The Scoop

The big money behind Alameda Research, the sister trading firm of crypto exchange FTX, came from two influential backers of the Effective Altruism movement: Luke Ding, a former currency trader turned philanthropist, and Jaan Tallinn, the co-founder of Skype, according to people familiar with the matter and documents reviewed by Semafor.

Ding loaned Alameda $6 million in January 2018, according to people familiar with the matter. Tallinn, who sold Skype to eBay in 2005 for $2.6 billion, loaned the firm $110 million worth of Ether, a cryptocurrency, according to documents and one of the people. The loans charged a sky-high interest rate of 43%.

The funding gave the nascent crypto trading firm set up by Sam Bankman-Fried and co-founder Tara Mac Aulay, along with a handful of other effective altruists, a firm financial footing. (Bankman-Fried is an investor in Semafor.)

But Alameda lacked risk controls from the start. It lost track of millions of dollars, inaccurately recorded losses as profits, and vaporized money on simple cryptocurrency transfer mistakes, according to the people and documents.

Its backers quickly turned on it: On March 22 of 2018, Ding visited Alameda’s offices in Berkeley, according to documents. In a tense meeting, Ding told Bankman-Fried that he and Tallinn would be calling in the majority of their loans to Alameda, and expected to be paid with interest. It was an early schism but it didn’t derail Bankman-Fried’s growing role in the Effective Altruism movement.

In this article:

Reed’s view

The previously unreported origins of Alameda, which crypto exchange FTX is accused of bailing out using customer funds, reveal deep ties with Effective Altruism, a movement that espouses using evidence and reason to identify the most effective form of charity.

That origin story suggests that Bankman-Fried is a creation of the Effective Altruism movement and not, as has often been written, the other way around. The movement’s attempt to distance itself now from its golden boy are undermined by a clear look at their shared origins.

Alameda wasn’t even Bankman-Fried’s idea. Mac Aulay had been trading cryptocurrency on her own already, and the concept came from conversations among effective altruists about the quickest way to raise money for the movement. Bankman-Fried, a trader, had already joined the Centre for Effective Altruism board.

When Bankman-Fried and others like Mac Aulay tried to raise money for the idea from crypto investors outside the Effective Altruism movement, they weren’t taken seriously. Without backers inside Effective Altruism, it’s hard to imagine Bankman-Fried, a recent college grad, getting more than $100 million to play with at a crypto trading firm. And without Alameda, there never would have been an FTX.

Semafor previously reported that Alameda employees approached the board of the Centre for Effective Altruism about their concerns regarding Bankman-Fried’s management of Alameda and tried to get the board to remove Bankman-Fried from his leadership position, but Centre co-founder Will MacAskill and others backed Bankman-Fried instead.

A person familiar with the discussion said that MacAskill spoke with Bankman-Fried about concerns over how he was managing the fund, but said he did not believe them to be serious. Bankman-Fried ultimately stepped down from the board in 2019, according to tax records.

In some ways, the decision to back the “star” over the whistleblowers is an old story. As Bankman-Fried became Effective Altruism’s golden goose, its leadership seemed to forget what they had learned in the spring of 2018.

Tallinn said in an email that he never heard of any mismanagement at Alameda. “The main reason I recalled the loans was that Sam seemed to have gotten other financing so he did not need my funds anymore,” he wrote.

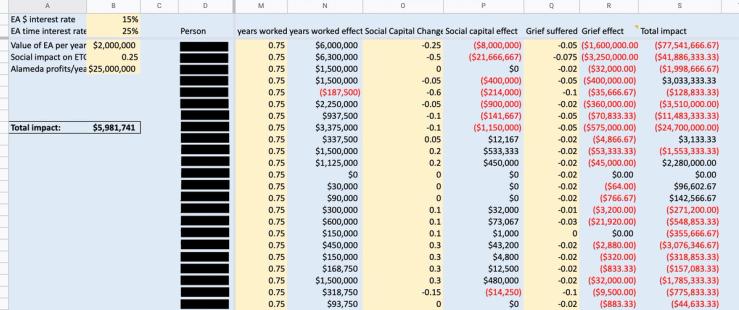

After half of Alameda walked out the door, Bankman-Fried took stock of the situation in the same way effective altruists determine how to deploy charity funds. In a May 2018 spreadsheet obtained by Semafor, Bankman-Fried assigned dollar figures to everything from the “grief effect” each employee experienced as a result of the turmoil to the cost to the EA movement of leaving their previous jobs for Alameda.

His assessment: “Alameda’s net impact on the world has [been] close to neutral.”

Room for Disagreement

When any scandal breaks, it’s possible to Monday morning quarterback it and point fingers at those who “should have known.”

Even people who thought Bankman-Fried, who has not been charged with a crime, was acting improperly may not have guessed he would be accused of using customer funds at FTX to cover losses at Alameda.

Notable

- The Centre for Effective Altruism has had to deal with a lot of questions about Bankman-Fried since FTX’s collapse. Here’s an FAQ put together by the Effective Altruism Forum. (A previous version of this article said the FAQ was posted by the Centre for Effective Altruism. It was not).

- On internet message boards for effective altruists, rumors about Bankman-Fried swirled before the FTX collapse. MacAskill says he never saw them.