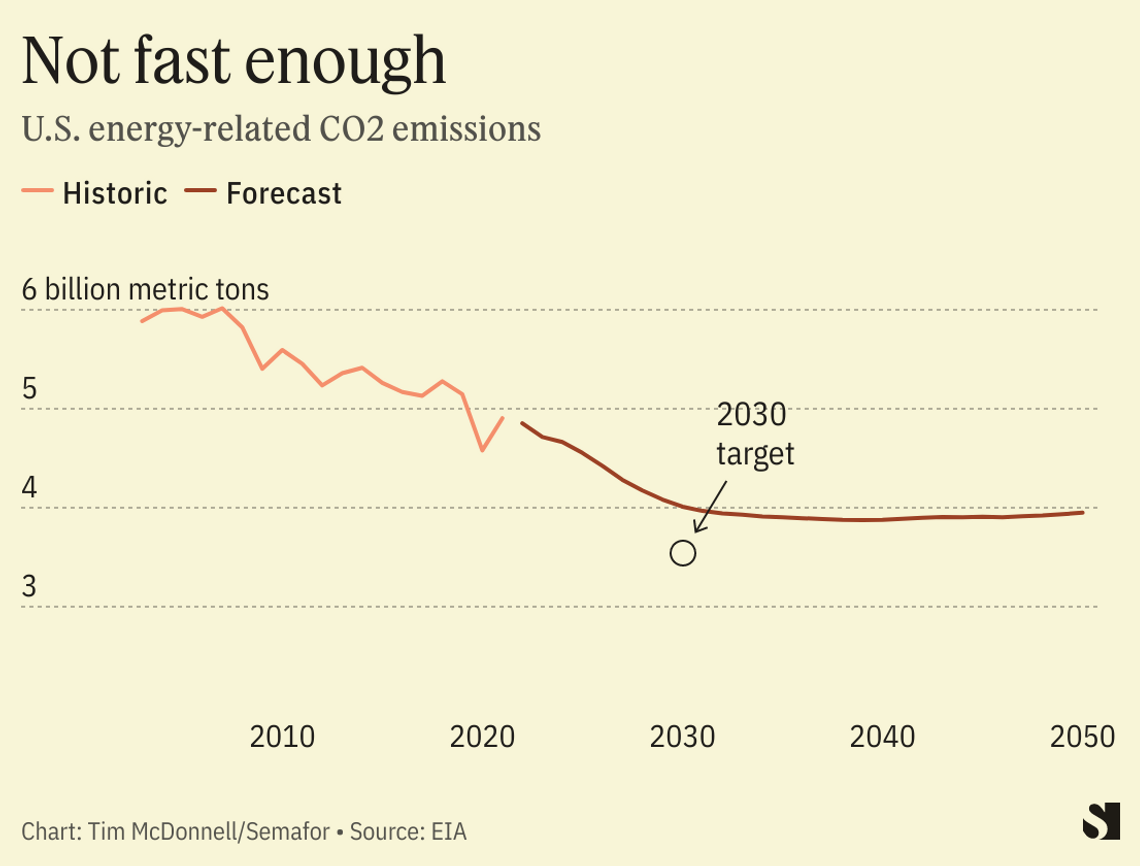

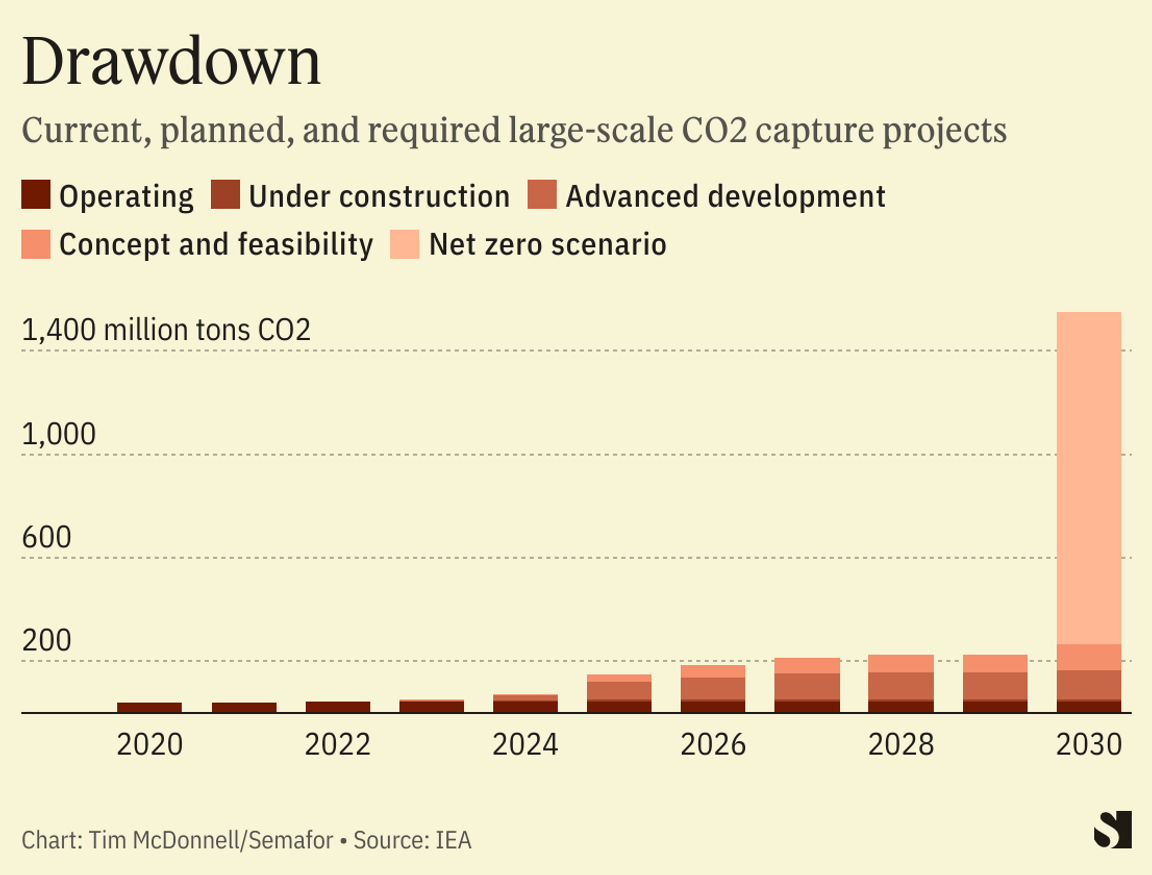

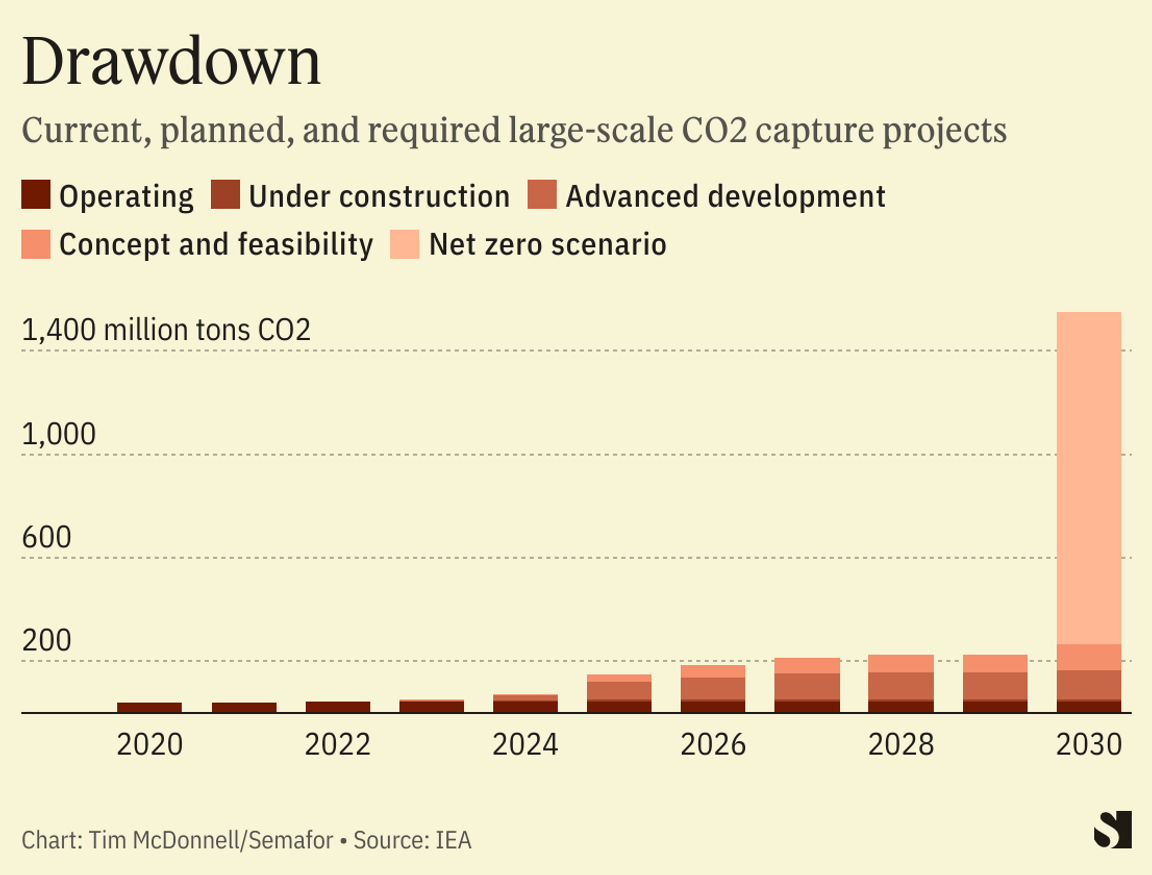

Shell’s carbon capture and storage facility in Fort Saskatchewan, Alberta, Canada. REUTERS/Todd Korol Shell’s carbon capture and storage facility in Fort Saskatchewan, Alberta, Canada. REUTERS/Todd KorolTHE SCOOP Global oil and gas companies are writing their own rules for controversial carbon-sequestration projects, officials say — but they’re divided over what those rules should be, in particular on proposed legislation that would offer protection in lawsuits over negative side effects. Two bills introduced last week in the Texas state legislature — one of which was partially authored by Chevron — aim to shield companies that inject CO2 captured from factories, power plants, or the atmosphere into underground reservoirs from some litigation, in the event that the reservoirs leak, trigger earthquakes, or otherwise cause damage. But Oxy, formerly Occidental Petroleum and an aggressive proponent of carbon capture, utilization, and storage (CCUS), opposes the moves, putting it in an unlikely alliance with environmental groups. TIM’S VIEW The debate in Texas shows how legacy energy companies are racing to write the rules for emerging climate technologies, and points to an issue on which the Biden administration’s clean energy development goals and its environmental justice promises may conflict. CCUS is a growing area of focus for oil and gas companies, who see it as a way to continue producing and burning fossil fuels with a lower climate footprint. Most energy modelers agree that given how entrenched oil and gas are in the economy, a large amount of carbon capture will be necessary for the world to meet the Paris Agreement warming goals. Texas in particular is keen to establish itself as a CCUS hub. By 2030, the volume of carbon captured globally is on track to more than double, up to 110 million tons per year. Demand for storage space, the International Energy Agency projects, could rise from about 40 million tons per year today to more than 5 billion by 2050. Liability limits for sequestration are a prerequisite for large-scale investment in a nascent technology, some companies say. Chevron, working with the Texas Oil & Gas Association (TXOGA), “helped author” one of the bills, a company spokesperson said, that was then introduced by Greg Bonnen, a Republican representing the Dallas suburbs. Bonnen did not return a request for comment; a BP spokesperson said the company supports the Bonnen legislation. But Oxy, which is pushing most aggressively to the forefront of CCUS, told me in a statement it “oppose[s] shifting long-term liability” off of companies and onto a state-managed trust fund, because the projects are in its view low-risk: “Properly selected and operated CCUS projects offer safe, secure and permanent CO2 storage.” Environmental groups have the same position, albeit for different reasons, arguing that although carbon sequestration has indeed been performed on a smaller scale for years without incident, it still entails risk to groundwater and that companies shouldn’t be completely off the hook for potential damages.  KNOW MORE Most carbon captured today is sequestered via “enhanced oil recovery,” a process in which it is injected into oil wells to push out the last drops. That type of use has helped make early-stage carbon capture facilities economic. But to reach the necessary scale, most CO2 will need to be injected deep underground into formations of porous rock. The Inflation Reduction Act doubled the tax credit available for geologic carbon storage, to $50 per ton. “Texas has an opportunity to take the lead on this technology,” state Representative Drew Darby, a Republican who authored the other bill, told me. “To do that you have to create an environment that will allow businesses to invest in CCUS.” Darby’s bill would limit the circumstances under which a company could be sued over an ongoing sequestration project, unless the company falsified information provided to regulators. It would also codify that sequestered CO2 does not qualify as a “public nuisance,” preventing suits brought on those grounds. Bonnen’s bill addresses the period after a sequestration project is closed — an important part of the timeline for projects that are, in theory, meant to keep CO2 permanently out of the atmosphere. It authorizes the state to collect an unspecified advance fee from companies to create a trust fund out of which future maintenance and legal fees can be paid. Once a reservoir is no longer being added to and passes closure inspections from regulators, the company is released from liability. The state operates a similar program for oil and gas wells, which has failed to keep up with the pace of oil well retirements and had to be buttressed with federal funds last year. Chevron is more supportive of the second proposal than the first, the spokesperson said: The company “believes that CCUS operators should remain responsible and liable during the higher-risk stages of projects (e.g. during injection) as well as during the immediate years after site closure to ensure it was closed properly, [but] we also support frameworks that allow for liability to be transferred to a governmental entity when risk is minimal and reasonable conditions have been met.” Environmental groups have complained that the public health risks of carbon sequestration infrastructure on nearby communities are understudied, and that the industry needs more, not less, oversight. The Bonnen bill is a “get out of jail free card,” said Scott Anderson, Austin-based senior director for energy at the Environmental Defense Fund. “It’s a problem for the industry to simultaneously say ‘Don’t worry, we can do this, but by the way if it turns out not to be safe and effective, we don’t want to be responsible for mistakes’.” STEP BACK One reason for the industry split over liability protections has to do with the grinding pace of federal permitting bureaucracy. Geologic carbon sequestration projects require a special permit from the Environmental Protection Agency. These permits are notoriously tedious to procure; only two have been issued so far nationwide, after a six-year application process. As a result, some states are keen to get permission to bypass that process and issue permits themselves. Wyoming and North Dakota have succeeded, but Texas is still bound by the federal process, which many in the industry would like to change. But if the state’s legal criteria for these projects are weaker than the EPA’s, that delegation is less likely to come through, Anderson said. Accepting greater liability, in other words, may be worth it to bypass the federal permitting process. ROOM FOR DISAGREEMENT Scientists have cautioned that built-up pressure in CO2 reservoirs has the potential to cause small earthquakes and that CO2 leakage into groundwater aquifers can lead to increased concentrations of lead and arsenic. Still, research and industry experience so far shows that carbon sequestration is far less environmentally hazardous than oil and gas production. Within a few years, depending on geologic conditions, the CO2 turns to stone, minimizing risk that it later escapes back into the atmosphere. To date there have not been any notable mishaps on carbon sequestration sites in the U.S., said Erin Burns, executive director of Carbon180, a carbon removal advocacy group, and the practice is a good fit for the business model and workforce expertise of oil and gas companies. “We can absolutely store lots and lots of CO2 very safely,” she said. “But it’s about public trust. We need to do it in ways that communities are comfortable with.” THE VIEW FROM CORPUS CHRISTI One venue looking to dive headfirst into carbon storage is Texas’s Port of Corpus Christi, the country’s top oil export hub. In 2021, it announced a plan to eventually sequester 10 million tons of CO2 per year, and in February it was awarded $16.4 million from the Department of Energy to put that plan into action, the largest such grant awarded so far. In an interview last week, Sean Strawbridge, the port’s CEO, said he supports the Bonnen bill. “We want to be the carbon holding tank for the hemisphere,” he said. “Bring us your carbon!” NOTABLE - One thing not to worry about is running out of storage space. The IEA estimates that the world’s total carbon sequestration capacity could be as high as 55 trillion tons — 11,000 times more than projected demand. It also found that 70% of global emissions come from sources within 100 kilometers of a potential storage site.

|