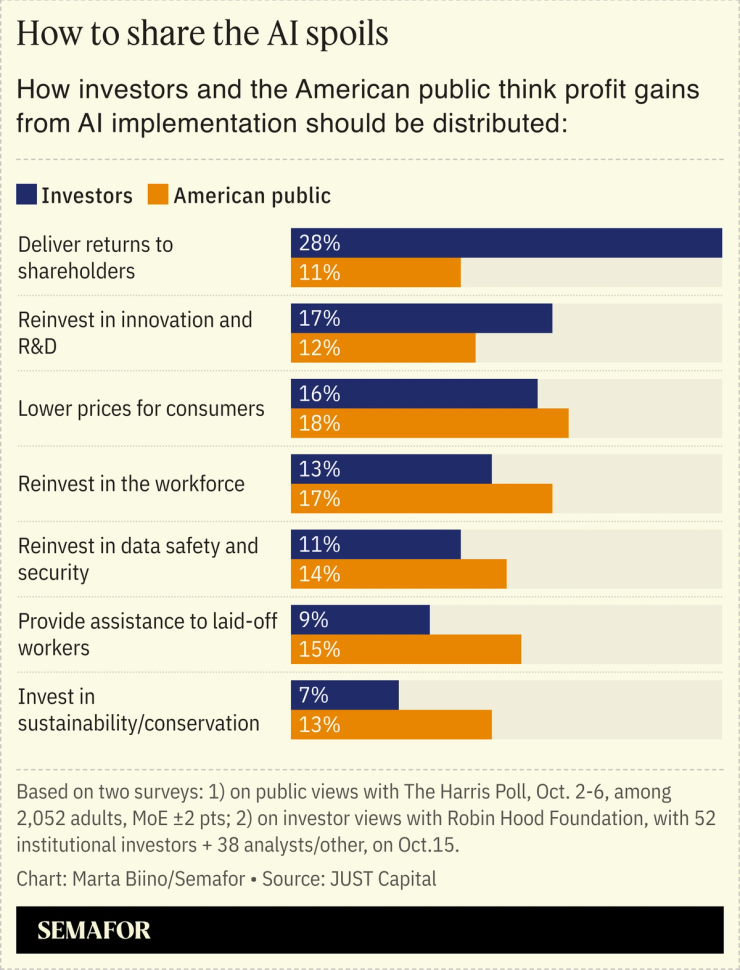

There’s a disconnect between how the American public and investors believe the returns on AI investments should be distributed. That’s what stakeholder capitalism nonprofit JUST Capital found in a pair of surveys with the Harris Poll and Robin Hood Foundation. But Martin Whittaker, JUST Capital’s CEO, is encouraged that so many shareholders think the gains should be shared with employees and customers.

The level of shareholder concern about AI guardrails and the potential for societal volatility from rapid tech-driven disruption is such that “investors are giving business leaders permission to focus on safety and social stability,” Whittaker told Semafor.

Plenty of CEOs worry about a backlash if AI prompts mass layoffs, drives energy prices higher, or exacerbates income inequality, he says. And “when inequality and social instability get to the point where it’s disrupting the system itself, that is bad for investors.”

One other theme emerges from JUST Capital’s research: AI is becoming the major driver of public opinion of how “justly” business is behaving, Whittaker says. How CEOs implement it could make more people believe that capitalism is working, “or the opposite.”