| | In today’s edition, we share what we want to ask finance ministers and business leaders at our marqu͏ ͏ ͏ ͏ ͏ ͏ |

| Liz Hoffman |

|

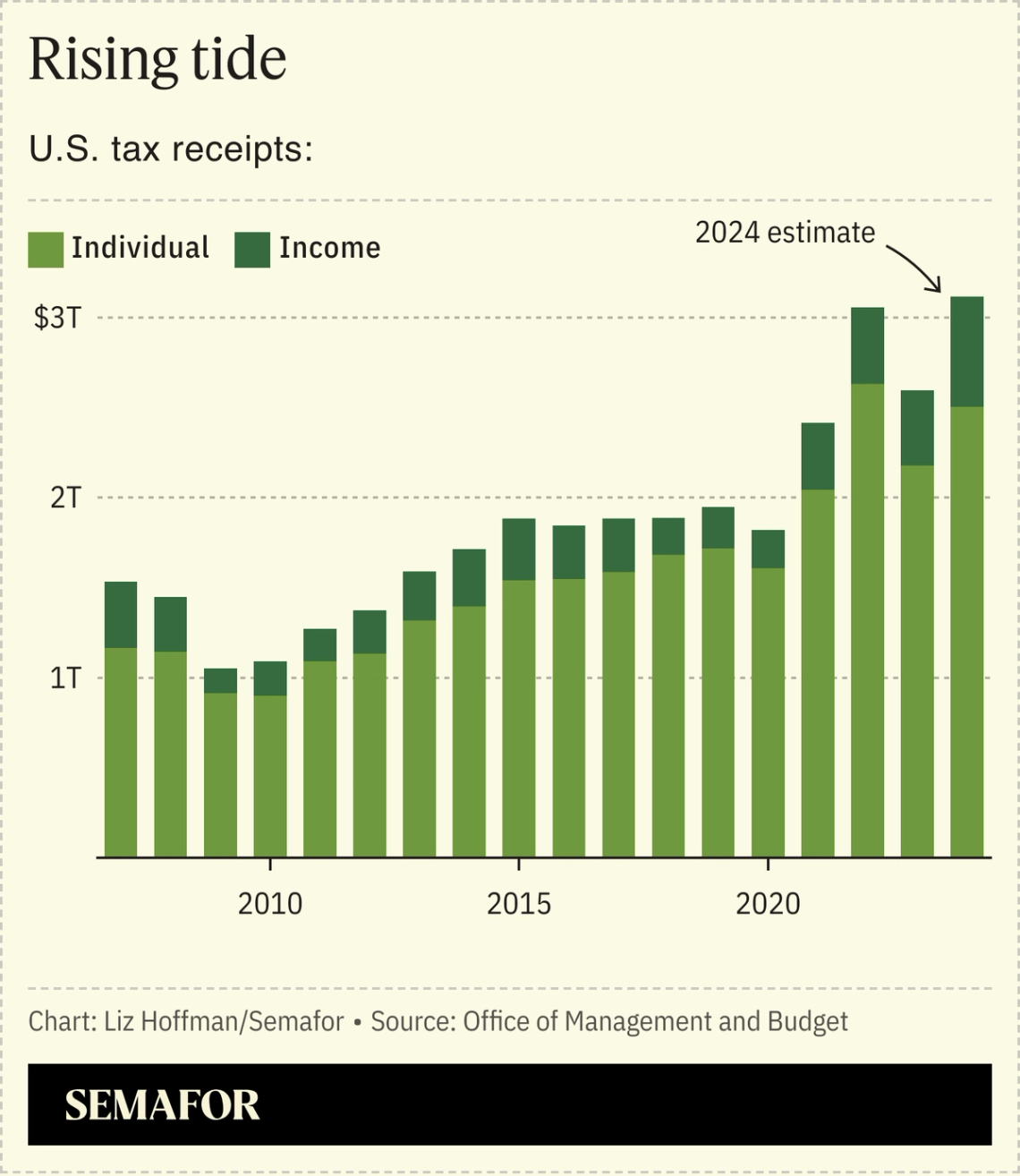

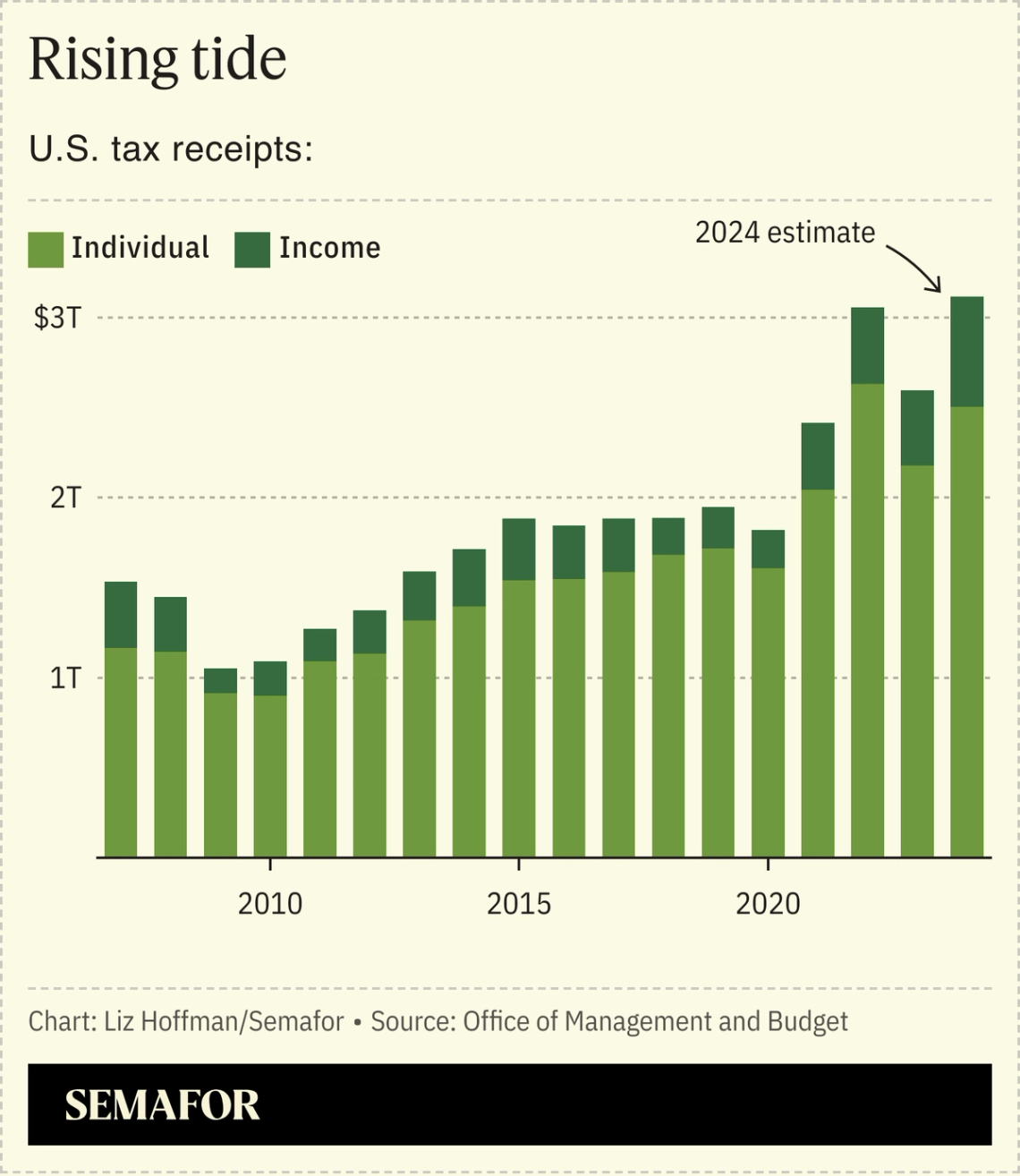

Governments, operating in emergency mode for four years, are struggling to find a new normal. Economies are shooting off confusing signals, which isn’t helping things. Europe hasn’t grown in the past 18 months, despite high inflation, which is usually accompanied by a red-hot economy. U.S. consumers are still spending, but how is anyone’s guess. The oil market absorbed Red Sea missiles and a war in Israel and shrugged. Against that backdrop, Semafor’s second annual World Economy Summit kicks off tomorrow in Washington, which is currently crawling with global central bankers, finance ministers, CEOs, and investors. My colleagues and I will be interviewing more than 100 of them about the biggest issues of the day — inflation, slowing global growth, debt doom cycles, and how to keep AI from killing us all. A preview below of what’s on my mind, and we’ll be back Friday with highlights. Plus, an ominous lending slowdown and CVC gives it another go.  Pedro Pardo/AFP via Getty Images Pedro Pardo/AFP via Getty Images➚ BUY: Dollar. The greenback is on its best run in more than a year, up 3% against a basket of currencies since December. Higher-for-longer interest rates generally benefit the dollar, but this rally is fueled more by American exceptionalism — a strong economy and (slowly) easing inflation. ➘ SELL: Bills. Flush with tax dollars, the U.S. government is paying off its short-term debts. Higher wages and booming corporate profits are expected to boost tax receipts 5% this year, outpacing inflation and shrinking the supply of near-dated T-bills by as much as $300 billion.  |

|

Here’s my interview dance card in D.C. this week, and what’s on my mind. But send me questions! You can reply to this email. John Williams, New York Fed President The Bank of England is launching a major overhaul of how it forecasts inflation after former Fed Chair Ben Bernanke detailed the failing of the BOE in a policy review. Does the U.S. Federal Reserve need a similar postmortem? Plus: The latest jobs and inflation data shows the economy is still running hot — perhaps too hot for the Fed to ease off before the summer. Does it have the guts to make a major move on interest rates in the back half of an election year? Christian Lindner, German Finance Minister Europe’s biggest economy is likely in a recession, with four straight quarters of near-zero or negative growth. “Germany is not the sick man” of Europe, Lindner said recently, but a “tired man” in need of some coffee. What’s the disease, and what’s the coffee? Plus: rearming a nuclear Europe, trade with China, and keeping the Western consensus on Ukraine together. Jeremy Hunt, U.K. Chancellor of the Exchequer Speaking of sick men of Europe — technically not Europe, which helps explain why it’s sick — the U.K. is also in a recession and expected to have essentially no growth until 2026. That’s despite recognizing early on that inflation was anything but transient and being the first major government to start raising interest rates. Where did it go wrong? Plus: AI investments (Hunt is Her Majesty’s government’s point man), EV subsidies, and his plan to build a Hollywood in east Britain. John Waldron, Goldman Sachs President Trillions of dollars of assets have moved out of banks and onto the balance sheets of their clients, out of view and much of it backed by untested funding. Are we headed for a reckoning? Goldman is also in the late stages of a retreat from consumer banking, getting back to its roots as a Wall Street firm. Where does it go from here? Valdis Dombrovskis, EU Trade Minister Is Europe ready for another Trump administration? His protectionist policies last time sparked a trade war and retaliatory tariffs on everything from steel to Harley Davidsons to Kentucky bourbon. The relative strength of the U.S. economy versus Europe’s has only widened since then. Plus: Janet Yellen was in China last week warning of “overproduction” — those exports have to go somewhere… Patrick McHenry, Chairman of the U.S. House Financial Services Committee McHenry launched his career as a Republican firebrand, but he has advocated for technocracy over partisan theater on “the most complicated bits” of economic policy, like the debt ceiling and budget negotiations. He’s criticized financial regulators over new banking rules and his own caucus over Ukraine funding. He’s not running for reelection, and I wonder if he’ll have a more pointed message for fellow Republicans on his way out. |

|

Loans to companies are a pretty good indicator of where the economy is heading, and they’re falling at America’s biggest banks. Commercial loans were flat or slightly down at the five biggest U.S. lenders. “At some point, that’s got to give,” PNC’s chief executive, Bill Demchak, said on this morning’s call with analysts. “But I do think there continues to be hesitancy, on manufacturers in particular, just in the face of this economy.” A big caveat: Companies are getting more of their debt from nonbanks. A busier bond market can shift lending away from banks though that’s off to a slow start this year, too. |

|

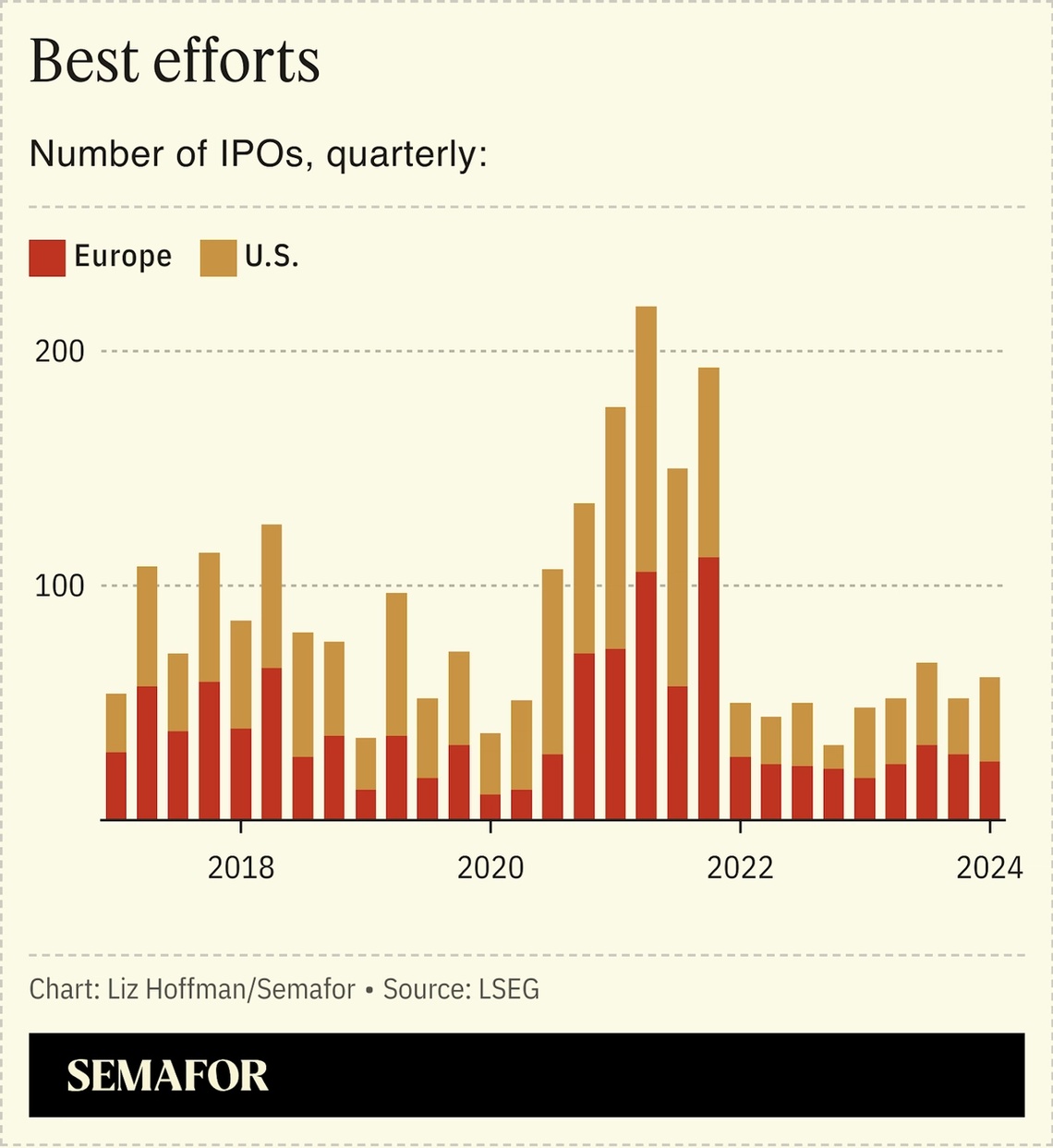

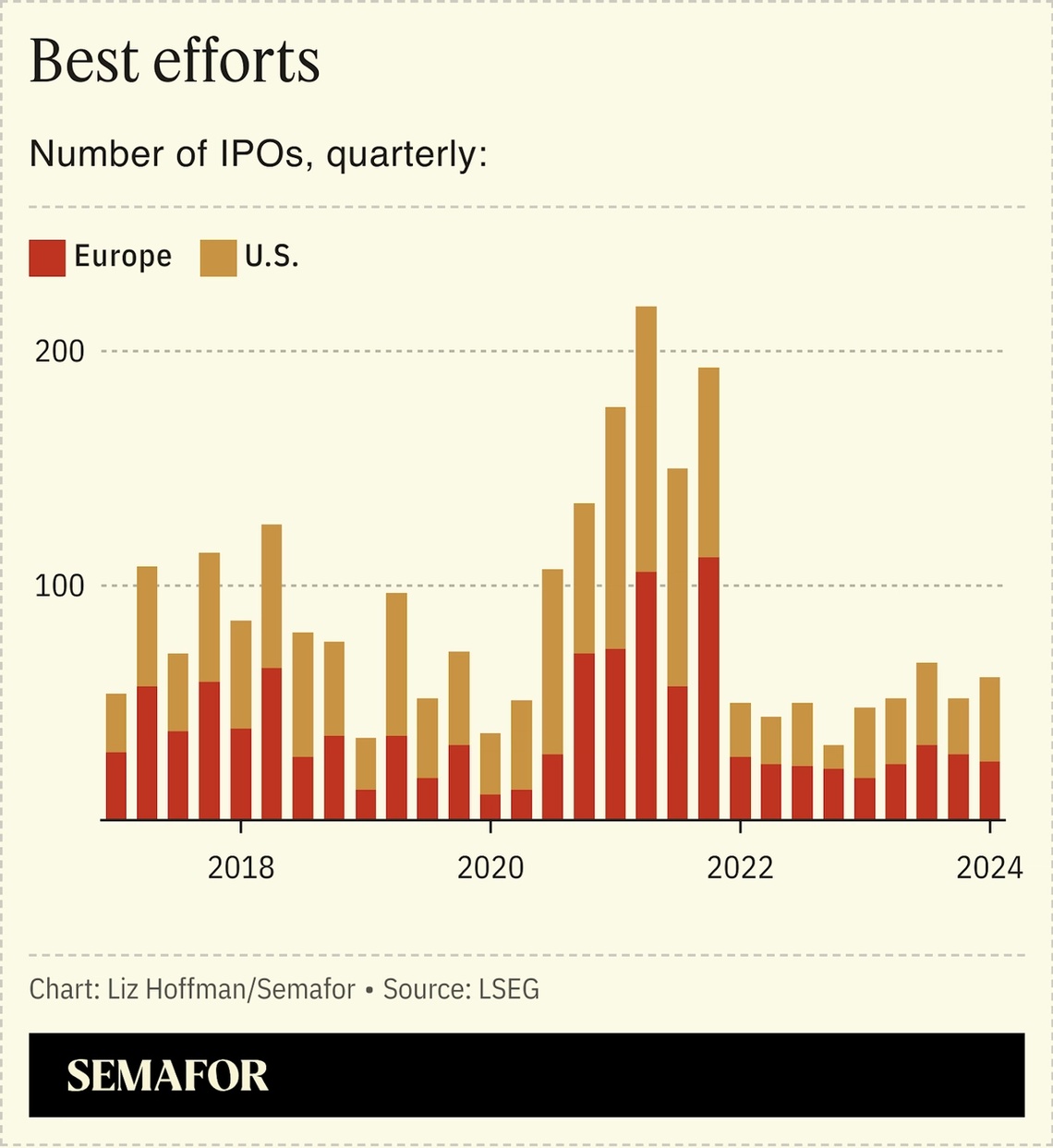

On second thought: In 2010, the U.S. Justice Department’s antitrust division blessed the merger of Live Nation and Ticketmaster. Now it’s planning to sue the company, WSJ reports. It’s unclear exactly what a case would allege, but regulators found in 2019 that the company had retaliated against venues that switched to a different ticketing service and put it under close watch through 2025. Since then, a botched sale of Taylor Swift tickets outraged fans and brought new scrutiny. “I just want to dispel this notion that this is not a monopoly,” Sen. Amy Klobuchar said last year. Antitrust regulators used to be more open to approving mergers with negotiated fixes. Live Nation and Ticketmaster had to sell a college-sports division and license their software to a competitor. But neither has made much traction — Live Nation still controls an estimated 70% of the market — and in the 14 years since the deal was approved, regulators have changed their tune after a handful of divested businesses, most of them bought by private-equity firms, quickly filed for bankruptcy. “Merger remedies short of blocking a transaction too often miss the mark,” DOJ’s antitrust chief, Jonathan Kanter, said in 2022. Once more, with feeling: CVC has revived its twice-postponed IPO, becoming the first private-equity firm to go public in more than two years and testing a listings market that is showing shaky signs of recovering. The private-equity firm is seeking a valuation of $13 billion, a bit higher than the last time, when it pulled a planned listing after Hamas’ attack on Israel.  |

|

- Senegal’s new leader is breaking old ties.

- Some MAGA politicians move left on abortion.

- The Intercept is running out of cash.

|

|

| |