David Bonderman, a private-equity pioneer who co-founded TPG, died at age 82 yesterday.

What started as a small outfit investing the personal fortune of Texas oilman Robert Bass turned into one of the biggest private equity firms in the world.

A deal for bankrupt Continental Airlines put TPG on the map in the early 1990s, and Bonderman and his co-founders developed a reputation for thorny deals with an edge. (They FedExed six one-dollar bills to buy the world’s biggest silicon-wafer company in 2001, later worth billions.)

“He was intelligent and clever as an investor… a real pioneer,” KKR co-founder Henry Kravis told me. His co-founder and cousin, George Roberts, called Bonderman “a smart, creative and a risk taker who loved what he did.”

“Smart and funny,” Carlyle’s David Rubenstein said.

Called Bondo by his friends, he belonged to a generation of buyout buccaneers whose influence over the industry is waning.

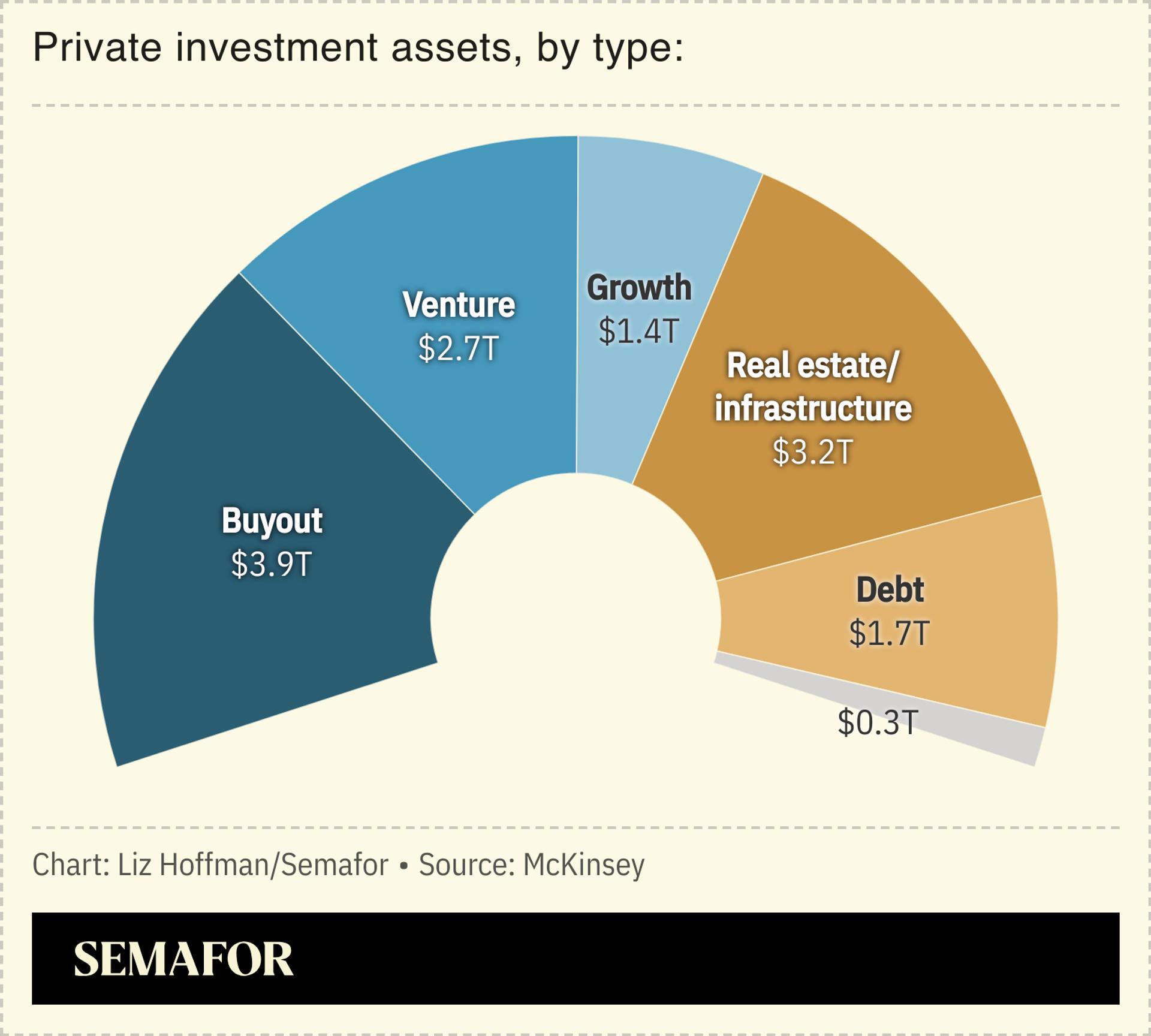

Private investments have moved away from big takeovers toward lending, insurance, and infrastructure.

Corporate buyout funds account for less than one-third of the $13 trillion in private investments, according to McKinsey, and are likely to be overtaken by credit in the coming years. TPG was slower to embrace private credit, but bought Angelo Gordon last year.