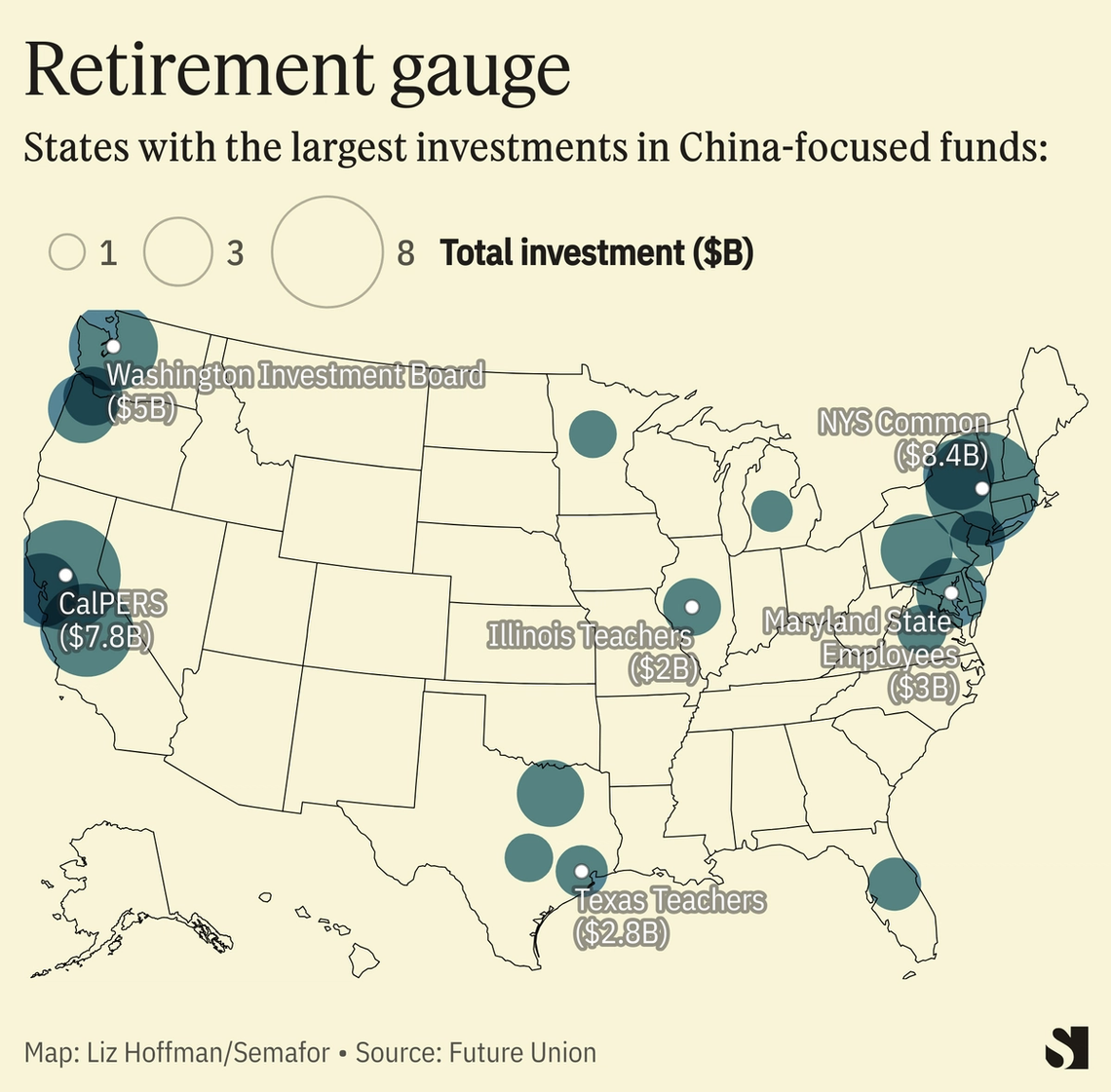

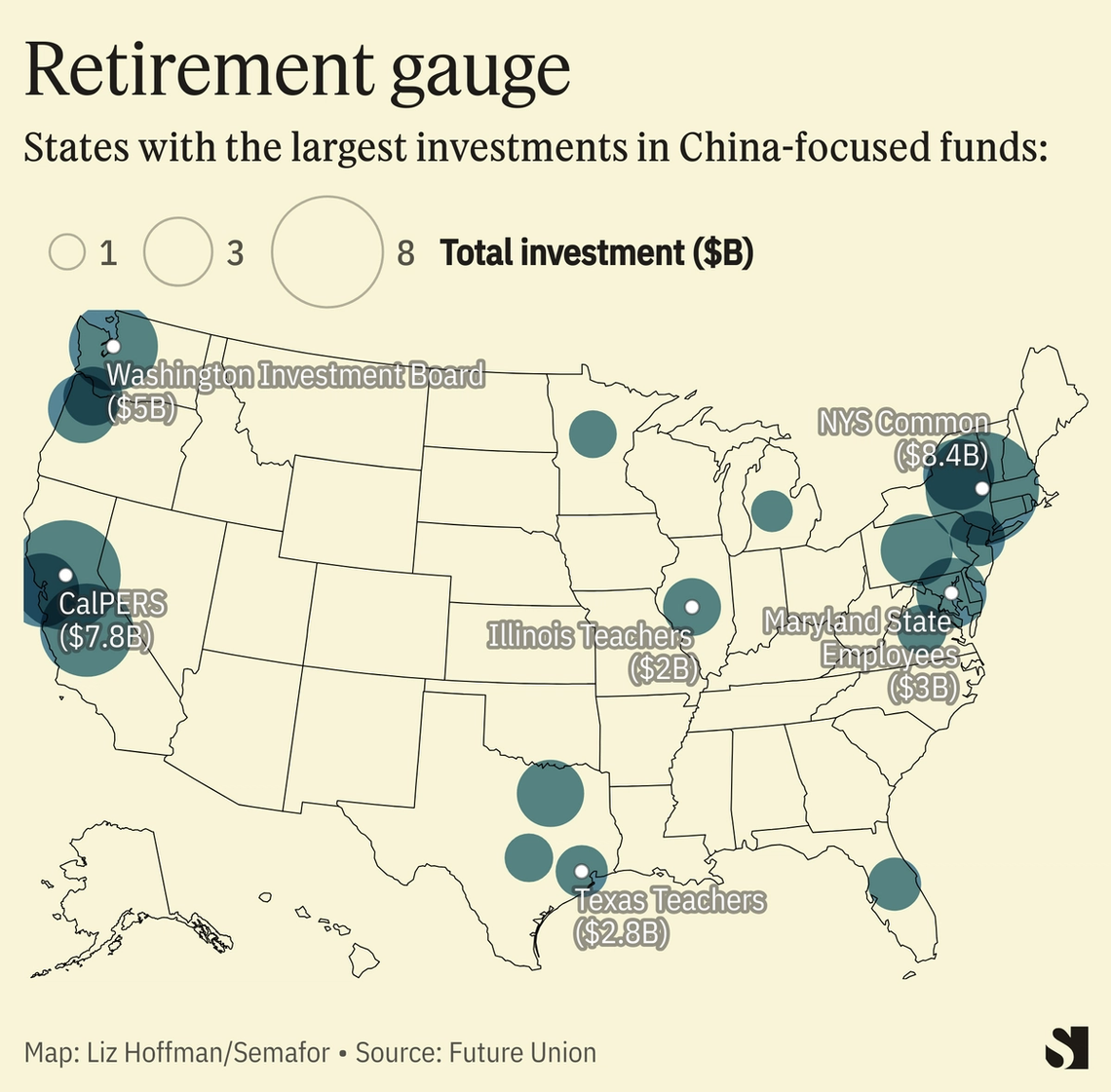

Concerns about economic competition with China are growing, with the Biden White House and a Republican-led House both pushing to limit U.S. investments in the mainland. But U.S. money is deeply invested in China, much of it through private-equity firms channeling pension dollars. Future Union, a nonpartisan group with a hawkish security bent, combed through public filings to find out just how much: at least $70 billion, through funds such as Legend Capital and Hony Capital.  Treasury Secretary Janet Yellen says in remarks prepared for a speech tonight that the U.S. “will deploy our economic tools when needed to secure our country’s national security interests.” The White House, in trying to limit U.S. investments into China’s high-tech sector, has deemed private-equity capital — two-thirds of which come from big pensions — to be one of those tools. CalPERS’ chief investment officer said recently that the pension giant, which has 3% of its $460 billion invested in China, was pulling back in case “we were to be told overnight to divest.” China’s economic growth has been tempting for public pensions, which have an obligation to maximize returns and are underfunded as it is. “We are talking about nonmarket actors that do not comply with the rule of law,” said Andrew King, a venture capitalist and executive director of Future Union. Pensions investing in China “risk retirees’ capital when all returns and assets can be seized by the state at a moment’s notice.” |