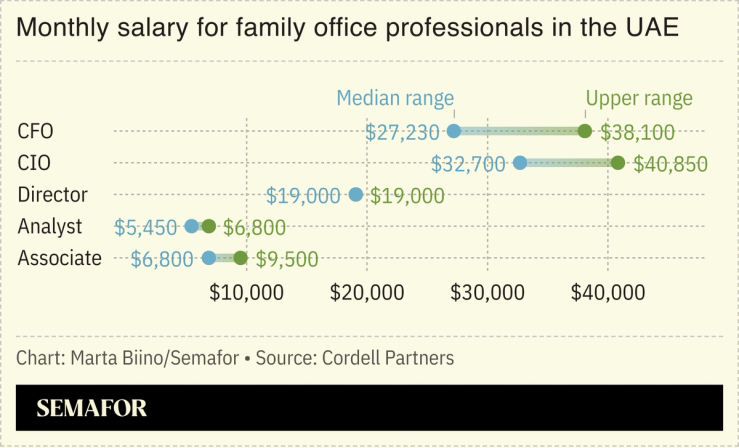

A generational shift at UAE family offices is reshaping how much they pay staff, but compensation still lags the richest global finance hubs. The top-paid investment and finance chiefs in the emirates earn well below the $1 million mark, and fixed pay for preserving the wealth of ultra-high-net worth families in Abu Dhabi and Dubai is typically lower than at other private finance firms, according to UAE headhunter Cordell Partners. Carry — or compensation tied to gains on investments — remains rare. Still, there are other perks: Schooling for children and accommodation allowances are often added on top of base pay and bonuses.

Cordell’s report likens family offices to “cruise liners turning round in the figurative canal, slowly but steadily lurching to their full form,” with a shift away from passive holdings like real estate — preferred by the founding generation of the 1960s and ’70s — towards more sophisticated, multistrategy portfolios, under the helm of the next generation, who are eyeing eight-year exit horizons and show a preference for hedge funds, digital assets, and technology.