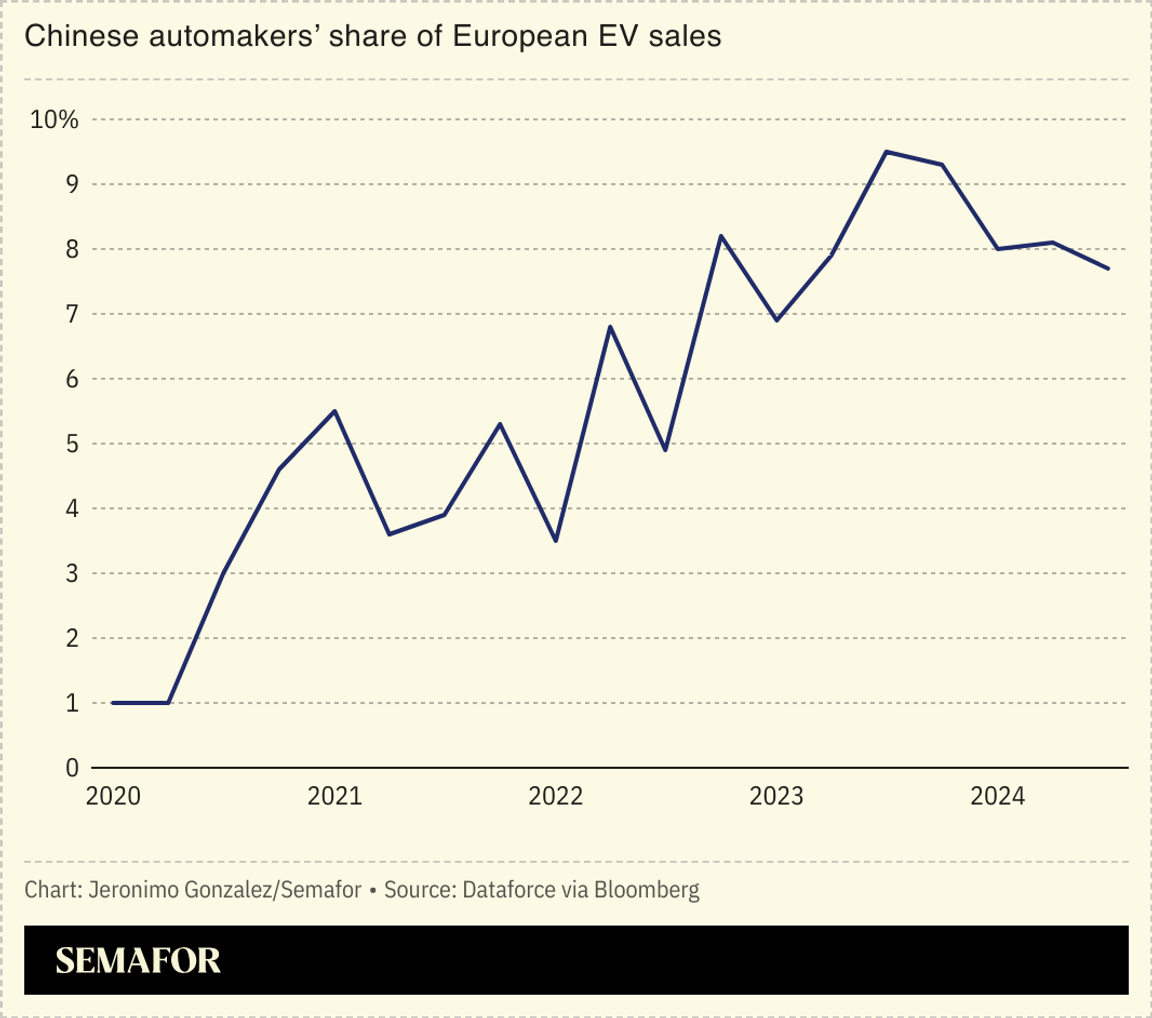

European Union member states approved tariffs on Chinese-made electric vehicles today. Given worsening US-China tensions and the imposition of 100% tariffs on their products by Washington, China’s automakers have long seen Europe as their “main battleground.” The EU, however, argues that Beijing has used illegal state subsidies to help its carmakers dominate the EV sector. Beijing is expected to retaliate with its own duties on European exports such as brandy, dairy, and pork, while its automotive companies will have to decide whether to absorb the EU tariffs or raise prices. Beyond the tariffs, a new challenge looms for EU countries: Chinese carmakers building manufacturing facilities within the bloc itself. “European policymakers will try to ensure that such investments produce jobs for their citizens and lead to a sharing of technological know-how,” analysts at Rhodium Group wrote in a recent note. “In other words, they may seek to give China… a taste of its own medicine.” |