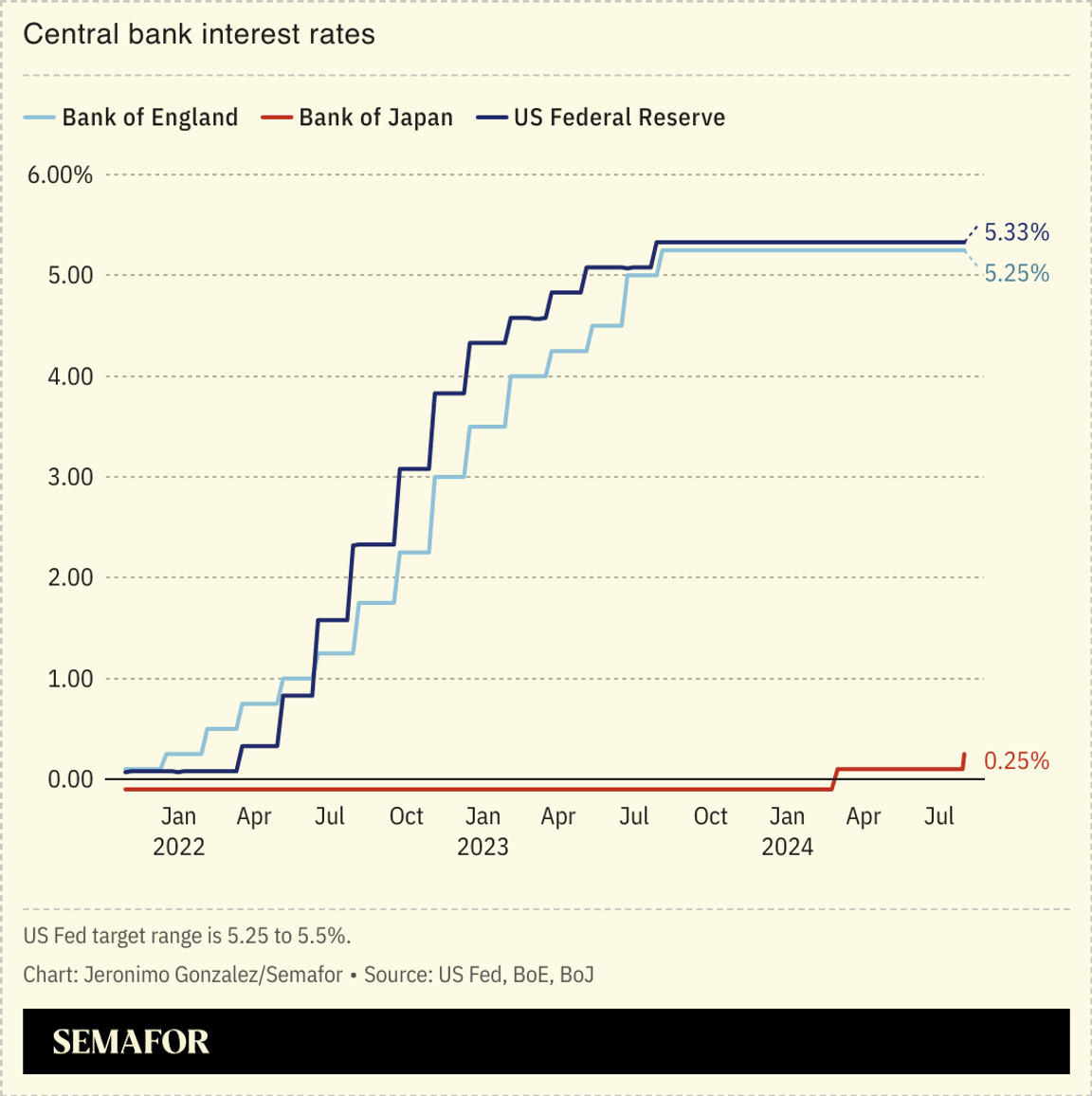

Clean energy companies and their Wall Street backers are watching this week’s meeting of the US Federal Reserve closely for signs that interest rates will fall soon, alleviating one of the most significant headaches Big Renewables has suffered over the last two years. On Wednesday, the Fed is expected to release its latest assessment of US inflation and employment trends. A change in the benchmark interest rate, now at its highest level since the early 2000s, is unlikely, but economists expect the report will contain enough good news about the cooling of inflation that a rate cut is likely forthcoming in September. If so, one of the biggest winners would be the clean energy industry, which relies heavily on borrowing for the upfront capital needed to build solar farms and other infrastructure.  Lower interest rates should give clean energy a jolt at a time when the US is falling far behind its electricity decarbonization goals — and should reward investors who held on to renewables stocks as they tumbled over the last two years. Supply chain bottlenecks and slow bureaucracy are also major headwinds for renewables. But interest rates touch on a particularly sore spot for the industry: its ability to turn a profit in the volatile, cutthroat power market. Cheaper borrowing means better margins, and gives the industry a buffer, albeit modest, against the political risk to the energy transition from Donald Trump’s presidential campaign. Renewables started to go mainstream during the 2010s in a period where interest rates were at or close to zero, a kind of training-wheels environment in which cheap borrowing made it easier for project developers to deliver on their investors’ profit expectations. The interest rate run-up that began in 2022 to combat post-pandemic inflation, and the fact that it has lasted this long, took the industry by surprise, said Melinda Baglio, CFO and general counsel at the renewables investment firm CleanCapital. In that time, the pace of new project development has slowed. Industry consolidation has also slowed, as smaller developers, eager to get debt off their books by selling their projects off, have been increasingly forced to accept discounted prices from larger buyers. With even a relatively small dip in the benchmark rate — Fed prognosticators expect it to fall by 0.25% in September — “there will be a lot more movement in the market,” Baglio said. |