The Scoop

New industry-backed polling suggests voters favor having access to private markets for their 401(k)s, even as the Trump administration effort faces an uphill climb in Congress.

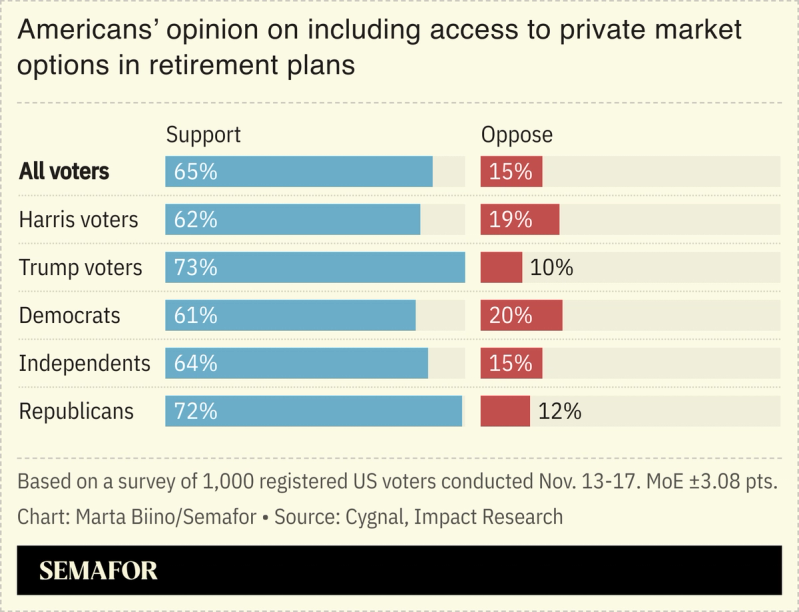

A new poll conducted by Cygnal and Impact Research on behalf of the private-equity group Council for a Safe and Secure Retirement, shared first with Semafor, found that 65% of voters support the ability to access private markets through their retirement plans. That includes 73% of President Donald Trump’s supporters and 62% of Kamala Harris’ supporters, according to the poll.

A majority of those polled also expressed concern about their retirement funds, and 58% of individuals indicated they’d be more likely to support the proposal when the poll referenced requiring companies to meet “strict criteria” in order to be eligible for such investments.

Know More

The private equity industry helped create the Council earlier this year to educate policymakers as part of its push to get lawmakers to pass legislation enshrining a related executive order Trump signed this summer. Democratic staff on the Senate Banking and HELP Committees hosted private equity, retirement, and labor policy experts on Monday for a briefing on the topic, a person familiar with the plans said, and GOP staff on the House Financial Services Committee are set to receive their own briefing this week.

It won’t be easy, lawmakers and aides said Monday, given pervasive skepticism on both sides of the aisle.

“You’ve got to be careful, because those underlying assets have higher risk. They have higher reward, but we got to call it what it is,” Sen. Thom Tillis, R-N.C., told Semafor. “I can’t imagine that it would get 60 votes over here.”

Trump’s executive order specifically directed the Labor Department and SEC to provide employers with guidance on how to include private investments, like private equity, and cryptocurrency in 401(k) plans. An August poll conducted by the Harris Poll on behalf of The Wall Street Journal found that only 10% of investors wanted more nontraditional 401(k) investment offerings.