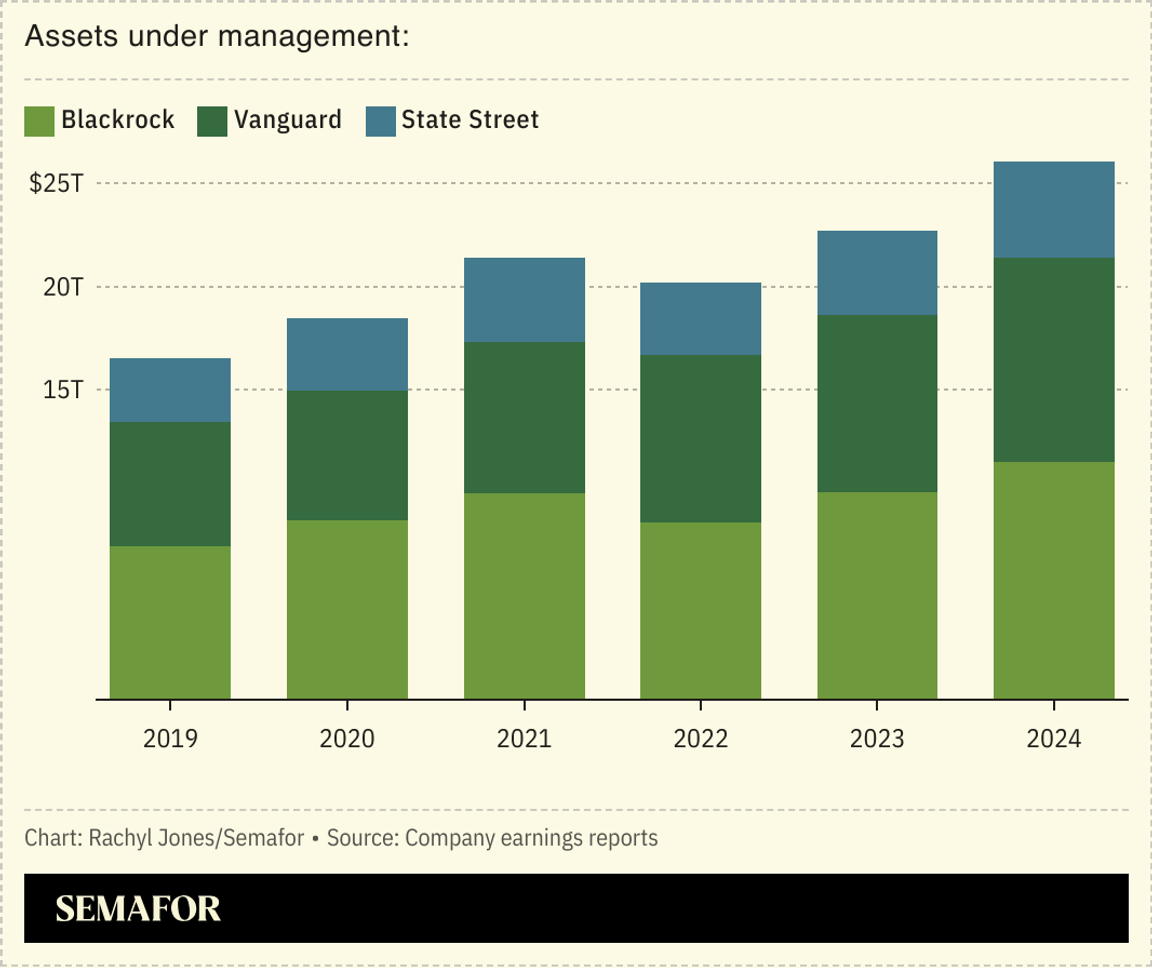

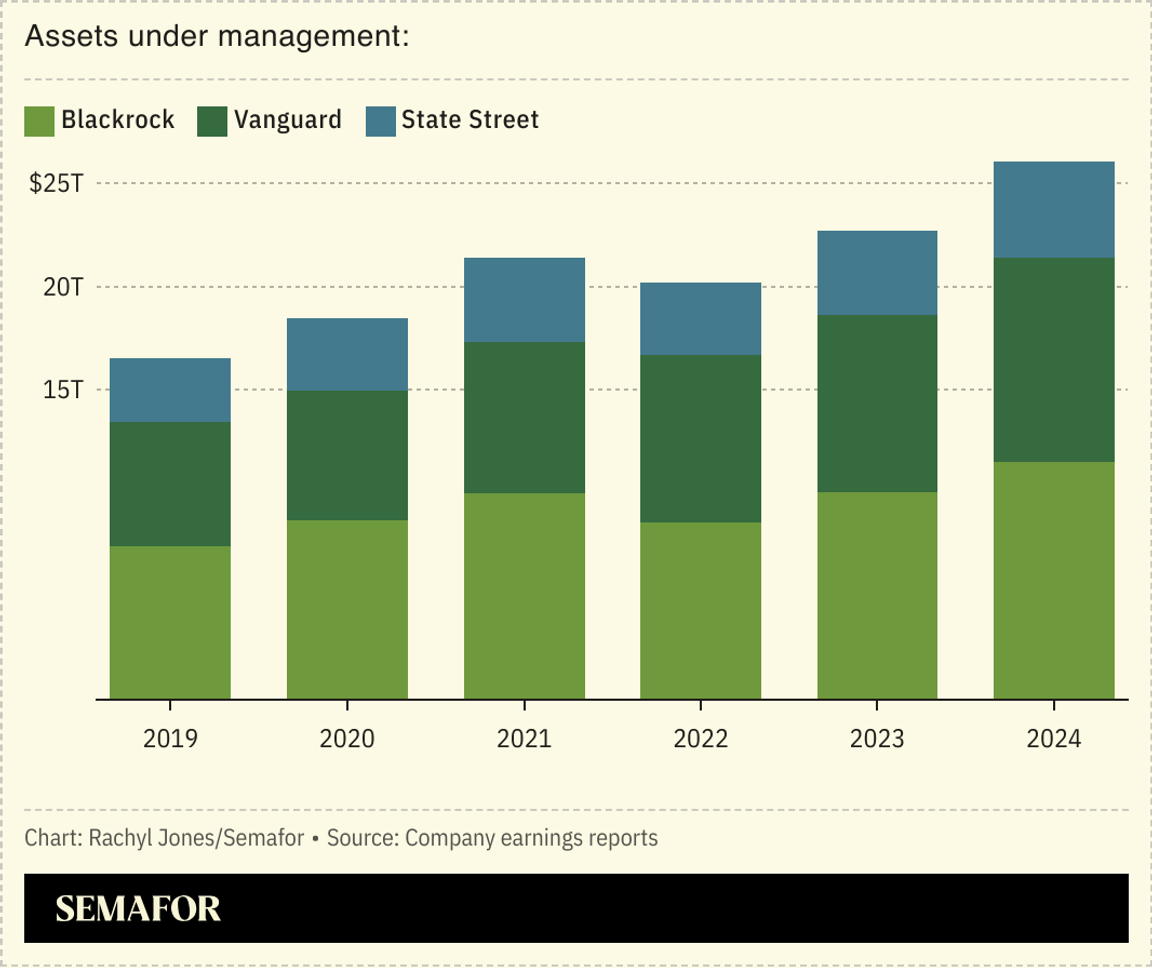

THE SCOOP BlackRock is under fire from a federal agency, which is itself a target of Washington scrutiny, over its influence in corporate boardrooms. It’s fighting back. The Federal Deposit Insurance Corp. wants to impose sweeping limits on how giant asset managers invest in US banks. The agency’s concern is that BlackRock, Vanguard, and other big money managers wield too much influence over lenders that decide what gets built in America. The effort has the rare backing of both Republicans on the FDIC, who think giant asset managers are too liberal, and Democrats, who think they’re simply too big. Two defining forces in corporate America — concerns over “wokeness” and monopoly power — are colliding, and the ensuing fight is likely to touch on a third: private-sector backlash against expanding regulatory power. The FDIC’s proposal to BlackRock and Vanguard, delivered Oct. 4, would bar them from trying to influence a bank’s behavior by, for example, nudging it away from financing oil projects — a nod to the past ESG priorities of BlackRock CEO Larry Fink. It would also require them to disclose any conversation their employees have with bank executives, and to notify the FDIC every time they acquire more than 10% of the shares of a bank — a level BlackRock already holds at about 40 lenders, people familiar with the matter said.  World Economic Forum/Manuel Lopez World Economic Forum/Manuel LopezThe FDIC “may request such additional information at its discretion,” the draft agreement says, which has left executives concerned that they’re signing up for a new permanent overseer. The agency set an Oct. 31 deadline for BlackRock and Vanguard to sign the agreements limiting their actions. Without a deal by that date, BlackRock and Vanguard could be forced to sell hundreds of millions of dollars worth of bank stocks — not ideal for a sector still bruised from last year’s mini-crisis. The agency can extend the deadline. BlackRock executives pushed back in a call with FDIC staff in recent days, the people said, arguing the rules are unworkable for funds that trade in and out of positions frequently to match indexes. Some of the rules would kick in at a 5% stake, which both BlackRock and Vanguard, because of their sheer size, hold in nearly every public company.  The push shows how FDIC Chair Martin Gruenberg, who agreed in May to resign after an investigation found pervasive sexual harassment at the agency, is determined to govern right until the end. He has also proposed new rules on deposits and is holding up a rewrite of new bank rules for being insufficiently strict, Semafor has reported. On the asset manager front, current rules allow investors to own big stakes in banks so long as they remain passive — although, as Jonathan McKernan, the Republican FDIC director who proposed the new rules in January, has pointed out, it’s a loose system of self-reporting. “The Big Three purport to be merely passive investors, but a growing body of evidence suggests that’s not always the case,” he said in a speech earlier this year, referring to BlackRock, Vanguard, and State Street. The FDIC and BlackRock declined to comment. A Vanguard spokesman said: “Consistent with our mission and passive approach, we have taken strong actions, engaged with policymakers, and suggested additional reforms that further clarify and refine expectations around passivity.” |