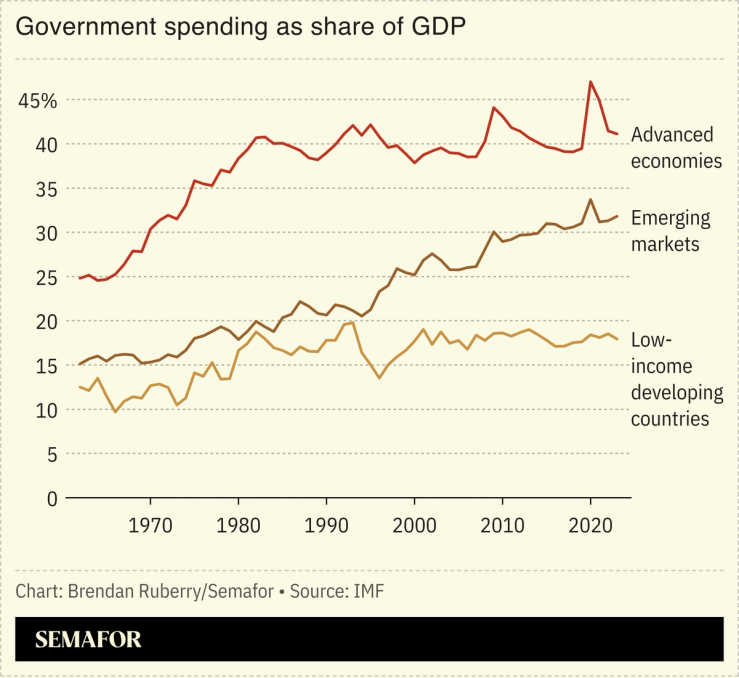

The IMF on Wednesday issued a stark warning over soaring global government debt, saying it is on track to exceed 100% of GDP by 2029.

Such a ratio would be the highest since 1948, when large economies were rebuilding post-war. Today, “there is little political appetite for belt-tightening,” The Economist wrote: Rich nations are reluctant to raise taxes on their beleaguered electorates — but they’re facing pressure to spend more on defense, and on social services for aging populations. Higher long-term bond yields, meanwhile, suggest investor wariness over governments’ balance sheets.

In the short term, the debt concerns manifest in political disruption: France’s budget fight recently toppled another government, while the US federal shutdown highlights the tension between new spending demands and deficit reduction.