The News

Middle East sovereign wealth funds have stepped up investments into Europe in 2025, even as they continue to earmark trillions of dollars for the US, according to a report by data provider GlobalSWF.

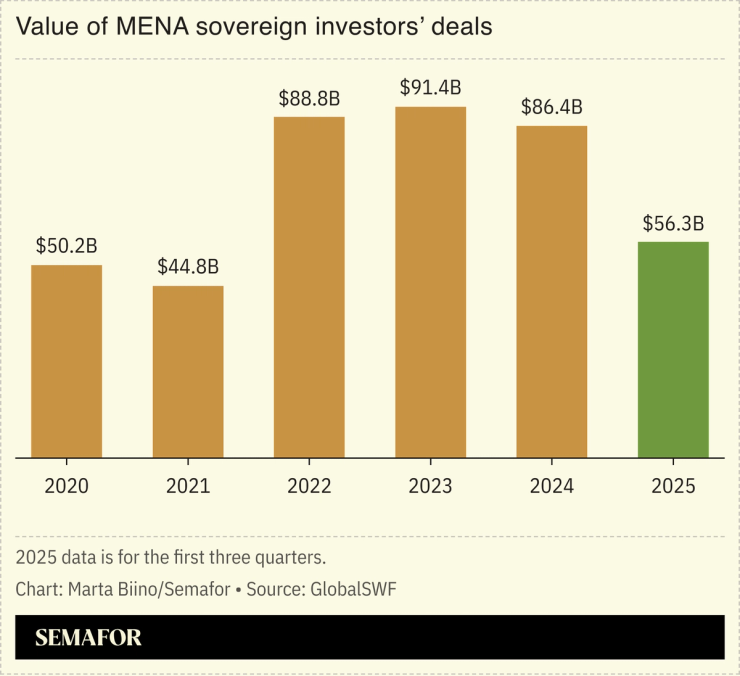

Funds controlled by governments including Abu Dhabi, Qatar, and Saudi Arabia deployed $56.3 billion in the first nine months of the year, with 28% of that flowing into Europe, the highest level in at least five years. While the US still remains the top destination for Gulf investors — which dominate Middle East sovereign funds — the rise in European deal flow is a noticeable shift.

Saudi Arabia’s Public Investment Fund, which manages nearly $1 trillion, plans to double European assets to $170 billion by 2030, while Abu Dhabi’s tech-focused MGX is part of a consortium planning to build one of Europe’s largest artificial intelligence data centers near Paris.

In this article:

Matthew’s view

You may not know all the state-controlled investment funds of the Middle East, but they almost certainly know you. From data centers to airlines, commodities to videogames, electric cars to the ports and shipping lines used to move them and other goods around the world, a handful of funds fueled by oil sales are increasingly touching the lives of people all over the world.

The latest figures from GlobalSWF, which we get into below, show that despite a prolonged period of low oil prices, these sovereign wealth funds’ influence and ability to project themselves across borders has only grown. That was clear from this week’s announcement that the Saudi Public Investment Fund was backing a $55 billion take-private of Electronic Arts.

As they now embark on a plan to back the technology and artificial intelligence companies that could become the engines of future economic growth, these opaque funds are set to become even more omnipresent. By 2030 they could control almost $9 trillion.

Commitments to pour trillions into the US, and a recent surge in European investing, also show how significant they have become as geopolitical forces, helping to knit together political alliances with commercial ones.

Oil sales have long provided Gulf states with a geopolitical importance that far outweighed their size. As the outlook for crude prices dims, the ability of these funds — and the small group of people who control them — to project power and influence across the world looks undiminished.

Know More

Abu Dhabi’s sovereign funds — which include Mubadala, Abu Dhabi Investment Authority, and ADQ — are driving deal activity in the region, accounting for more than half of all transactions. Mubadala is on track to be the biggest spender again this year, deploying $17.4 billion in the first nine months.

GlobalSWF has boosted its growth expectations for Middle East sovereign funds as they embark on a frenzy of dealmaking to get exposure to new technologies. The funds are expected to control $8.8 trillion by 2030, up from a previous forecast of $7.3 trillion. That compares to total current assets of around $5.6 trillion.

The governments of Abu Dhabi, Qatar, and Saudi Arabia pledged to invest more than two trillion dollars into the US, over the next decade, during President Donald Trump’s visit to the region in May.

Gulf sovereign funds have outpaced their global peers in dealmaking despite lower oil prices straining government finances and Saudi Arabia prioritising domestic projects. Middle East state-controlled funds made up 40% of all spending by similar investors, a similar level to previous years.

Still, there are signs that activity may be slowing as accumulated oil surpluses are deployed. Overall spending fell last year and looks on track to decline again in 2025.

Notable

- Saudi Arabia’s Public Investment Fund recently led the $55 billion acquisition of Electronic Arts, in a sign of its continued appetite for dealmaking and a push into the gaming industry, The Wall Street Journal reported.