The News

When the founder of Lagos-based crypto startup Nestcoin tweeted that his firm had been hit by the collapse of FTX, it sent a shudder through the African crypto community.

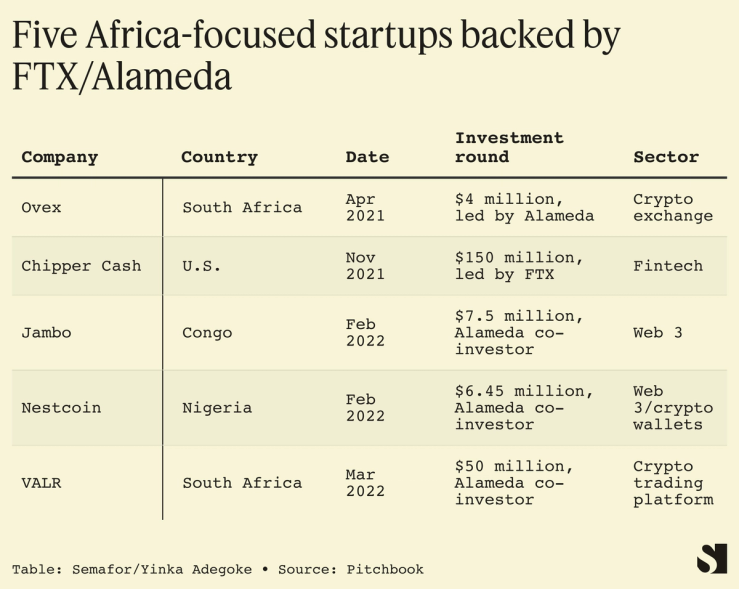

Yele Badamosi explained that his year-old firm, which was partly backed by FTX’s sister company Alameda Research, had placed a substantial amount of its operating funds on the crypto exchange. By some industry estimates, that amount topped $4 million. For context, Nestcoin raised $6.45 million in its pre-seed funding round in February. It has had to lay off around 30 people on its team and cut the pay of others who are staying on.

FTX invested in several African players, most notably leading a funding round of $150 million into Chipper Cash, a Africa-focused fintech unicorn headquartered in San Francisco. Others include Mara, Jambo, Ovex, and VALR, based on records seen by Semafor, though industry insiders told me there may be more.

An insider at one of the African startups FTX had invested in, who asked not to be identified, warned of the possibility of “cascading consequences.”

“It’s not easy to hide these things,” said the insider. “Everyone has been tested this past week with customers trying to see if they can get their money back.”

The fallout at Nestcoin has drawn particular criticism as a case of poor management. “Two, three weeks ago FTX was seen as safe as a bank, with attractive yields of up to 8%,” said Emeka Ajene, publisher of the Afridigest newsletter. “My question would be why they had that much on the FTX exchange.”

Last week South African crypto broker Ovex, in which FTX had an 8% stake, terminated its relationship with the exchange, saying it was subject to a run of panicked customers trying to pull their funds. “The public is cautioned from doing further business with FTX, as FTX is not permitted to market its offshore derivatives products in South Africa, at this time,” it said.

Speaking on a podcast on Nov. 16, Ovex chief executive Jonathan Ovadia said his firm is in discussions to buy the FTX equity stake back. “We have a small amount, less than 5% of owner’s equity, on the exchange.”

In this article:

Yinka’s view

Crypto has long been a big deal in Africa’s tech hubs and increasingly in its local economies too because of less developed legacy financial systems when compared with more advanced economies. Businesses and everyday people use crypto platforms to make it easier to move money around the continent and enable transactions outside the sometimes byzantine rules of African central banks with limited forex reserves. “The attraction to crypto is mainly through the promise of DeFi (decentralized finance), which is supposed to surmount the difficulties of accessing finance for African businesses,” said Ali Hussein Kassim, a Nairobi-based fintech investor.

But many of these nascent markets are still relatively small and could be set back if a so-called contagion takes hold in a continent which already must overcome numerous hurdles when it comes to finance and trust on the global markets.

Then there’s the issue of tech hubs being badly hurt by the prospect of some of their promising crypto players having to reset publicly like Nestcoin has had to do. “I think startups that lost money will have to scramble,” said Eghosa Omoigui, managing general partner of EchoVC Partners in Lagos. He predicted that more layoffs are imminent.

“They may also have to raise emergency capital in a market where investors now have the upper hand,” he added. Which, to be fair, is what we’d expect a smart investor to say.

Room for Disagreement

For all the hand-wringing over the FTX fallout and likely opportunistic VC strategic planning, believers in Africa’s crypto industry remained firm and said this whole episode tells us nothing meaningful about its future use on the continent. In this telling, the impact of FTX founder Sam Bankman-Fried — who is an investor in Semafor — cannot be dismissed but also must not be overstated.

“Of course I’m worried because it’s already affected me as a fund manager when I’m out raising money to invest,” said Barbara Iyayi, founder of Unicorn Growth Capital, a VC firm which focuses on decentralized finance in emerging markets.

“The noise around FTX adds negativity that I really don’t need, but this hasn’t changed my view as an investor,” said Iyayi. “We’re doubling down on our thesis that crypto and the blockchain protocol can be used to solve a lot of the problems we face when it comes to enabling transactions in Africa.”