The Scoop

SoftBank and Apollo discussed a giant fund to invest in data centers, chip factories, and other AI projects, joining a stampede of capital rushing to fund the next digital revolution.

The two talked about setting up a fund of more than $20 billion, people familiar with the matter said, though the talks have cooled since the summer and may go nowhere. The venture would likely involve industry partners including Arm, the chip giant that is majority-owned by SoftBank, the people said. One person familiar with the matter said SoftBank had also had talks with other funding sources, though those with Apollo were the most advanced.

SoftBank CEO Masayoshi Son has been looking for a deep-pocketed partner to build a competitor to Nvidia, which dominates the market for high-end AI chips, Bloomberg reported in February. He’s no stranger to giant, bet-the-farm funds that underwrite whole sectors. His $100 billion Vision Fund, launched in 2017, did as much as any investor to inflate the unicorn bubble, and overbet on startups only lightly enabled by tech, like on-demand dog-walking and, famously, WeWork.

Now Son is all in on artificial intelligence, which he says will be 10 times smarter than all of human intelligence by 2030 and 10,000 times smarter a few years after that. He has admitted to asking ChatGPT for investment advice, warned that companies have to “take advantage of it or be left behind,” and in a presentation slide that was puzzling even by Son’s enigmatic standards, compared AI doubters to goldfish.

Representatives for both companies declined to comment.

In this article:

Step Back

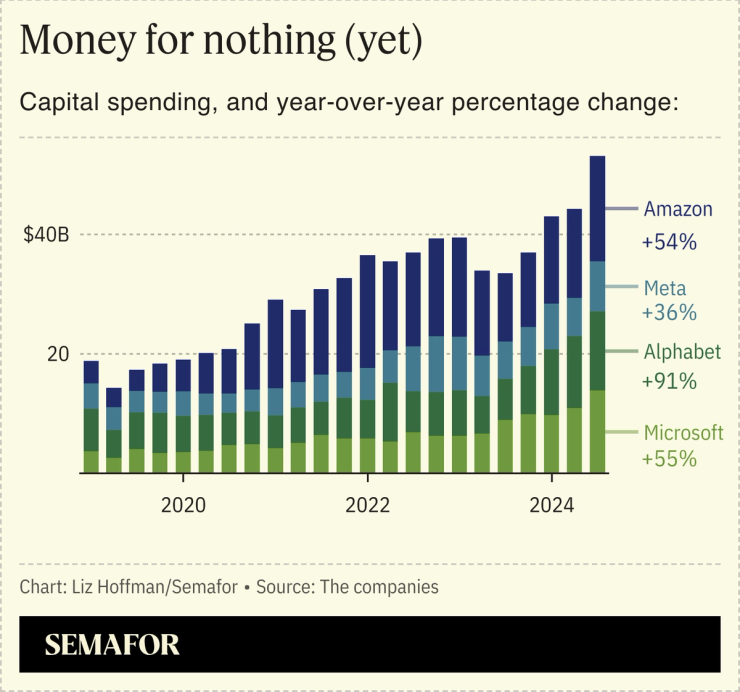

Tech giants are racing to secure the processors, power, and plumbing needed for AI, and Wall Street is racing to back them. BlackRock and Microsoft are teaming up on a $30 billion fund. Blackstone wrote its largest ever loan check, $4.5 billion, to CoreWeave, which leases on-demand access to AI chips inside data centers, and is “positioning itself to be the largest financial investor in AI infrastructure in the world,” CEO Stephen Schwarzman said recently.

Past tech cycles, like the 2010s business-to-business software boom, required money up front, but each new customer was essentially free. AI, even at scale, will require huge amounts of computing power and hardware. “The question you should ask is, is there enough capital, not if there’s enough power,” venture capitalist Vinod Khosla told Semafor earlier this month. “Because if there’s enough capital, people will do all kinds of clever things.”

Know More

Apollo has capital — $700 billion of assets as of June 30 — and an unstoppable fundraising spigot through its retirement arm, Athene, which brought in $37 billion in the first half of 2024 by selling insurance policies.

The firm has leaned on partners to put that money to work, like its recent agreement to fund $25 billion of loans to Citigroup’s corporate clients. “We are not constrained by capital,” Apollo executive Chris McIntyre told investors earlier this month. “We are only constrained by our ability to originate great assets.”

Arm, too, would likely play a key role in any SoftBank venture. A mostly behind-the-scenes technology provider to chipmakers like Nvidia and Apple, its stock has tripled since its IPO last year and is the most valuable thing SoftBank owns.

Liz’s view

Choose your fighter. The next few years in AI will see the formation of a handful of consortiums that combine big Wall Street firms and technology players: BlackRock and Microsoft, Apollo and SoftBank, Blackstone and CoreWeave. Google and Amazon will have their pick of financial partners to choose from.

The good news for now is that there’s plenty of opportunity to go around. But the first vintage of investments in a red-hot sector rarely age well. Just look at SoftBank’s Vision Fund or the less obviously silly but equally overpriced rush into scientific-lab properties that are now sitting empty.