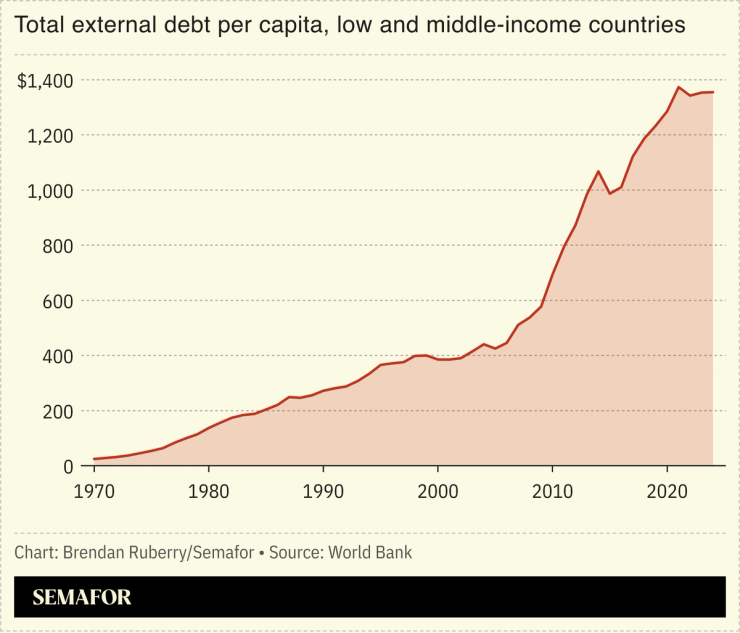

The gap between developing nations’ debt repayments and new financing from 2022 to 2024 reached a 50-year high, a World Bank report found.

The $741 billion shortfall is a result of high borrowing costs, with interest payments hitting a record $415.4 billion last year. While some risky borrowers like Suriname and Angola have raised billions through debt sales this year, the World Bank warned policymakers should “make the most of the breathing room that exists today to put their fiscal houses in order instead of rushing back into external debt markets.”

The Bank for International Settlements, an institution owned by central banks, has similarly raised the alarm over risks posed by ballooning public debt.