The News

African lender Ecobank is developing a new strategy to tap into the continent’s underinvested agriculture sector as part of plans to capitalize on high gains this year, the bank’s CEO told Semafor.

Revenue for Ecobank, which has operations in nearly two-thirds of African countries, rose 18% year-on-year to $1.8 billion in the first nine months of 2025. It was the company’s fastest revenue growth in a decade boosted in part by its corporate and investment banking sector which grew 43% delivering pre-tax profit of more than half a billion dollars, CEO Jeremy Awori said.

The Togo-headquartered lender will build on its year-to-date performance by exploring new products. “We didn’t have a coherent agriculture strategy but have now worked on one,” Awori said in an interview. “We know the crops and countries that we are going to focus on,” he said, and the company has hired agronomists to advise on its approach.

Agriculture — which the World Bank has referred to as the “sleeping giant” of the continent’s growth — presents an opportunity for Ecobank to lead an untapped, underserved sector, Awori said.

Know More

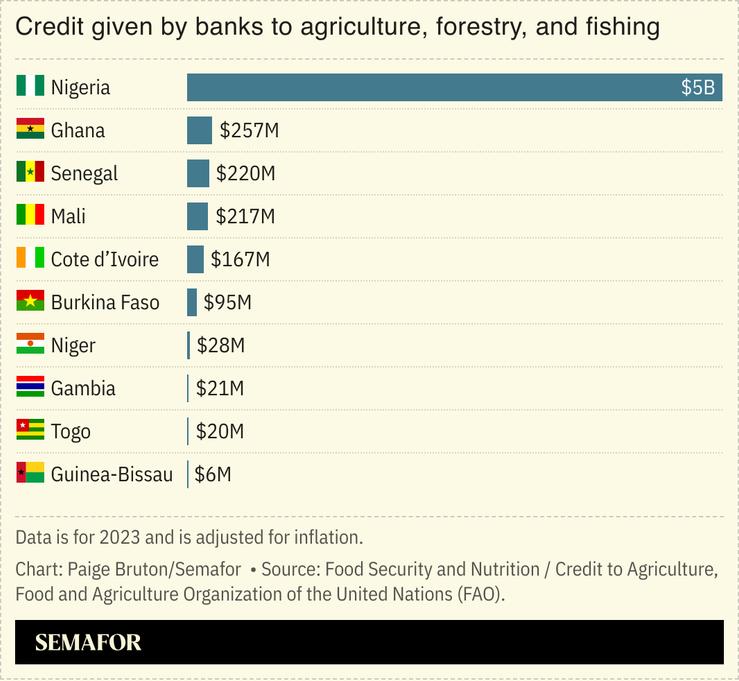

Agriculture accounts for around a third of national output in many African countries, but investment in agriculture typically falls far short of that economic contribution. The $49 billion invested in African agriculture in 2022 meant that African farmers received 10% of the investment of farmers in other regions, the Boston Consulting Group said. The African Development Bank estimates that lending to agriculture accounts for less than 5% of loan portfolios in many African countries, as farmers are often seen as high-risk borrowers.

A high interest rate environment has led to growing profits for sub-Saharan African banks, with interest income on government bond holdings being the key profitability driver, a European Investment Bank survey of African finance found. But banks are looking to fortify revenues as a downward trend of inflation in many African markets causes central banks to lower interest rates.

Infrastructure financing, a rising theme in African finance with $170 billion needed annually, also appeals to Ecobank but it is better executed in partnership with other institutions owing to the large amounts that are involved, Awori said. In September, the company co-led the $270 million raised by the Ugandan government to finance infrastructure spending. But very large infrastructure plays are better funded through concessional finance “because they are too expensive to run on a commercial basis,” he said.

Operating in 34 African countries, though more prominent in the French-speaking West Africa region that is rife with political tensions, Ecobank is close to the vulnerabilities of doing business on the continent. Instability around the Sahel “obviously does impact the speed” at which the bank’s local units grow, Awori said, but the group anchors its long-term presence in the region on the fact that local populations continue to have banking needs regardless of political upheavals.

“If you’re in the core sectors of the economy, it’s a natural hedge to your business because it’s not like people can all emigrate and leave the country,” Awori said.

Notable

- African commercial lenders charge above 40% interest rates for loans to smallholder farmers, the Abidjan-based Making Finance Work for Africa group estimates.