The News

It was the boardroom version of Black Monday: Four CEOs of big public companies were abruptly replaced yesterday.

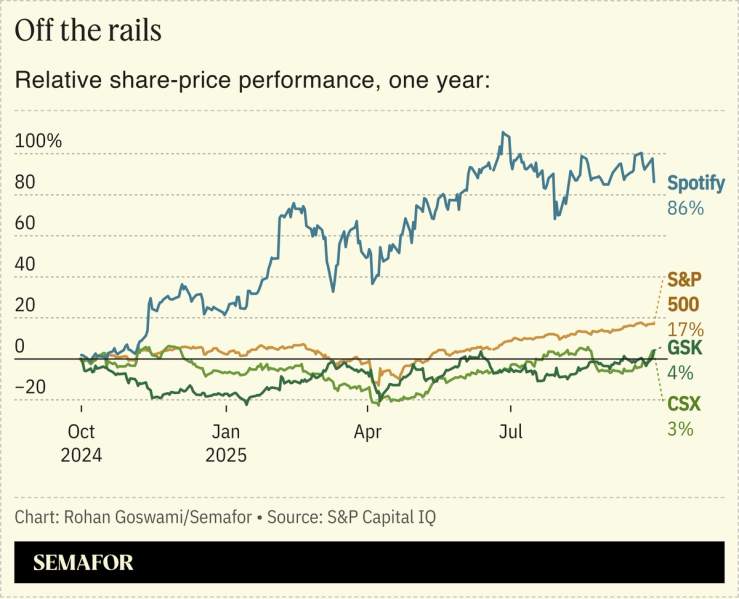

The exit of Barrick Mining’s Mark Bristow was a surprise, while that of rival Newmont’s Tom Palmer was better telegraphed. And CSX’s Joe Hinrichs, under pressure from a pair of activist hedge funds, was ousted effective immediately in favor of a 70-year-old executive with dealmaking chops. GlaxoSmithKline chief Emma Walmsley will leave the job in December, almost a year before her notice period expires (though she’ll be paid the full period), and just weeks after setting out her strategic plan for the drugmaker in an interview with Semafor’s Andrew Edgecliffe-Johnson.

It looks to be the most ax-heavy stretch since late September 2019, when WeWork, eBay, and Juul all fired their CEOs.

HSBC’s executive chair Mark Tucker also stepped down without a permanent replacement, a leadership vacuum impactful enough to draw regulatory attention, the Financial Times reported. (The departure of Spotify’s Daniel Ek, announced this morning, adds to the tally but with none of the drama; it’s an investor darling.)

Know More

It has been an unforgiving year to be a big-company CEO. More than 1,500 chief executives have left through the end of August, the highest year-to-date total since search firm Challenger, Gray & Christmas started tracking CEO exits. The numbers for S&P 500 companies for the first half were roughly on par with 2024, according to Russell Reynolds, but the search firm’s own CEO Constantine Alexandrakis told Semafor the executives are on a shorter leash.

“Boards and institutional investors are becoming more purposeful and shrinking the amount of time between which they feel that there’s a problem and they want to make a leadership change,” he said.

Turnover is notably, if unsurprisingly, fastest at laggards: Almost half of S&P 500 companies that parted ways with their CEOs in 2024 were in the bottom quartile of shareholder returns, according to The Conference Board.