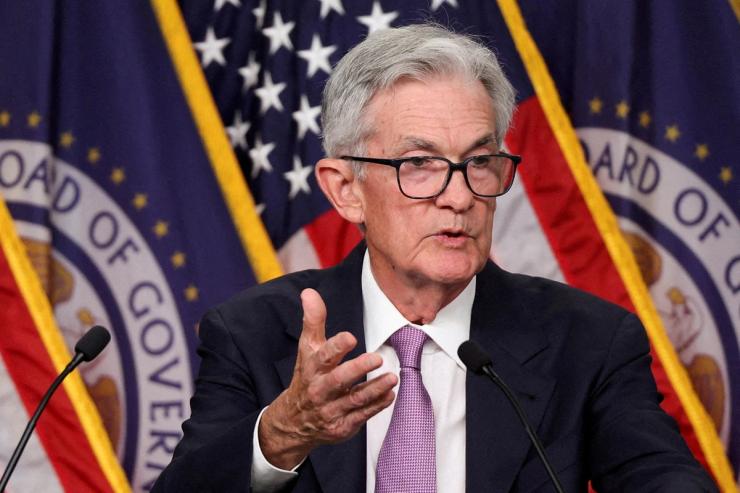

Hawkish remarks by the chair of the US Federal Reserve Monday point to a slowing in the central bank’s rate-cutting cycle.

Traders pared back bets on a 0.5-percentage-point reduction at the Fed’s November meeting, while the European Central Bank’s chief made clear she was more dovish on the 20-nation eurozone’s economic prospects, cementing investors’ expectations that the euro area will see rate cuts at each of the ECB’s next six meetings.

Eurozone inflation fell below 2% for the first time since mid-2021 in September, boosting the likelihood of another central bank rate cut this month, Reuters reported Tuesday.

Though both central banks are easing monetary policy, their differing paces — driven by their economies’ differing prospects — could drive market volatility: “The balance of risks in the very near term is probably skewed to the upside for the dollar,” analysts at the Dutch bank ING said.