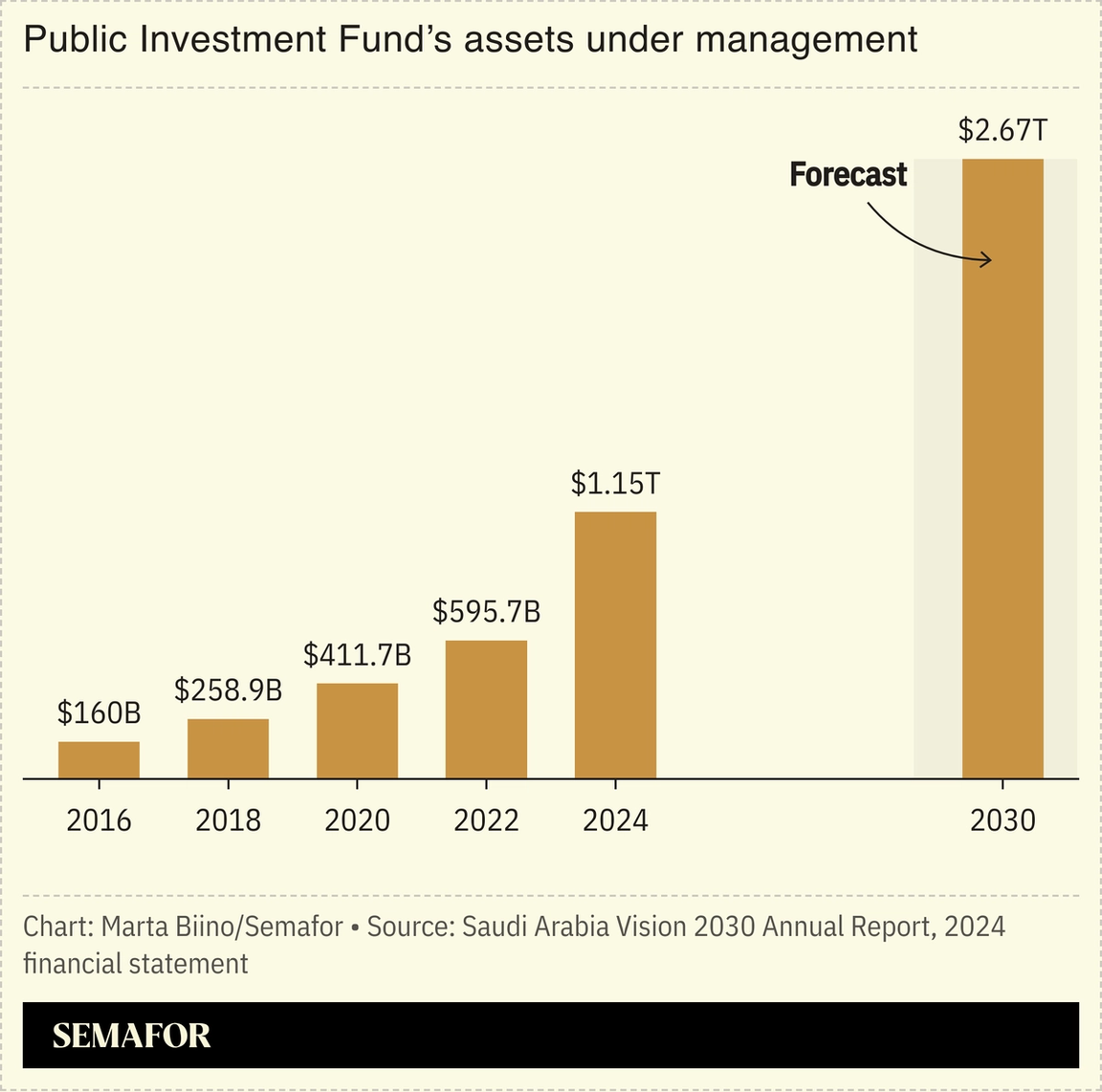

Saudi Arabia’s Public Investment Fund now manages more than $1 trillion in assets for the first time, even as profits have plunged and costs for the kingdom’s ambitious projects have surged. Joining the illustrious club shows that PIF remains “one of the boldest institutional experiments in sovereign finance,” fund tracker Global SWF noted. Yet underlying the headline figure, unveiled in PIF’s annual report, are signs of Riyadh’s shifting priorities. As Vision 2030 nears its 10-year mark, projects like NEOM and The Red Sea Project remain illiquid. They are now on tighter budgets and longer timelines. A third consecutive annual fall in foreign investment has also meant PIF is footing more of the bill than originally intended. “You can’t defy gravity forever, especially when interest rates are high, oil prices are middling, and foreign capital is wary,” Global SWF said, characterizing PIF’s evolution as moving “from grandiose to grounded.” Indeed, there are signs that the kingdom’s support of its mature, operational businesses is paying off, which may prove critical to threading the post-oil needle. Esports company Savvy Games, aircraft lessor AviLease, telecom firm STC, and mining giant Ma’aden, as well as dividend earnings from Saudi National Bank, helped boost 2024 revenues 25%. |