Private equity returns in Africa’s largest economies have fallen short of expectations set in the mid-2010s, in part because foreign investors have struggled with worsening exchange rates against the US dollar, according to Nigerian data analytics company Stears.

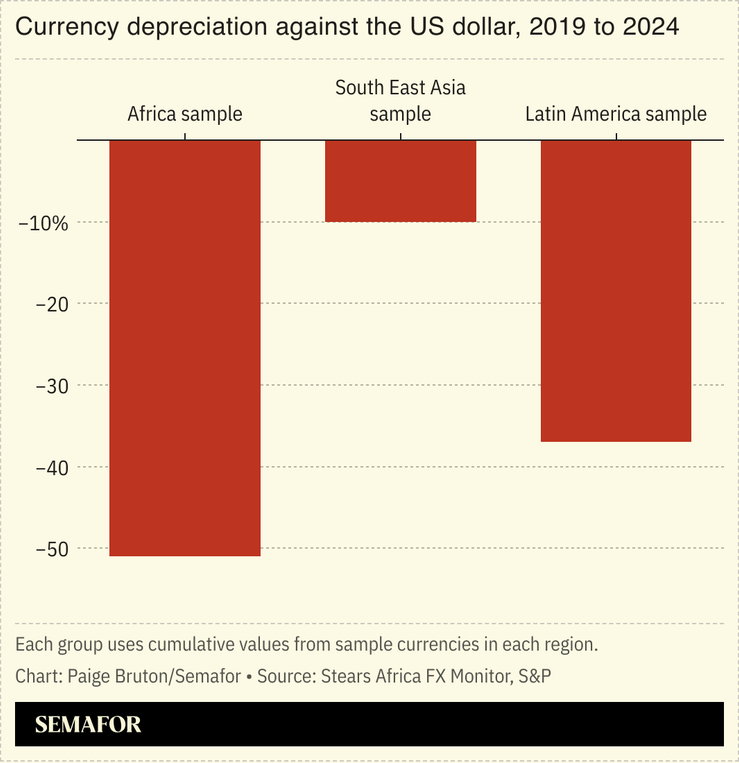

In the last five years, five of Africa’s biggest economies — Egypt, Ghana, Nigeria, Kenya, and South Africa — experienced a combined currency depreciation of 51% against the dollar, compared to the 2010-2013 period when depreciation was around 17%.

While the effects of a strong US dollar have been felt globally, currency weakness in Africa has been “more damaging” compared to other emerging regions, Stears said in a report.

However, economic policy changes, particularly in Nigeria and Egypt, are creating a base for more stability. Stears forecasts that depreciation in those five economies will ease to around 15% by 2029, which “should lead to higher USD returns, lower perceived risk, and broader investment opportunities.”