The News

As the eye-watering AI investment deals keep coming, skeptics are starting to ask: Where is the money?

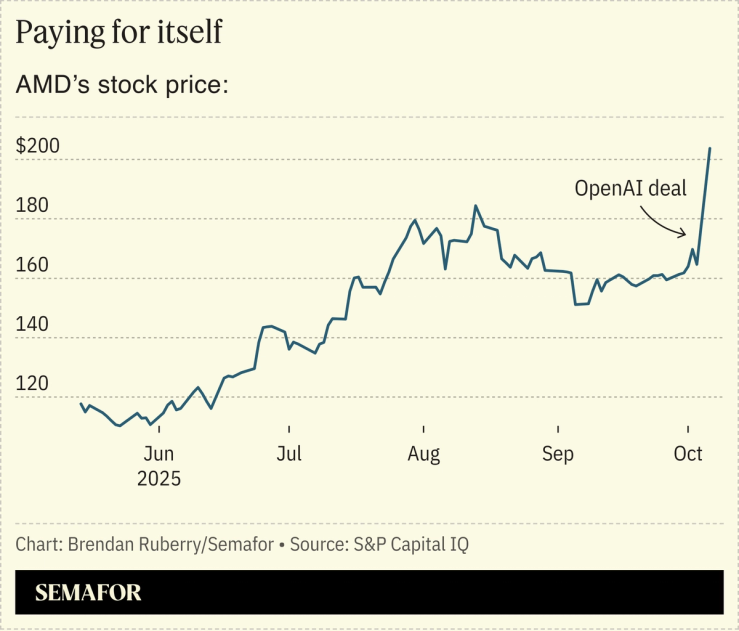

Monday’s deal between AMD and OpenAI shows both the markets’ AI enthusiasm and the financial experiments being launched to pay for it all. Some are warning that AI spending is unsustainable and circular, as companies prop up money-losing customers. “OpenAI is in no position to make any of these commitments,” one analyst told the Financial Times.

OpenAI has $12 billion in annualized revenue and $8 billion in annualized losses, The Information reported in July. Making good on the $1 trillion it has committed to AI compute will require some combination of near-constant private fundraising, an embrace of debt, and nifty financial footwork that uses public stockholders’ AI mania to cover the tab. (“Chips are being paid by the [AMD] shareholders lmfao,” one engineer and tech investor wrote.)

“We look at everything — equity, debt… [we are] trying to find creative ways of financing all of this,” OpenAI president Greg Brockman told Bloomberg Monday

Know More

For some, it harkens uncomfortably back to the dot-com boom, when telecom giants funded startups building huge fiber networks they couldn’t afford. “When the capital markets say no, Nortel says yes,” TheStreet.com wrote in 2000.

The capital markets haven’t said no to AI yet, and unruffled investors note that debt-light Silicon Valley giants have plenty of financial breathing room. “You don’t have the same dynamic of [the dot-com bubble, that] if the music were to stop, these companies would fall over,” Todd Lemkin of investment firm Perimeter tells Semafor. “That’s important. But for the first time, three or four years into this, people are talking about it. They’re questioning it.”