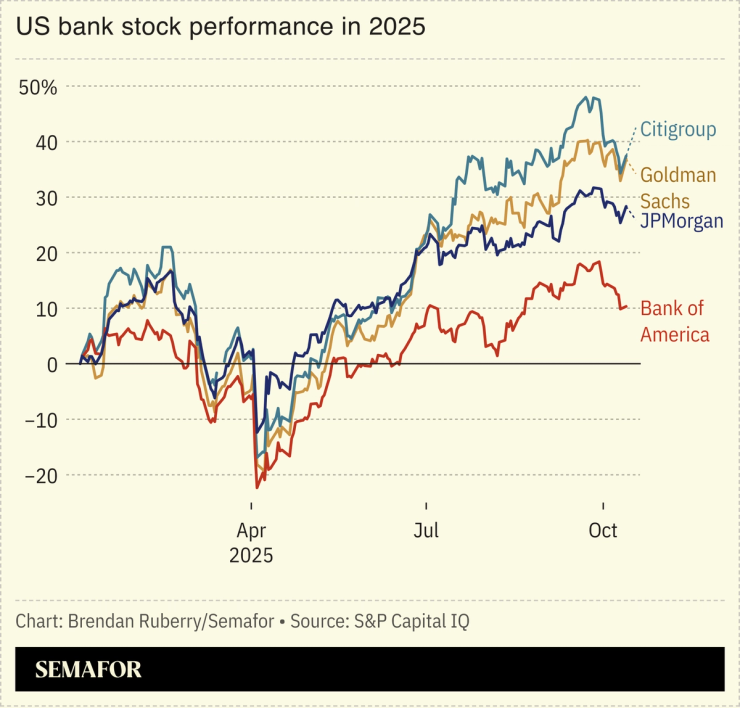

A surge in dealmaking and trading boosted the profits of the largest US banks, though some CEOs warned that investor excitement fuels the risk of a bubble.

Wall Street banks are getting “their party hats on,” the Financial Times wrote, as the AI boom has helped prop up the private sector despite looming concerns over the labor market and inflation. While executives like Citi CEO Jane Fraser cautioned about “pockets of valuation frothiness,” the banks credited a “resilient” economy for their strong earnings.

The global economy has indeed held up this year despite trade and geopolitical turbulence, the IMF said Tuesday, lifting its 2025 GDP growth forecast to 3.2%.