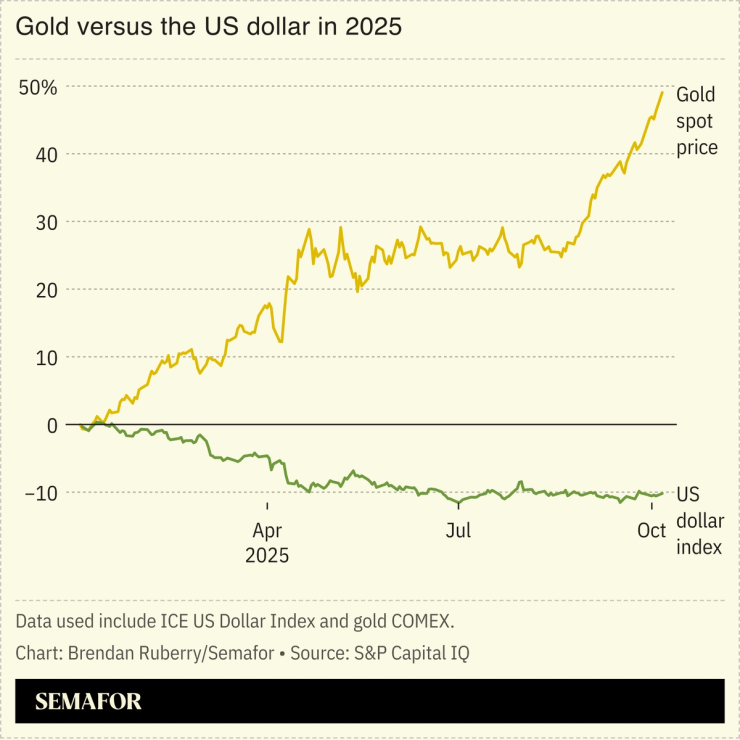

The price of gold topped $4,000 per ounce for the first time on Tuesday, a reflection of the unease plaguing both investors and central banks.

Gold is widely seen as a safe haven asset during turbulent times, and analysts attribute the latest surge to a desire among financiers to move away from US assets, even as stocks have hit new highs: The country’s government shutdown, delaying the release of official government economic data, has particularly heightened anxiety. Billionaire investor Ray Dalio compared the current environment to the inflation-heavy early 1970s, calling gold an “excellent diversifier,” although Bank of America warned of “uptrend exhaustion.”

Jewelry companies have begun raising the alarm over possible price increases afflicting already-weary consumers.