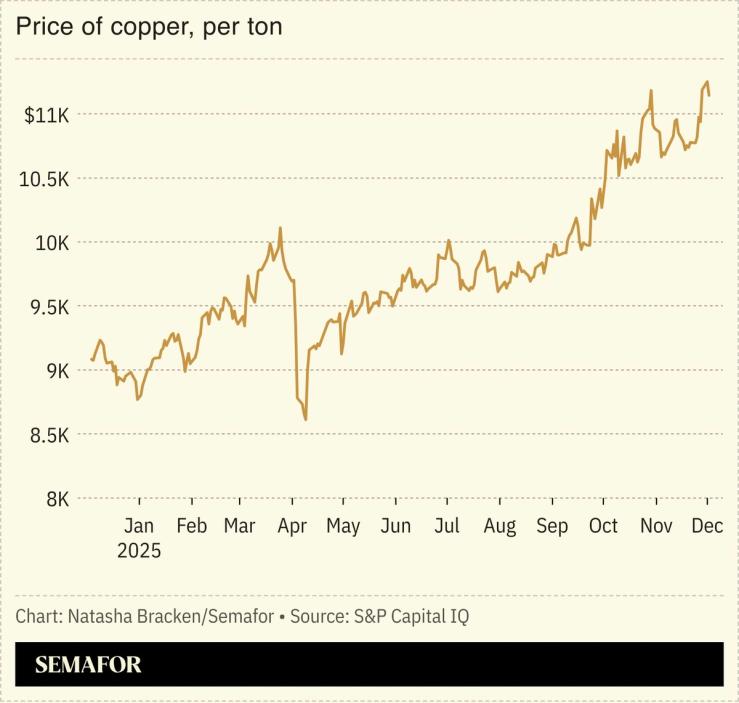

Copper prices hit a record high on concerns about tightening supply and potential US tariffs.

Futures hit $11,485 a ton, up 30% so far this year. Demand is soaring — the metal is vital for chips, electric vehicles, and power grids — and the market has been hit by disruptions. Mining giant Glencore cut its 2026 production targets by about 10% on the back of problems at its mine in Chile, and there have also been setbacks at other major sites in the Democratic Republic of Congo and Indonesia.

There has also been speculation that the White House could impose new import tariffs next year, and buyers are ramping up shipments to avoid potential price rises.