US companies inked deals worth $80 billion in a span of 24 hours, the latest sign that mergers and acquisitions are picking up after tariff-induced trepidation earlier this year.

President Donald Trump’s lighter regulatory approach had spurred expectations of an M&A surge, but the uncertainty wrought by “Liberation Day” duties threw those projections into doubt. “Merger Monday” signaled that animal spirits are making a comeback, the Financial Times wrote: “Dealmaking breeds dealmaking,” one M&A lawyer said.

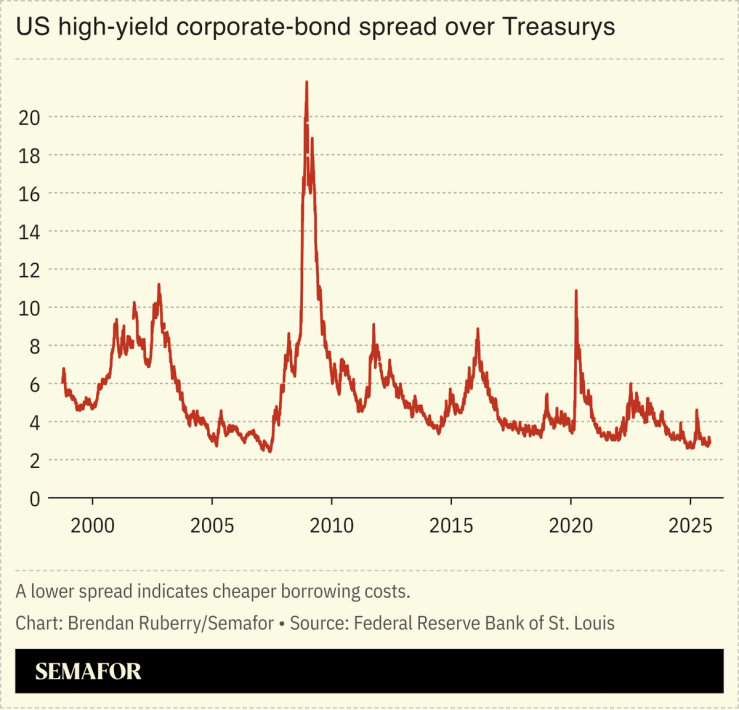

Still, the number of transactions in 2025 remains below last year’s total. “Confidence and capital” are propping up the recent boom, The Economist wrote, as tariff angst subsides and borrowing costs remain low.