The Scoop

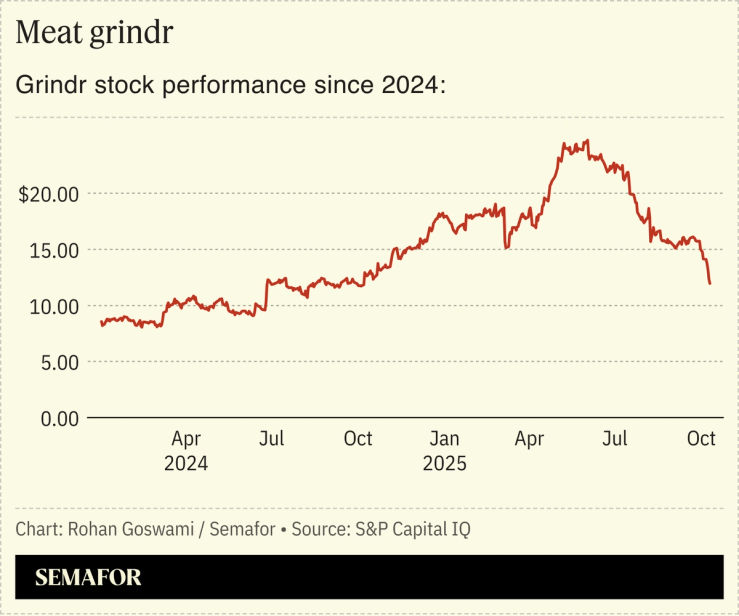

Insiders at Grindr are discussing taking the company private after a stock slide forced its owners into a precarious personal financial position, people familiar with the matter said.

Raymond Zage and James Lu, who control a majority of the dating app, are in talks to secure debt financing from Fortress Investment Group to acquire Grindr, which has a market value of $2.4 billion, the people said. The fast-moving talks come after a unit of Temasek, which had made personal loans to at least one of the men secured by their holdings, seized some of the underlying shares last week and sold them, the people said.

Zage and Lu have discussed a buyout price of around $15 a share, some of the people said, cautioning that number could change. A deal at that price would value the company at around $3 billion.

Spokesmen for Grindr and Fortress declined to comment. A representative for Temasek, a sovereign-wealth fund in Singapore, wasn’t immediately available to comment. Grindr shares rose 7% on Semafor’s report.

Any deal would likely carry national-security implications. Grindr was originally owned by a Chinese firm, which sold it in 2020 after the Committee on Foreign Investment in the United States raised concerns about sensitive personal data — which could be used in blackmail attempts — being accessed by Beijing. Zage, a US expat who is now a Singaporean national, surpassed 50% ownership of Grindr just last month through stock buybacks. Lu is a Chinese-born US citizen, according to the South China Morning Post.

Know More

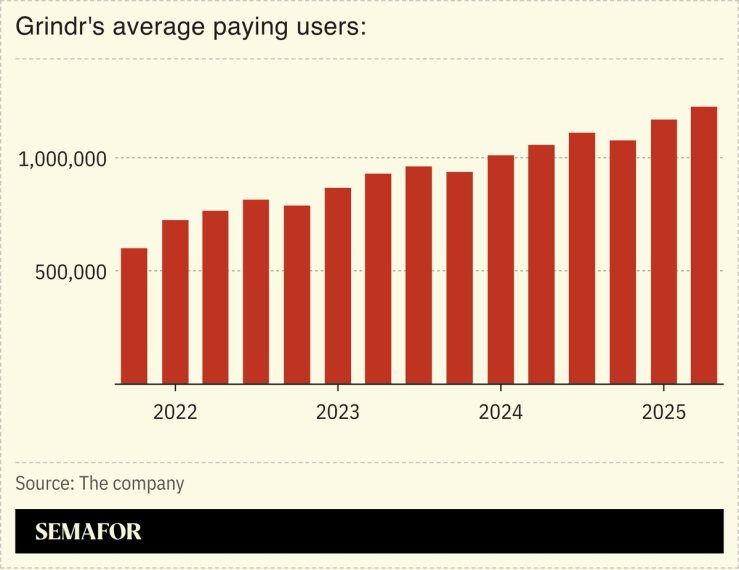

Taking Grindr private could arrest a stock slide that appears to have little to do with the company’s financial performance: Profits were up 25% in the second quarter from a year ago, but the stock has fallen more than 20% since late September. Grindr went public in 2022 through a blank-check company.

Corporate filings show that Zage and Lu, who together owned more than 60% of Grindr’s shares as of June, had pledged nearly all of their stock for personal loans. That lender, the people said, is SeaTown Holdings, a unit of Temasek, which seized the shares last week after the loans became undercollateralized.