British fintech giant Wise secured conditional approval from South Africa’s central bank to offer international money transfer services to personal customers in the country — its first such approval in Africa. The South African Reserve Bank’s approval paves the way for Wise, which specializes in low-cost international money transfers, to disrupt the market for cross-border payments in Africa’s most developed financial sector.

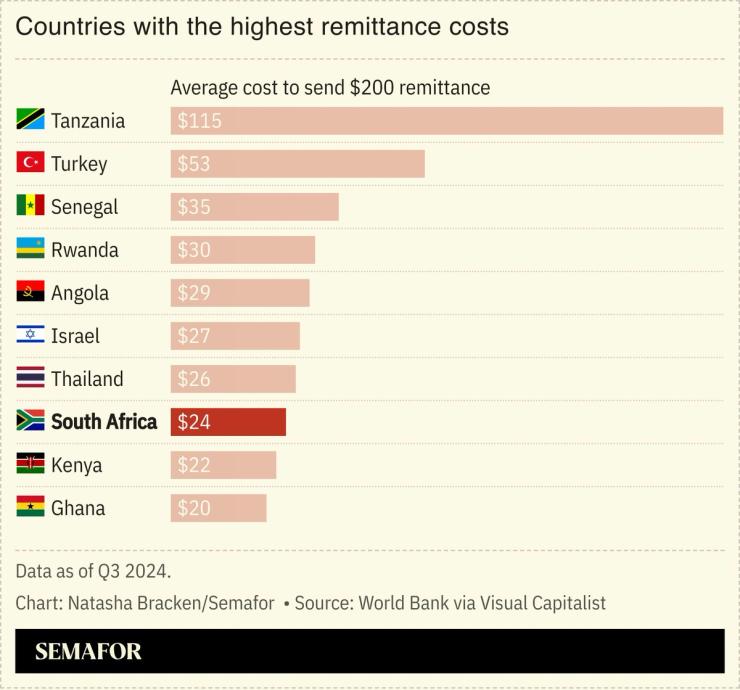

South Africa’s international payments market has long been dominated by banks and global money transfer operators, but fees are often high and opaque. Cross-border flows are largely driven by trade and remittances sent by migrant workers from neighboring Lesotho, Malawi, Mozambique, and Zimbabwe. A

report by the nonprofit FinMark Trust found the remittance market for payments from South Africa to countries in regional bloc SADC had “experienced substantial growth” in recent years, with formal outflows growing around $350 million in 2016 to more than $1 billion in 2024. The sharp rise was spurred by the COVID-19 pandemic, which shifted flows from informal to formal money transfer channels.