| In today’s edition, the government’s funding cuts could hurt the US’ lead against China in the tech ͏ ͏ ͏ ͏ ͏ ͏ |

| Reed Albergotti |

|

Hi, and welcome back to Semafor Tech.

A pullback in federal spending on scientific research is threatening the nation’s tech sector and could hamstring the US in its cold war with China. But don’t blame President Donald Trump or Elon Musk.

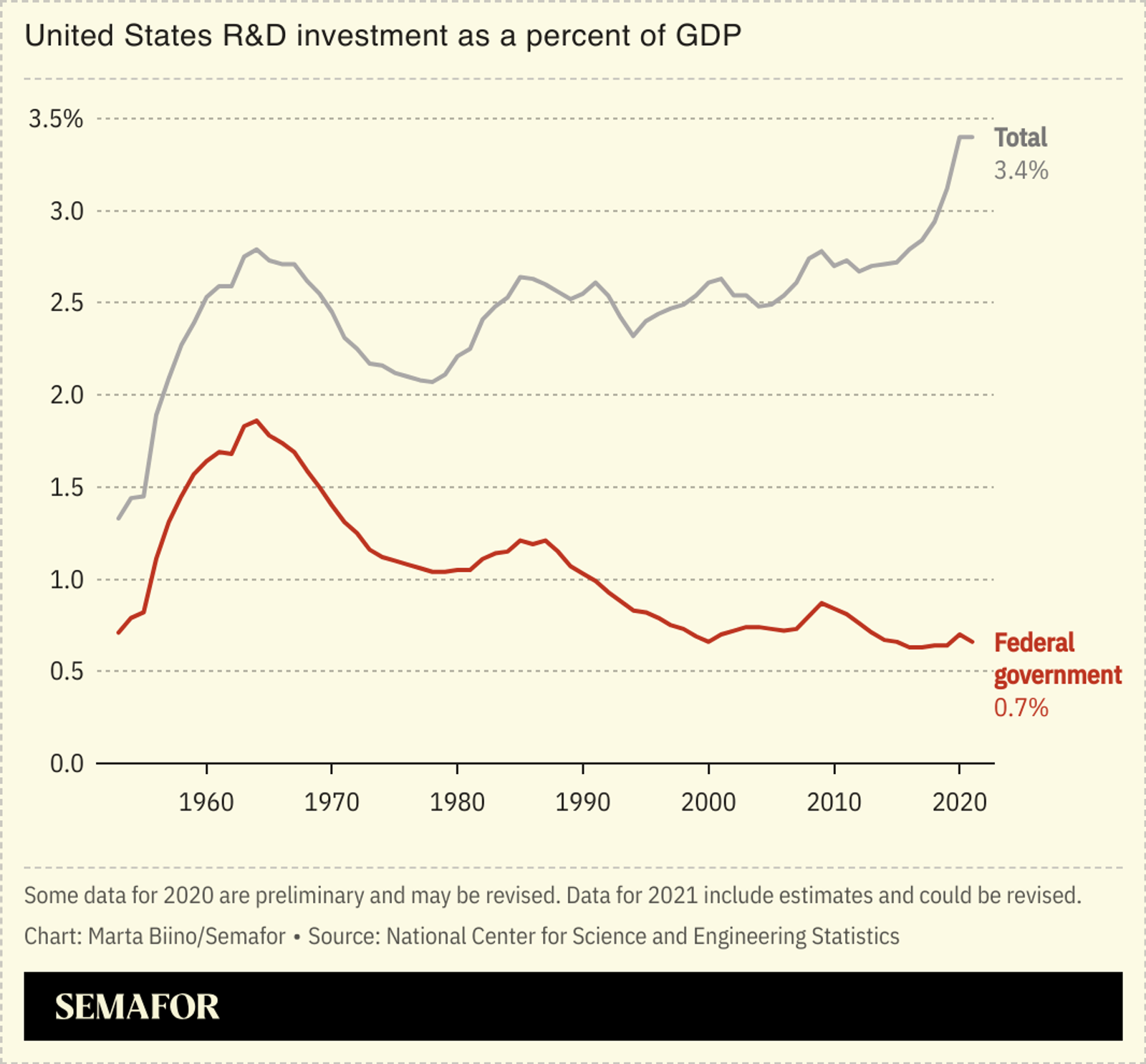

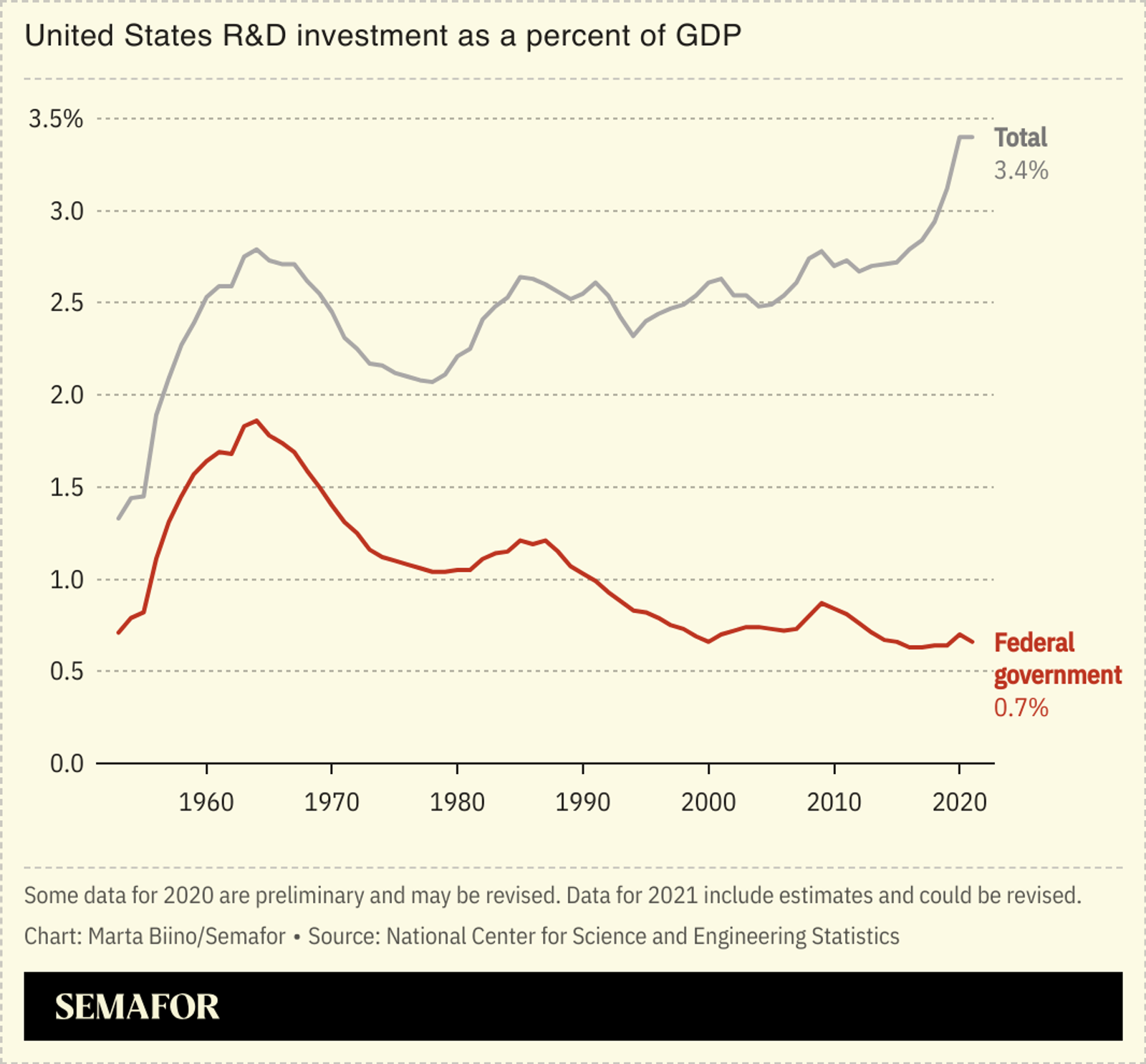

Since the 1960s, federal spending on research and development has been steadily dropping as a percentage of the country’s gross domestic product — and despite that, research grants were pivotal during the Cold War against the Soviet Union, fueling one of the greatest periods of economic growth the world has ever seen.

But the US fell asleep at the wheel and allowed China to catch up, challenging it for scientific superiority. In recent years, however, Silicon Valley has largely come to appreciate this, ditching anti-government attitudes in favor of ramping up funding for R&D and defense tech.

There are plenty of people within the Trump administration who understand how the government’s role in R&D affects the technology race with China. And it seemed like a good bet that we’d see big, ambitious efforts like a “Manhattan Project for AI.”

But instead of moonshots, the story has more so been about budget cuts and firings at agencies like the National Science Foundation and the National Institutes of Health, partly under the belief that some of the funding was being “wasted” on DEI-related programs.

What’s unclear is whether the funding cuts will be diverted to research deemed more important, or simply be cut. If it turns out to be the latter, it could spell trouble for Silicon Valley in the long run.

The US is still riding the wave of technological breakthroughs that were funded by federal research grants decades ago. The internet, lithium-ion batteries, and semiconductors are just a few examples. The ROI for the country has been immense — NSF’s paltry annual budget is about what Apple spends on R&D quarterly.

But as China ramps up spending on cutting-edge technologies like quantum computing and AI while improving its domestic chipmaking capabilities, what will the US do to leap ahead?

The private sector alone won’t be able to compete with China in the long run. But a significant ramping up of federal R&D spending across the board, from the NIH to the NSF, could get the US back on track. There isn’t much time to waste. It takes years for the fruits of research funding to pay off.

Even if you disagree that federal funding for science is important, the whole exercise is a head scratcher because it has saved taxpayers very little money. If you think of DOGE as a consulting service hired to cut costs, it’s been utterly ineffective, avoiding the many big and obvious targets in government.

The tech industry is hoping the Trump administration will think big, but cutting employees who help allocate research grants doesn’t move the needle.

➚ MOVE FAST: Gifts. OpenAI is giving more users access to its powerful tool for performing in-depth analysis, allowing subscribers of its Plus service 10 queries per month. The tool has been a big hit among AI enthusiasts and the expansion shows the company is finding ways to lower the back-end cost. ➘ BREAK THINGS: Gaffes. On the heels of Apple’s kiss-the-ring moment where it gave Donald Trump credit for its data center plans, its AI transcription tool automatically changed the word “racist” to “Trump,” the latest example of an AI model blunder to set off conservatives. |

|

Courtesy of X Courtesy of XIt just got a little more difficult to keep those GPUs cool. Elon Musk’s xAI released “Sexy” mode Tuesday, a voice chat option that lets users get NSFW with their chatbots. Twitter was immediately full of steamy examples, but the voice sounds a bit like a bored librarian reading a romance novel. Still, it’s another signal that a major foundation model company has embraced what the internet has been about from day one: sex. |

|

Is it actually a good time to buy a Tesla? A new media narrative has taken hold about Tesla as publications blame a drop in the electric carmaker’s auto revenues on its founder’s political activities. That may be true, in part, but it could also stem from media confirmation bias. What’s missing from most legacy media articles I’ve read on this subject is any context on the state of the company’s big product lineup. Its Model Y, which was the top-selling vehicle in the world in 2023, is slated for a major refresh this Spring, which has prompted the company to slash pricing on the current model. It’s also launching a new, lower-priced Model Q this year. Its luxury Model X and Model S lines in need of a major refresh, are also expected to come later this year. If I were in the market for an electric car, I would not buy a new Tesla right now (maybe snagging a deal on a used one is a good idea). You’d think this would be pertinent information when analyzing the company’s sales numbers. I’m sure some potential customers are turned off by Teslas because of Musk’s politics, but it seems unlikely that it’s a major factor in overall sales numbers. In my county, Trump got 18% of the vote and I live in a sea of Teslas. I see brand new license plates on them every day. And automobiles are among the biggest purchases a consumer makes, so they’re often more heavily researched beforehand as a methodical decision rather than sentimental. When wading into divisive political topics, we should raise our level of skepticism and be careful not to fall victim to confirmation bias. |

|

“This sort of shameless selling out of Taiwan is in actuality pandering to the United States.” |

— Zhu Fenglian, spokesperson for China’s Taiwan Affairs Office, in response to reports that Taiwanese TSMC, the largest chipmaker in the world, was in talks to acquire a stake in ailing Silicon Valley giant Intel. The reported talks come as US President Donald Trump recently criticized Taiwan for taking the United States’ chip business away, while he also pushed for more domestic production. Trump administration officials have “encouraged TSMC to do the deal,” in hopes of ensuring a better future for the only American-owned chipmaker, whose business has struggled to keep up with competitors, The New York Times reported. So far, neither TSMC nor Intel have confirmed the reports, and Taiwan’s economy ministry — which, by law, is required to approve companies’ overseas investments — said it had not been made aware of any such investment application from TSMC. |

|

Kevin Dietsch/Getty Images Kevin Dietsch/Getty ImagesWorkday CEO Carl Eschenbach isn’t buying the idea that artificial intelligence will replace vast swaths of the workforce, even as he laid off 8.5% of the company’s workforce to prioritize “innovation investments like AI.” “I don’t think it’s going to destroy jobs at all,” he said in an interview with Semafor’s Andrew Edgecliffe-Johnson. The demand for AI agents among its 10,000-plus enterprise customers is “tremendous,” he said. But his optimism comes with a note of caution. “When it comes to quantifying the return on the investment that people have made [in AI], it hasn’t been there as much as people had anticipated,” he says. Companies will still spend, he adds, “but they’re going to be smarter about the ROI that they can expect. And if they don’t see that, they might not invest as heavily as they once thought they would.” Questions about whether Workday’s own investments would drive stronger revenue growth prompted Morgan Stanley analysts to lower their price target from $330 to $275. High hopes for AI spending have powered Big Tech valuations since Eschenbach became Workday’s co-CEO in December 2022, but investors are waiting to see stronger returns from companies such as Workday, whose stock is down more than 10% in the year since he took sole charge. |

|

An employee showing around Meta’s data center in Mesa, Arizona. USA Today Network via Reuters An employee showing around Meta’s data center in Mesa, Arizona. USA Today Network via ReutersMeta is planning yet another massive data center expansion to train future AI models, The Information reports. The company plans to spend more than $200 billion on the project. That’s in addition to previously announced plans to build one in Louisiana that is almost the size of Manhattan. The news comes amid a wave of promised big data center investments since Trump took office. OpenAI announced its $500 billion Stargate investment at the White House and Apple said it would invest $500 billion in the US to power its Apple Intelligence feature. Meta could also link its $200 billion planned investment to the new administration. Meanwhile, markets reacted to an analyst note that Microsoft is wriggling out of some data center leases, implying that the company is rolling back its AI strategy (Microsoft denies the implication, but that didn’t stop Wall Street from fixating on it). |

|

Georg Ulrich Dostmann/Imago via Reuters Georg Ulrich Dostmann/Imago via ReutersThe Qatar Investment Authority has committed nearly half of its $1 billion Fund of Funds program to draw six venture capital firms to establish their regional headquarters in the country, a top official in the sovereign wealth fund told Semafor’s Mohammed Sergie. The initiative was launched following a three-year government study aimed at addressing a funding gap for startups looking to scale in the gas-rich country. “There is sufficient capital today in Qatar for early stage, pre-seed, and even seed rounds, but it’s at Series A to Series B, C, that’s where there’s a funding gap,” said Mohsin Pirzada, QIA’s head of funds investment. |

|