The Facts

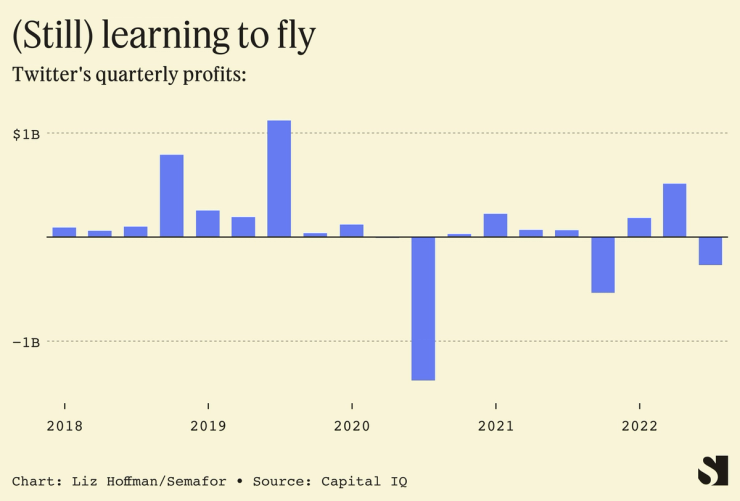

Twitter’s finances are looking increasingly rickety, as Elon Musk’s platform loses revenue and faces about $1 billion in annual interest payments.

Since taking over six weeks ago, Musk has fired half the staff; driven away advertisers with his chaotic and conflicting approach to free speech; and put his own tenure as CEO in the hands of users, in the form of a Twitter poll. “Be careful what you wish,” he warned them, “as you might get it.”

Semafor reported Friday that the billionaire’s team is trying to raise new money for Twitter — at the same price $54.20-a-share price Musk paid.

In this article:

Liz’s view

When Musk went public with his bid for Twitter in April, I called my then-editor at The Wall Street Journal with a slightly contrarian question: Could the world’s richest man actually afford to buy its 14th-largest social-media site?

Musk was worth $250 billion on paper but was cash-poor, and like many billionaires lived mostly on money borrowed from his stakes in companies he controlled. Much of his Tesla stock was already tied up in personal loans. And because Twitter was inconsistently profitable, it was a poor candidate for traditional buyout debt, which is secured by the cash flows of the company being acquired.

Plus, Musk had already done this once before. The list of billionaires who have tweeted an offer to buy a company with no money lined up is, to my knowledge, a list of one, and it is Elon Musk. I thought he would, in order: fail to raise the money, lose interest, and go away.

I was wrong. Within three weeks, Musk had assembled a $46.5 billion financing package that was, by Wall Street standards, pretty conventional. Musk agreed to put up about half the money himself and borrowed the other half from Morgan Stanley, whose bankers were confident they could sell bondholders on the idea.

Since then, two things have happened: Markets have tanked, and Musk has made a serious of chaotic personnel and product moves. (Actually a lot more than that happened, involving a swing through Delaware court, but if you’re reading this, you know all that.)

Tesla stock, which underpins Musk’s wealth, has fallen by more than half. Despite promising in April that he was done selling shares of the electric carmaker to fund his Twitter purchase, he has done so three more times, most recently unloading $3.6 billion worth last week, with each sale weighing on the share price.

And Twitter’s financial outlook has deteriorated. Musk said last month that Twitter had seen a “massive drop in revenue” due to advertisers leaving the site. Nonprofit watchdog group Media Matters for America, a left-leaning research group that tracks what it calls “conservative misinformation, estimates that half of the top 100 advertisers, accounting for $750 million in revenue this year, have left.

Musk himself tweeted this week that Twitter is “in the fast lane to bankruptcy” though he says that’s been the case since May, before he took it over. That he is now trying to raise new money suggests an acute concern that Twitter can’t shoulder its $13 billion current debt load, which brings an interest payment of about $1 billion early next year. I think a restructuring is most likely, and probably soon.

Selling new shares at the deal price is like buying a new car, crashing it, and then trying to sell it back to the dealer at sticker price. I explained why on Friday, though I allowed that I might be underestimating the willingness of Musk’s fans to part with their money for the chance to hang out with him at Twitter HQ. I also wrote about the irony, should it work, of Musk getting full price for Twitter’s stock while his bankers are stuck with bonds they can’t offload, even at a steep discount, “because nobody buys bonds for the fun of it.”

Speaking of his banks, Morgan Stanley (and a long list of others) has a choice to make in the next 10 days. They are holding $13 billion of debt that nobody wants to buy for anything near face value. They can either dump those bonds in a fire sale and lock in steep losses when they close their books for the year, or, more likely, carry them through to next year and hope things improve. Don’t count on it.

Room for Disagreement

Maurice Levy, chairman of advertising giant Publicis, thinks most of the advertisers that have paused spending on Twitter will return — if Musk can return the site to its rowdy but mostly inoffensive status quo.

“If we are back to something more controlled, advertisers will get back to Twitter,” Levy said at a CNBC conference in Paris on Friday.

Advertisers expect a Twitter that promotes “plurality of opinion, and the possibility of having something which is not leading to extremism [or] racism,” he said.