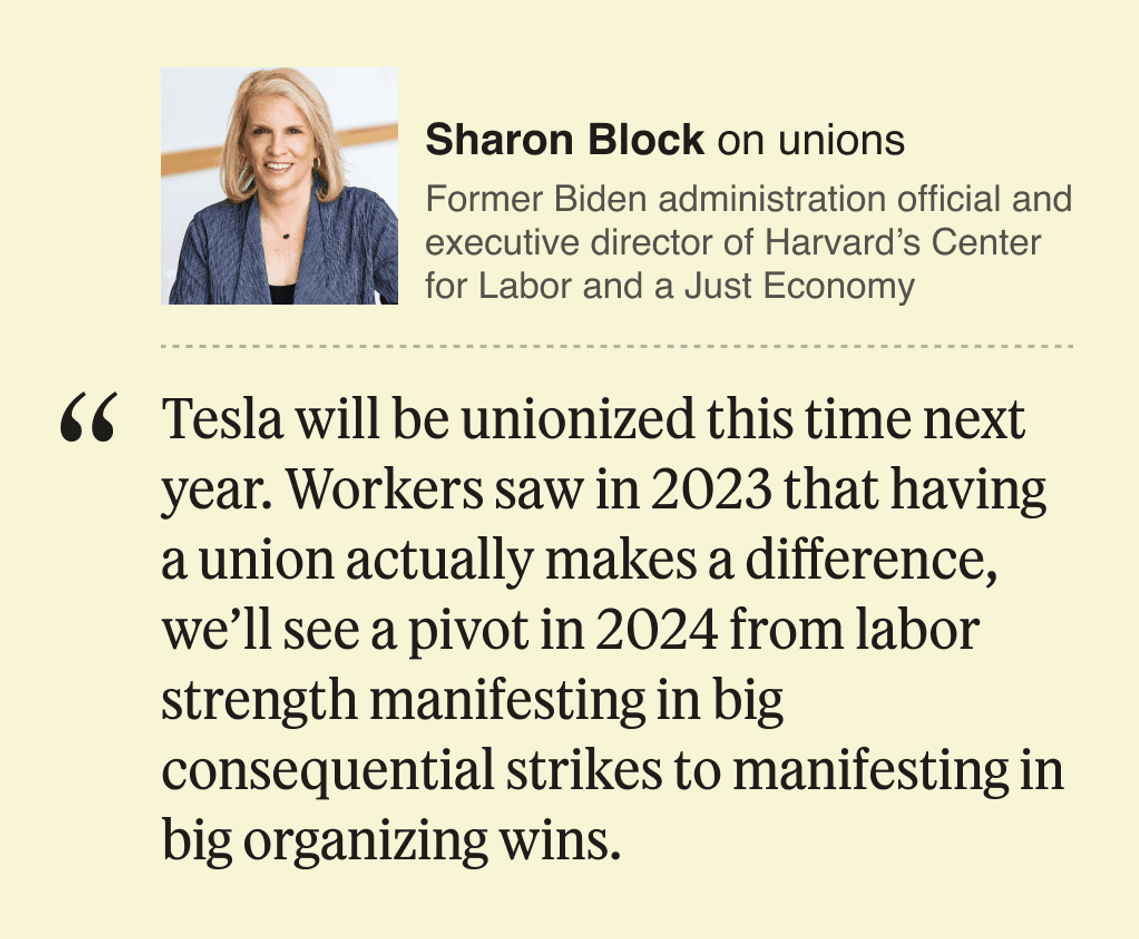

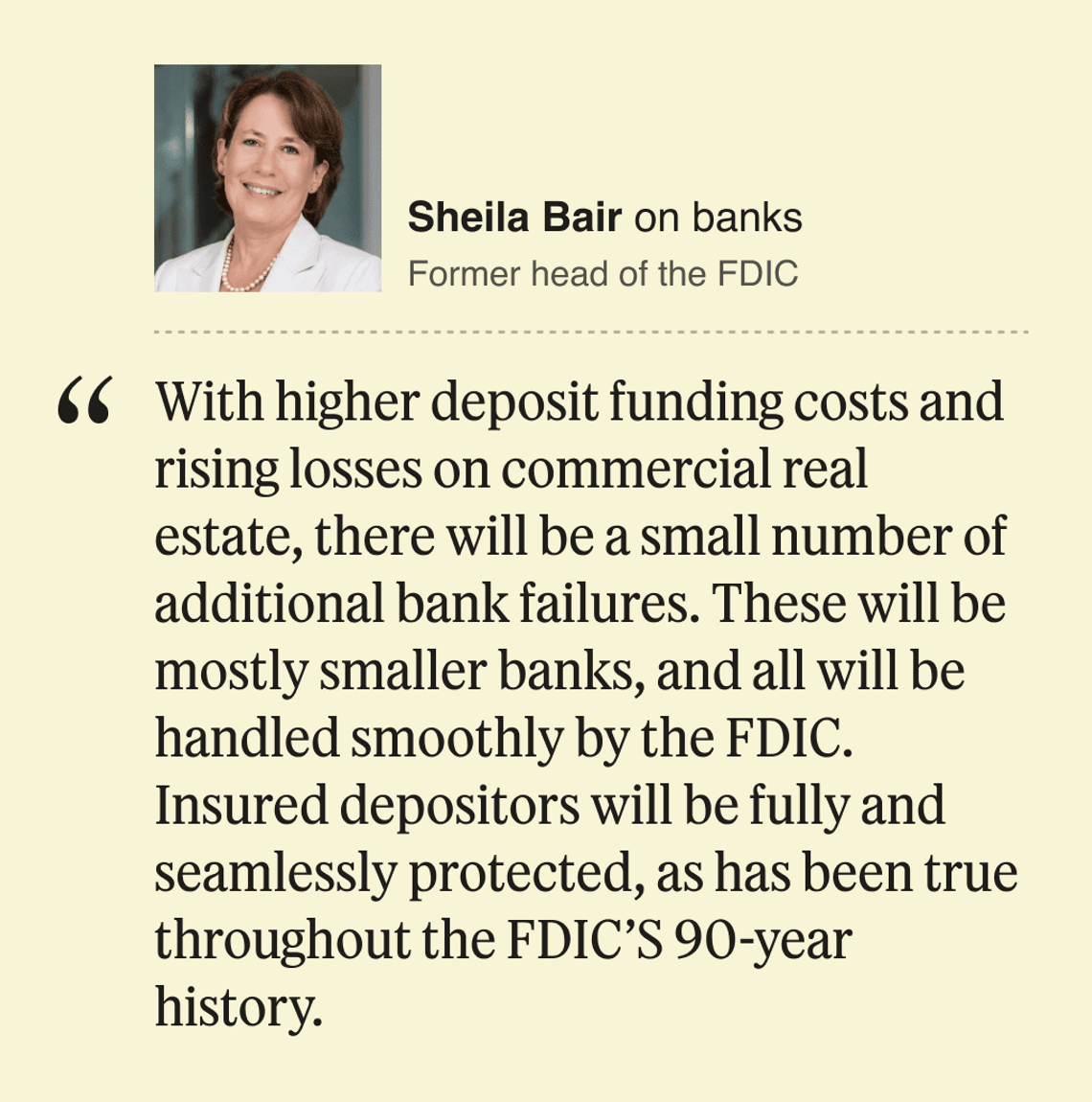

Because it’s that time of year, today we’ve got predictions for the year ahead. These people know of what they speak — former FDIC chief Sheila Bair on bank failures, Sir Martin Franklin on the free-money hype era — and shared their expertise. (Credit to Joey Pfeifer for design chops.)

And because any prediction worth making is decently likely to be wrong, let’s revisit my favorite call from last year. It came from Ross Gerber, an investor on what was then Twitter, newly in Elon Musk’s hands: “It will be great. More YouTube-like features, lots of new content. Advertising is coming back. [Elon] will have a replacement CEO but he’ll be working on product. He’ll be more aware of his actions.” There is, at least, longer video.

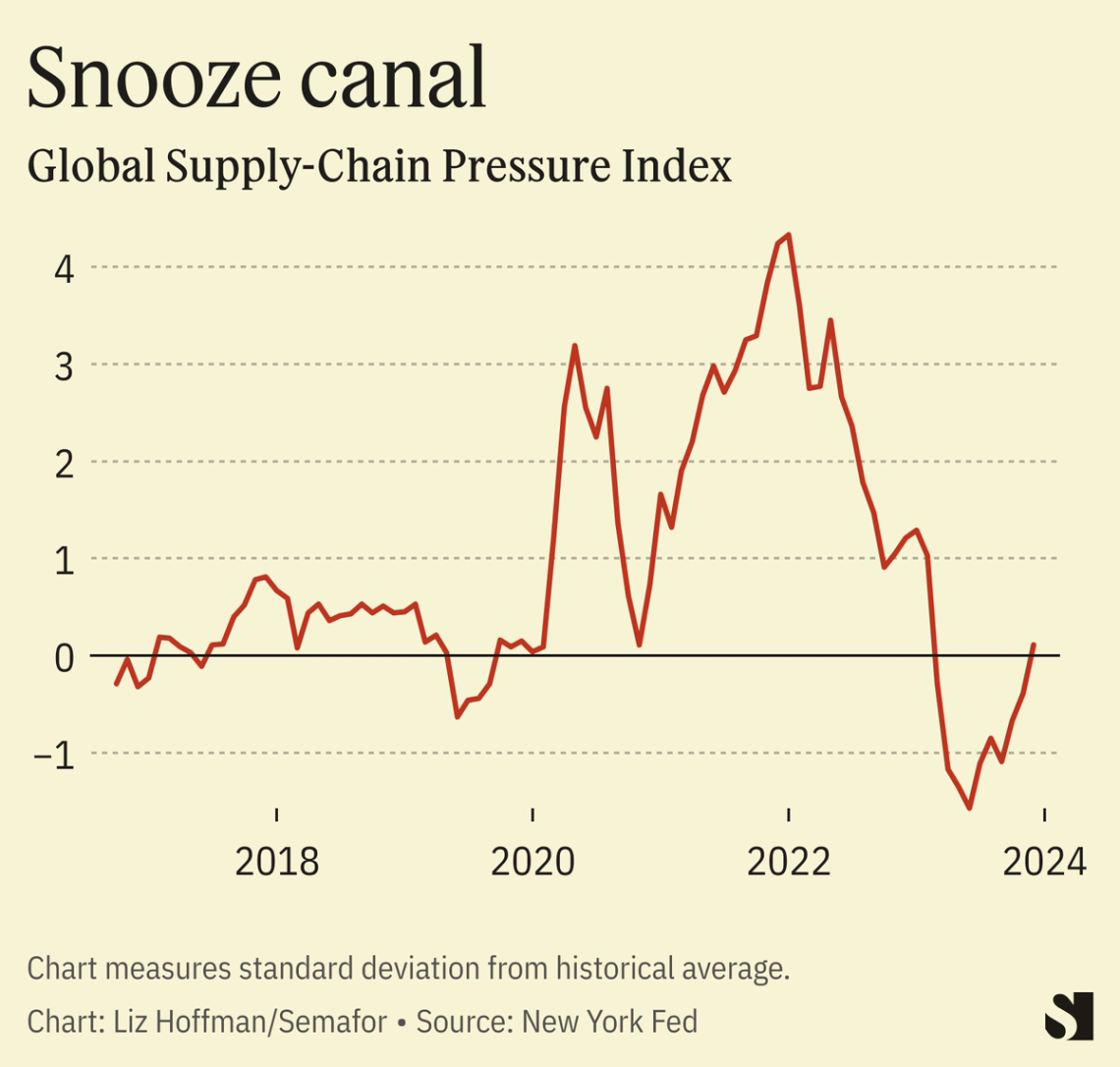

Plus, supply chains are snarling again, and it’s back to the 90s in Buenos Aires.

Also, a programming note: No newsletter on Tuesday. Wishing you all a happy holiday.

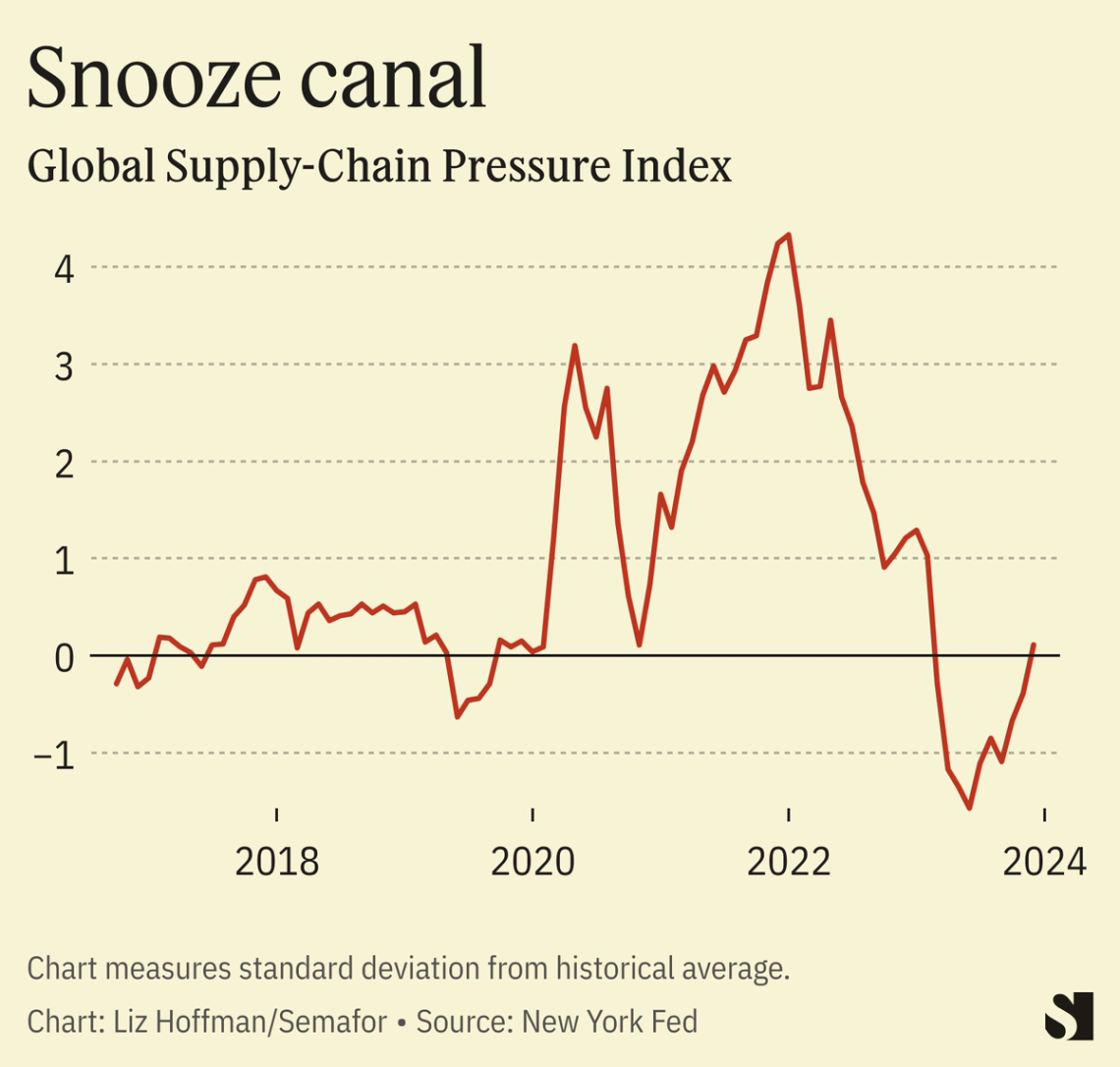

➚ BUY: Shopping. For all the kitchen-table politics of inflation, consumers are still spending. Black Friday kicked off what’s expected to be the biggest holiday U.S. shopping season on record, according to the National Retail Federation, which is predicting an up-to-4% bump to $967 billion. ➘ SELL: Shipping. The Red Sea attacks are diverting carriers around the Suez Canal, and a drought has limited traffic through the Panama Canal. Good news for air cargo.  |

|

Deal memo: Dennis K. Berman, a longtime WSJ editor turned investment banker (and one of my first bosses) has figured out the secret of Wall Street: It’s better to be a principal than an agent. After six years at Lazard advising media companies, he’s teaming up with investor Jahm Najafi, whose portfolio includes the Phoenix Suns, McLaren, and StubHub. Back in 2003, Berman profiled Najafi for the Journal as a broadband wildcatter, picking over the dot-com wreckage, which makes me wonder which of you, my sources and subjects, I’ll be bugging for a job in 20 years. |

|

“If this deal were not to be approved, it would cast a shadow on the [U.S.-Japanese] alliance, and that is not in our interests.” |

— Heino Klinck, America’s former deputy assistant secretary of defense for East Asia, on backlash to the Nippon-U.S. Steel merger. |

|

Back from the red: BlackBerry posted a surprise (adjusted) profit of one cent in the third quarter. News that might once have drawn the meme-stock crowd instead failed to delight investors, and shares fell 12% this morning. Pampa and circumstance: Argentina has a complicated history when it mixes state assets with private industry. There was the time Elliott, the U.S. hedge fund, impounded an Argentine Navy ship after the country failed to pay interest on its bonds. A wave of privatizations in the 1990s failed to stick, and successive governments basically ignored those contracts. In one case, a U.S. judge this summer ordered the country to pay $16 billion to a group of investors for nationalizing YPF, the oil company, and zeroing out their stakes. The country’s new, libertarian leader, Javier Milei, is preparing state-owned assets, including YPF and Aerolineas, for privatization, part of his effort to drastically shrink the size of government. Already his austerity plans are being met with widespread protests.  Reuters/Agustin Marcarian Reuters/Agustin Marcarian |

|

- The high-profile Senate sex scandal that rocked D.C. this month was, in fact, the second time in less than two years that sexually explicit videos filmed in the U.S. Capitol prompted an investigation.

- Despite starting his career in artificial intelligence and staying on top of the latest developments, Meta’s CTO says the latest generative AI craze still caught the company by surprise.

- The COP28 agreement says annual global greenhouse emissions need to peak by 2025 to stay within the global warming limit of 1.5 C. That means for the biggest emitters, 2024 will be a critical turning point for the energy transition.

|

|