The News

Six months after a panic that killed four of them and threatened others, regional banks still aren’t in the clear — and their problems are coming for giant lenders.

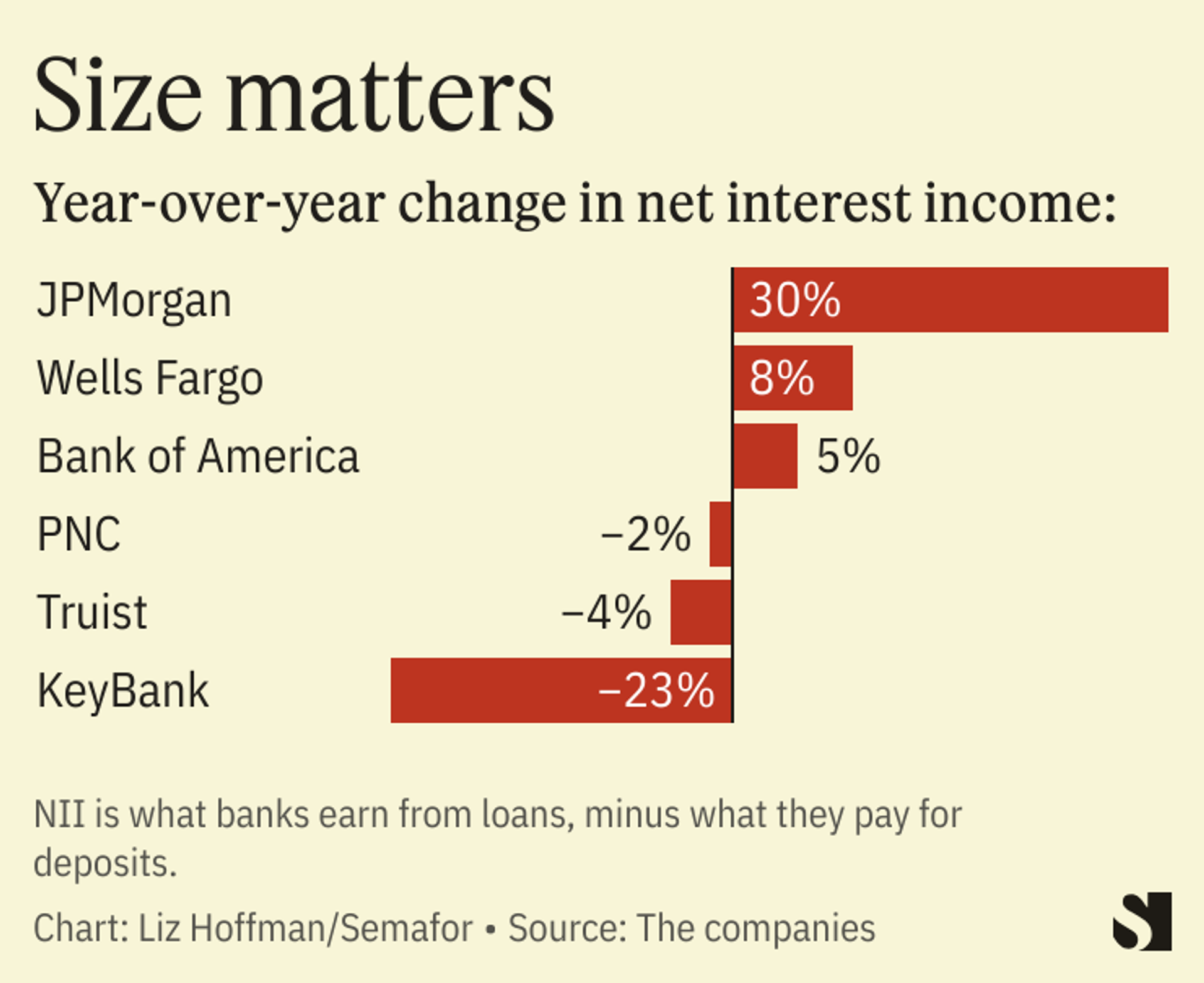

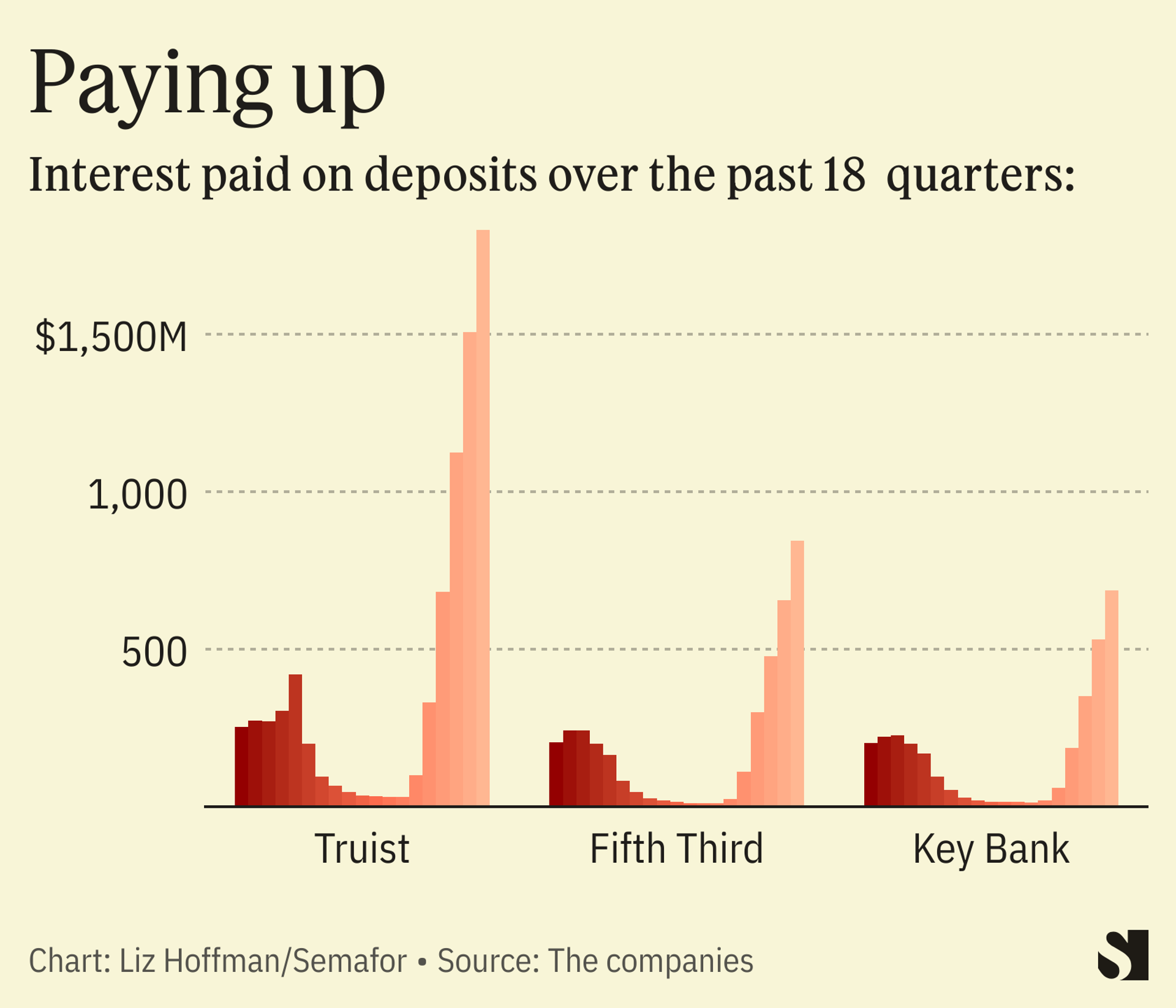

Third-quarter results today show that a slow-moving earnings crisis has replaced the acute liquidity woes of the spring, as smaller banks pay up for deposits without seeing the benefits from higher rates enjoyed by giant banks, which are sitting on $11 trillion of deposits that are earning a relative pittance and being lent out at increasingly higher rates.

Profits fell 48% at Ohio-based KeyBank, 31% at North Carolina-based Truist, and 32% at Rhode Island-based Citizens. JPMorgan and Bank of America both reported double-digit increases last week.

The troubles at smaller banks are likely coming for their bigger rivals, whose numbers are still good but trending bad. Deposits are shrinking, defaults on those loans are rising, and demand for new ones is slower but still growing.

In other words, banks are living in a pleasant limbo — one that even their CEOs know won’t last. “It’s unsustainable,” Morgan Stanley CEO James Gorman said yesterday. Speaking for his own bank and its rivals, he said: “We’ve overachieved.”

In his own call with investors, JPMorgan’s Jamie Dimon called the current moment “the most dangerous time the world has seen in decades.”

Coming down the pike are tougher capital rules that would require big banks to hold $170 billion in extra capital as a cushion against losses. That will come from hoarding profits, rather than sharing them with investors through stock buybacks and dividends.

“We’re going to be a little bit more cautious and wait until we have a little bit more clarity around the capital rules before we plow ahead” with buybacks, Goldman Sachs CEO David Solomon said on Tuesday.

In this article:

Liz’s view

This was entirely predictable. The financial lifeline that regulators threw to troubled regional banks in March ensured that most of them would survive, but doomed them to years of zombie status. At the time, I wrote that it would “leave them far less profitable, almost ensuring they will eventually need to be sold to giants.”

That’s a problem because the climate in Washington isn’t warm to mergers. “They think smaller is better, in the banking world in particular,” Gary Cohn told me earlier this month at Semafor’s inaugural business summit.

But banks, particularly the midsized ones that teetered this spring, are going to limp along and almost certainly one of them is going to run out of capital. Regulators can either allow the natural order of things — bigger, stronger firms acquiring smaller, weaker ones — or they can broker those same deals over an emergency weekend.

The View From Sherrod Brown

The U.S. Senate Banking Chair ramped up his quest to hold big banks’ feet to the fire, arguing they hold too much power and scheduling the third hearing with CEOs for December. The last one was held before the spring crisis.

“Wall Street megabanks continue to make record profits and to reward corporations that raise prices on Americans,” he said.

Notable

- The Fed’s early warning on the impact of higher rates.

- Its postmortem of how it failed to heed that warning with Silicon Valley Bank.