| Highlights from Semafor’s World Economy Summit in Washington, D.C. ͏ ͏ ͏ ͏ ͏ ͏ |

| Liz Hoffman |

|

We just wrapped up our World Economy Summit in Washington, where we interviewed more than 100 global newsmakers, many of whom made news.

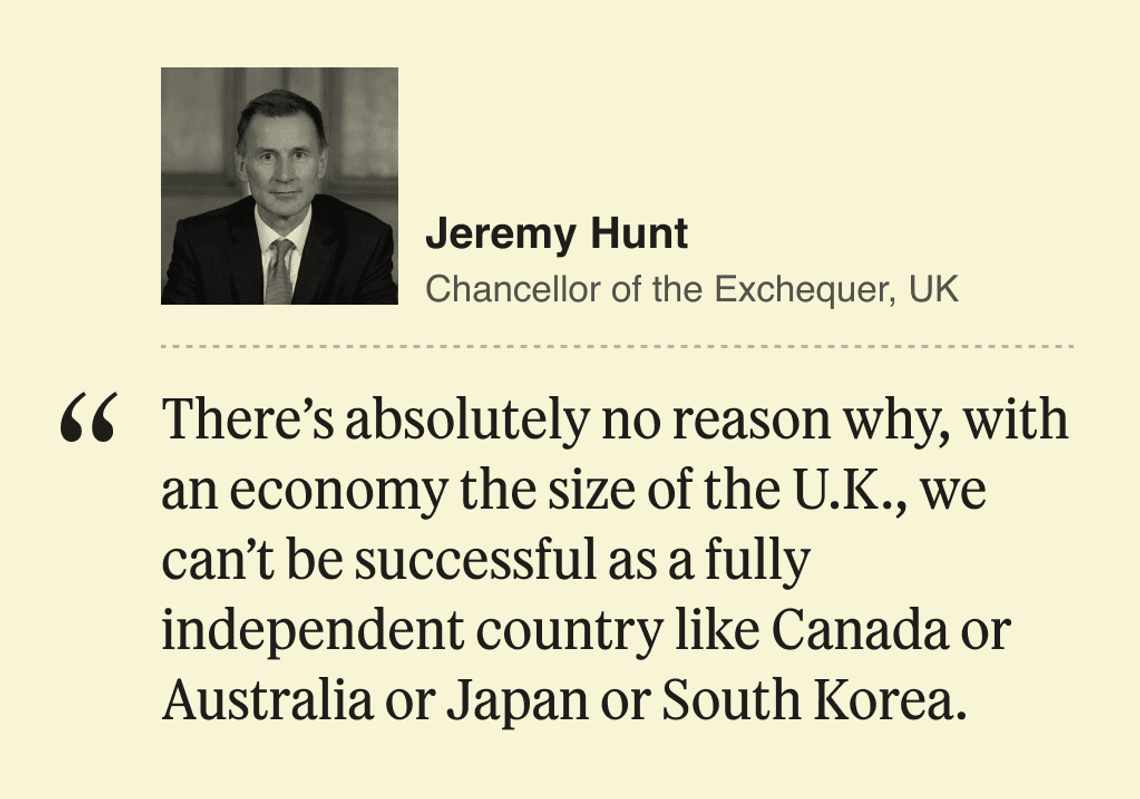

New York Fed President John Williams briefly tanked the Treasury market by raising the prospect, however unlikely, that the Fed’s next move is up, not down. German chancellor Christian Lindner took shots at American fiscal policy. Kevin Warsh was unsparing in his criticism of the Fed; Rep. Patrick McHenry was unsparing in his criticism of his own Republican caucus. Chancellor of the Exchequer Jeremy Hunt confirmed that Downing Street is indeed infested with fleas. (We ask the tough questions here.)

“Our national fiscal trajectory is unsustainable,” Hank Paulson said. “The national debt we have will ultimately, if unchecked, destroy our economic well-being and our national security, which is rooted in the economy.”

The sheer amount of debt doomerism I heard this week was notable. The U.S. will spend more this year paying the interest on its $35 trillion debt than on either national defense or Medicare, according to the Congressional Budget Office — and that forecast assumed rates would start coming down in June, which looks increasingly unlikely.

“Nobody seems to be worried that much” about America’s soaring debts, David Rubenstein said, “in part because people have been willing to buy our Treasury bills. At some point people won’t be willing to do that.” He reminded us that the Dutch guilder was once the world’s reserve currency.

It’s easy to brush off Paulson and Rubenstein as hawks whose aversion to debt is generational and personal. Paulson was a spendthrift even when he ran Goldman Sachs, living in a 1,200-square-foot apartment and once returning a new winter coat his wife, Wendy, found too showy. Rubenstein grew up poor in Baltimore, worked in the Reagan White House, and, to hear him tell it, recently bought the Orioles as a bit of “patriotic philanthropy.”

But it was a multigenerational message in D.C. this week. “There’s a risk that we are taking the reserve currency position for granted,” Goldman President John Waldron told me. “We’re really betting on U.S. households to keep funding the Treasury.” Recent auctions have gone poorly, as once-reliable buyers, particularly the Chinese government, have stepped back. “I wish Washington would get its spending under control,” Waldron said, warning of a political spark that could jolt the Treasury market.

In the U.K. last year, it was Liz Truss’s mini-budget. In the U.S., in 2024? Take your pick.

➚ BUY: Dining. Strong retail sales are complicating the Fed’s plans to declare victory over inflation, and a core cause is Americans’ insatiable desire to eat out. Sales at restaurants and bars, seen as a reliable indicator of household finances, rose 0.4% in March after climbing 0.5% in February. ➘ SELL: Whining. Trump Media Group, whose shares are down by half since late March, complained to Nasdaq about short-selling and blamed — who else — Citadel, which responded by calling TMTG’s chief executive, Devin Nunes, a “loser” and “exactly the type of person Donald Trump would have fired on ‘The Apprentice.’” |

|

| Highlights from Semafor’s World Economy Summit |

|

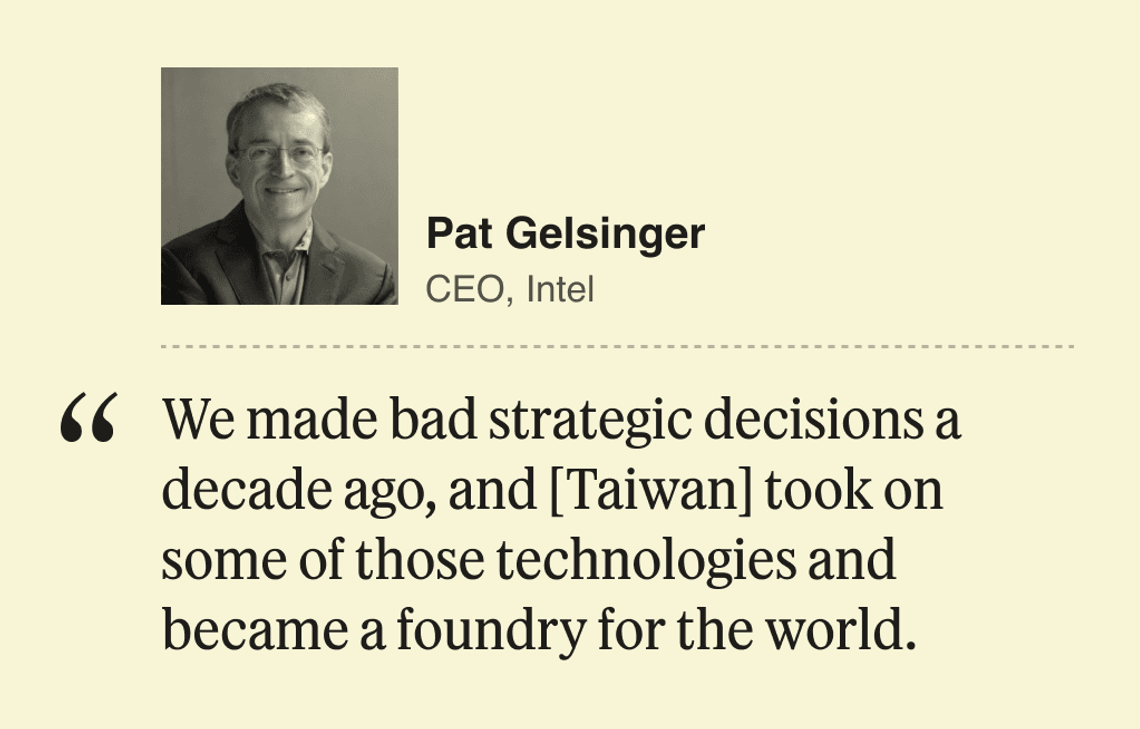

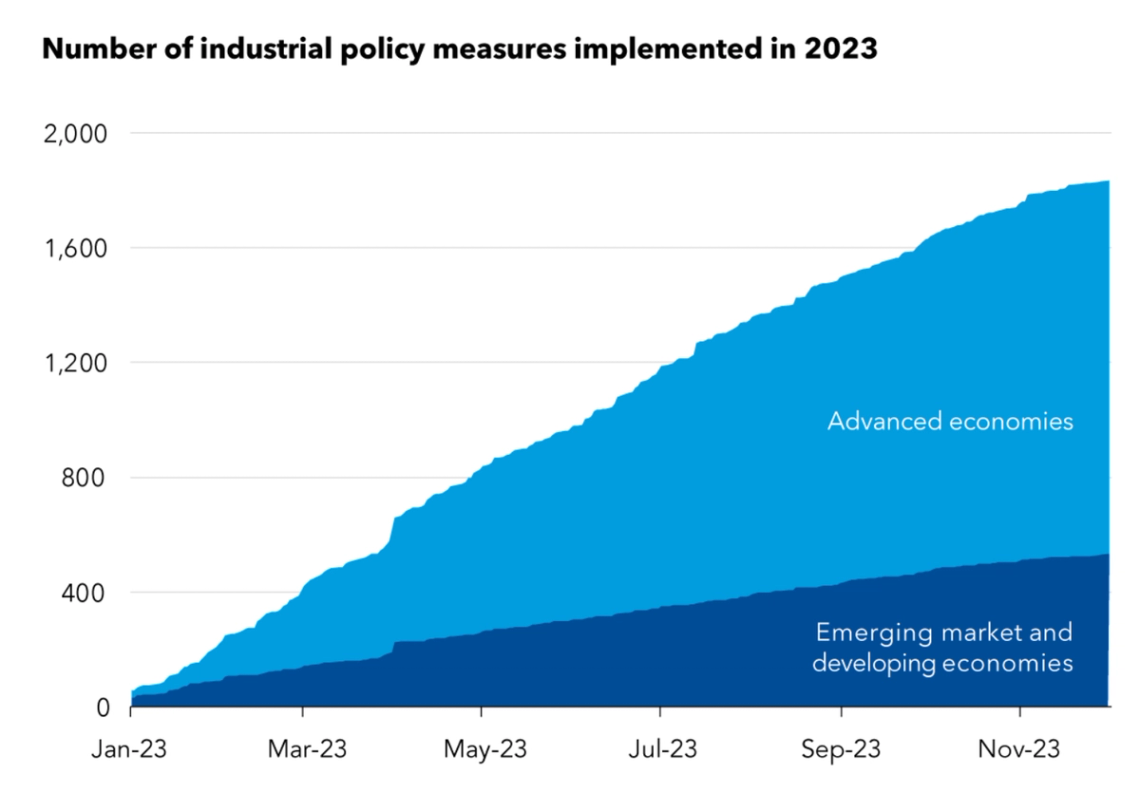

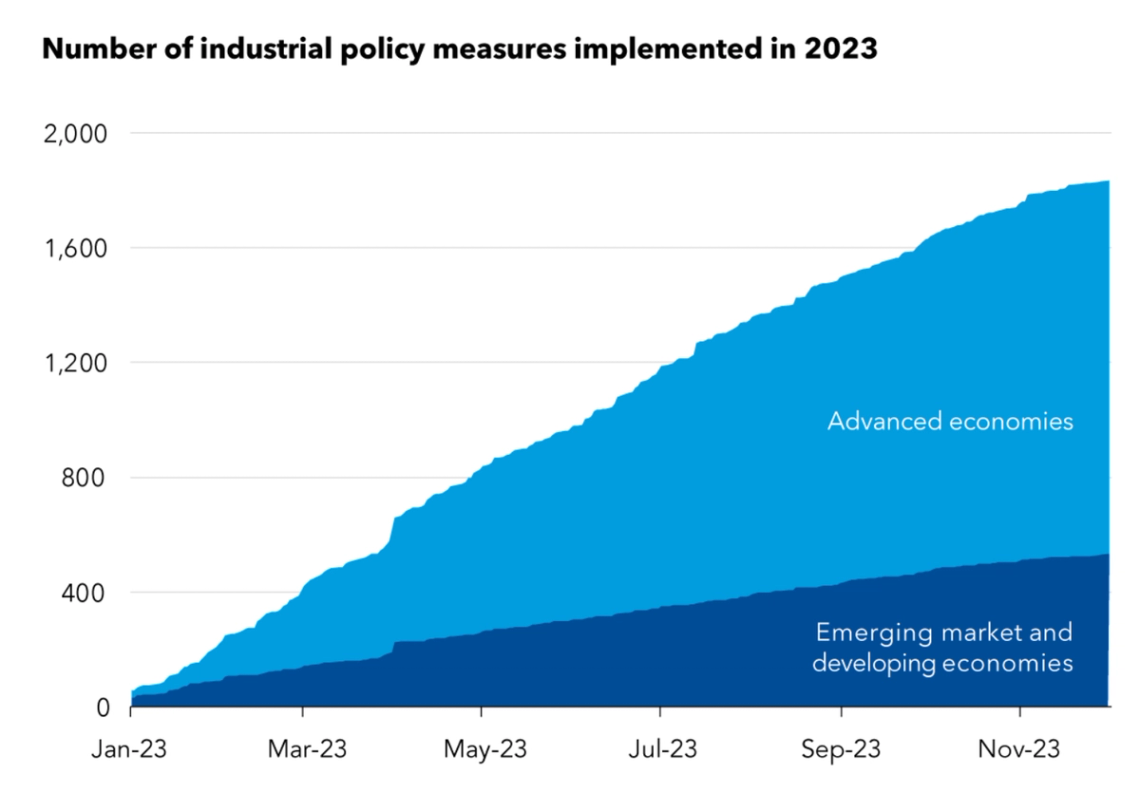

International Monetary Fund International Monetary Fund“Industrial policy is back,” this week’s Washington host, the IMF, wrote recently in a new research paper that found 2,500 new trade barriers, incentives, subsidies and public procurement measures introduced around the world in 2023. The biggest offenders are advanced economies, not small countries trying to prop up local industry. The race to own the green-transition supply chain is behind about two-thirds of new measures, the IMF found. “We’re open for competition, but it must be a fair competition,” EU Trade Commissioner Valdis Dombrovskis told me this week, by way of explaining why Europe is cracking down on Chinese EVs and other imports. |

|

Here’s the lede of a WSJ story I wrote in 2019.  And here’s the lede of a WSJ story today.  Two things that are evergreen: Regulatory dithering and anti-bonus sentiment. A handful of Dodd-Frank reforms are still unimplemented, but this one faces long odds because the Federal Reserve isn’t on board. |

|