Tim’s view

The year ahead in energy promises to be dominated by the scramble for electrons, pitting “drill, baby, drill” politics across much of the world against the hard realities of cost and supply chains.

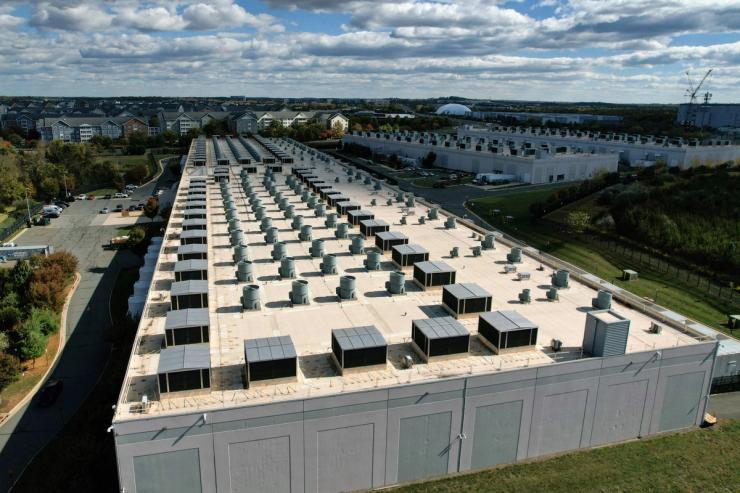

The most significant change in rich-country energy markets over the past year or two has been the overturning of longstanding supply-demand dynamics. Electricity, which was abundant enough to be taken for granted, now looks like the bottleneck constraining everything from data centers to manufacturing.

Meanwhile oil — which pushed close to record high prices after the pandemic — is oversupplied. In a market with scarce power and a glut of fossil fuels, policymakers and investors will have to make some tough choices about whether they can afford to keep up an anti-green posture.

Smart money will look for the speediest electrons to fire up: The AI revolution doesn’t want to wait. But given that global demand for coal, oil, and gas all hit record highs in 2025, and aren’t going away anytime soon, there are still lots of strong bets to make in anticipation of an eventual upswing in the fossil fuel price cycle.

It’s never easy to boil the energy story down to a handful of sub-plots. But here are a few predictions that I’m fairly confident will define my coverage in 2026:

- Power affordability will be the year’s inescapable talking point. Everyone has their preferred bogeyman: The problem is data centers! It’s wind farms! It’s old coal plants! It’s transmission permitting! It’s carbon regulation! It’s rate design! Politicians will deploy the pursuit of cheaper power as an argument for — and against — all of these and more, with voters deciding which arguments are most convincing.

Meanwhile, expect more partnerships and deals between energy companies and Big Tech, and watch the disappearance of clean energy tax credits in the US to see which businesses and projects are really strong enough to survive on their own. It will likely be a banner year for energy storage, which is the skeleton key to combining renewables’ low cost with the round-the-clock reliability of gas. - LNG competition will heat up, and burn some players out. Oil majors’ biggest gamble at the moment is the full-court press to expand their liquefied natural gas trading capabilities. Especially after the full-scale invasion of Ukraine, LNG looked like a surefire bet: Europe was desperate for it, China needed even more, and plenty of countries across the Global South saw it as the route away from coal. In 2026, a number of new export facilities on the US Gulf Coast will come online or ramp up, competing with new terminals in Australia, Qatar, and elsewhere for market share that — in China and Europe at least — has already started to flatten. The price of gas turbines is going up as the cost of renewables comes down. So the US gas industry needs a strategy to get more competitive.

- China will continue to set the terms of the energy transition. China is the biggest energy story in the world by just about every metric. The country’s power-sector emissions could peak this year, but analysts expect solar deployment next year to moderate from its feverish pace. The choices China makes in 2026 about investments in domestic and overseas cleantech manufacturing, trade controls on critical minerals, and domestic consumption of fossil fuels have enormous ramifications for the economic and security prospects of other countries, not to mention their emissions trajectories. It will be a long time before the US or any other country is even close to catching up.

- Energy will play a decisive role in emerging geopolitical conflicts. One interesting takeaway from 2025 was that oil markets mostly shrugged off sanctions and infrastructure attacks, proof that in a glut, policymakers have more flexibility to use energy markets to hurt their adversaries without causing pain for their constituents. That will continue this year in the contexts of Russia and Venezuela.The contest between China and the US on critical minerals and nuclear power innovation will play an even more central role in their broader relationship. Meanwhile, escalating tensions between China and Taiwan will also likely come to hinge on energy; the island nation’s LNG imports are among its chief vulnerabilities. The new era of energy wars is just beginning.

Notable

- Heatmap’s writers and editors discuss their biggest stories and predictions for 2026 in a new Shift Key episode.