Liz’s view

During the 2010s ride-share wars, the joke was that the brightest minds in Silicon Valley had reinvented the public bus.

Now, the brightest minds on Wall Street, in tackling the retirement crisis left by the decline of traditional pension plans, have reinvented… the traditional pension plan.

That begins with “Trump accounts,” which would seed every US newborn with $1,000 in an investment account. Michael Dell’s $6.25 billion gift this week will supplement that for slightly older kids who missed the cutoff. The government is rewriting rules to allow that money to be invested not just in stocks and bonds but in private equity, private credit, real estate, and infrastructure, and Wall Street is — obviously — salivating at the chance to manage it all.

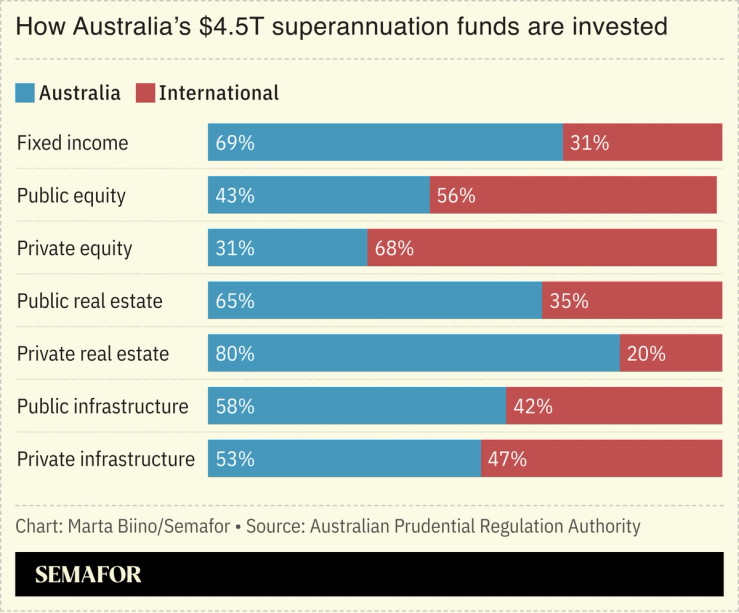

The model, former SEC chairman and current SDNY Chief Jay Clayton suggested to me at our The Ledger live event this week, is “a well-run pension fund… invested across American industry as much as possible” — like, he said, Australia. There, a national system of mandatory wage-garnishment has created a $4.5 trillion complex of “superannuation” funds — an astounding $300,000 per worker — that’s invested mostly in Australian stocks and property, with enough left over for the country to punch well above its weight as an international investor. The US Social Security trust fund has about $15,000 per employed person today, and it’s clipping Treasury coupons.

This may sound like a justification for a Wall Street money grab. But the best case for it is psychological. The gap between how the economy is doing (mostly good) and how people feel about it (mostly bad) has been the defining political factor for two successive White Houses now.

As BlackRock CEO Larry Fink told me earlier this year: “You’re detached from the economy, and you don’t feel like you’re winning.”

In this article:

Room for Disagreement

“The 401(k) scheme bodes to be the successor to the 2008 mortgage crisis,” wrote an unlikely critic — the founder of a $12 billion private-equity firm. In a letter obtained by the Financial Times, Robert Morris warned that, accounting for high fees and “ample dollops of additional risk,” individual investors would better off owning simple stock indexes.

Notable

- Treasury Secretary Scott Bessent said earlier this year that the “Trump accounts” would amount to a “back door for privatizing Social Security.”