The News

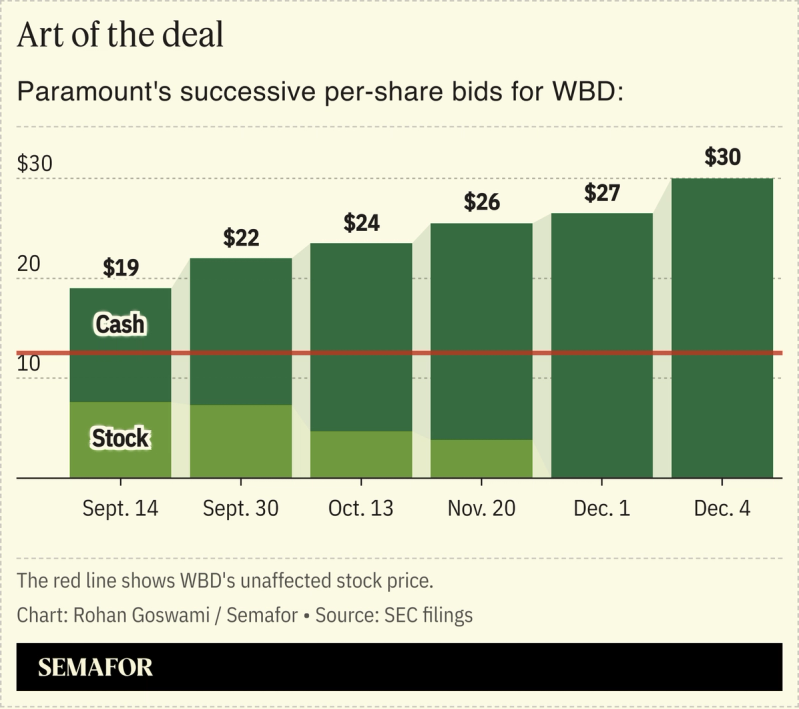

Paramount’s reliance on Gulf sovereign money was a major reason why the company’s bid for Warner Bros. Discovery failed to win in an auction for the owner of major media brands like HBO and DC Comics.

Emirati, Saudi, and Qatari sovereign wealth funds fronted $24 billion as part of both Paramount’s initial offer and its $108 billion topping bid for all of WBD, led by the wealthy Ellison family. The money accounted for roughly 30% of the equity value of the deal, whose headline figure is inflated by WBD’s debt load.

But the guarantees on that money — specifically, on how and when the dollars would clear, according to people familiar with the matter — were fuzzy enough to give Warner’s board one more reason to go with Netflix’s $83 billion offer, according to securities filings and people briefed on boardroom discussions.

Billionaire and Oracle co-founder Larry Ellison, along with his son and Paramount CEO David Ellison, are one of the richest families in the world. But the size of the WBD bid, which includes CNN, meant that even they had to find other financial partners.

In this article:

Know More

Under both versions of the deal, the Ellisons would front the $40 billion required to buy WBD’s stock, with some help from Gerry Cardinale’s RedBird Capital, and then partly pay themselves back with sovereign cash. That “cross-conditionality of the equity financing” gave WBD pause, despite the deep pockets and “credibility of the players,” according to securities filings made public Monday by Paramount. The sovereign wealth funds would not play any management role or have board seats, government filings show, which could help the arrangement avoid a US national security review.

Such a deal would still likely draw political heat, given the howls already coming out of Hollywood, and WBD’s advisers worried that any deal structured to sidestep scrutiny might instead invite it, people familiar with the matter said

Representatives for WBD and Paramount both declined to comment.

Rohan’s view

Ellison also tapped Apollo, Citigroup, Bank of America, and Jared Kushner’s Affinity Partners to finance their bid, which relies heavily on borrowing against Oracle stock owned by Larry Ellison. Those shares have fallen by about a third from their highs this fall on fears of an AI bubble, which added to Warner Bros. concerns about Paramount’s bid, the people said.

The bid’s complexity — three different debt financing sources, three sovereign wealth funds, a media investor, and Kushner — made Netflix’s straightforward, one-party bid far more compelling.

The View From David Ellison

“We believe the WBD Board of Directors is pursuing an inferior proposal which exposes shareholders to a mix of cash and stock, an uncertain future trading value of [WBD’s] linear cable business and a challenging regulatory approval process,” David Ellison said in a press release. “We are taking our offer directly to shareholders to give them the opportunity to act in their own best interests and maximize the value of their shares.”