The Scoop

The global energy transition is forging ahead, fracturing old trade alliances and generating new forms of geopolitical leverage that all companies need to be more attuned to, JPMorgan believes.

In a report shared exclusively with Semafor, two top researchers at the largest US bank argue the global economy is moving into a “new energy security age” that will see the relative power of fossil fuels wane, but not disappear, and a wider range of assets — including critical minerals, electric grids, nuclear technology, and investments in R&D — come to define what really constitutes energy “dominance.” The US could still fare very well in this scenario if it takes advantage of the full resources at its disposal, not just oil and gas, they write.

The bank is advising its clients to take that change seriously, Sarah Kapnick, its global head of climate advisory, told Semafor. “As a bank, some of the things that we’ve taken for granted about energy over the last few decades are changing,” she said. “The rug has been pulled out from under us, and we need to think about how to have growth under this different regime.”

In this article:

Tim’s view

These are dicey times for the energy transition. The Trump administration is doing everything in its power to tear down former President Joe Biden’s clean energy agenda, while surging global electricity demand and multiple ongoing wars seem to cry out for more fossil fuels, not less. Even the International Energy Agency, which has turned increasingly bullish about the transition in the last few years, will soon produce a scenario that under current policies, oil and gas demand won’t peak for decades, according to a scoop this week from Bloomberg’s Javier Blas.

In that context, the JPM report reads as a strong endorsement that the transition is real and already happening, and indicates there are powerful forces on Wall Street who still think it’s foolish to bet on a continuation of the fossil energy status quo. The main argument Kapnick and her co-author Derek Chollet, head of the JPMorganChase Center for Geopolitics, advance is that the main driver of energy geopolitics in the coming decades will not be tension between fossil fuels and renewables, per se, but the race by all countries to find new ways of being energy independent and less exposed to fossil fuel price volatility.

“Today’s contest is no longer just about barrels and pipelines,” they write. “It’s about who controls minerals, grids, financing, and the technologies that will power the 21st century.”

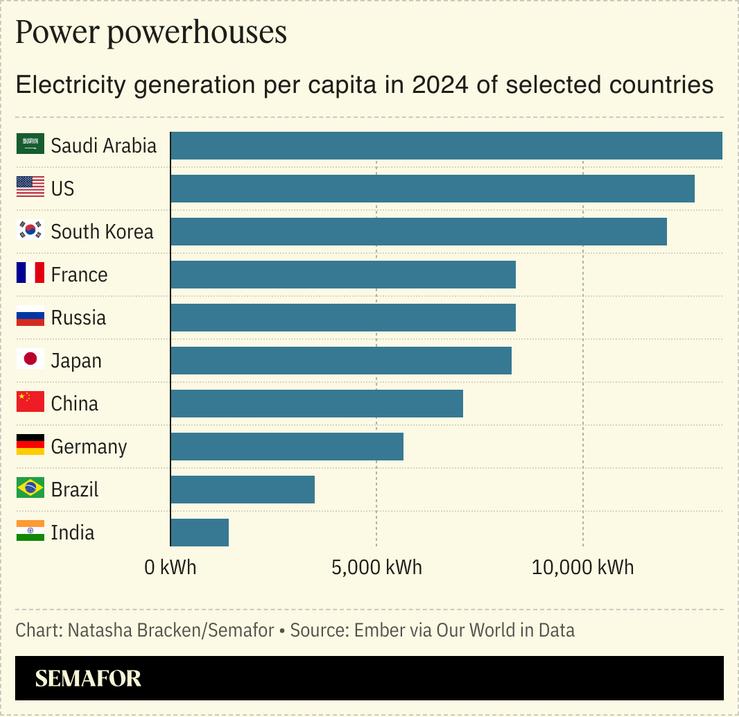

Fossil fuels, in other words, may not be going away for some time; the report doesn’t venture a guess on the deadline for peak oil and gas. But already, the report argues, those resources don’t supply the same geopolitical leverage they used to. That’s not news in China, where the world-leading push into clean energy has relatively little to do with emissions and is much more to do with reducing reliance on fossil imports.

A world that is more polarized over trade, immigration, territory, and other issues will place a premium on energy independence. That has always been true, but the wide range of new energy technologies that are now proliferating make that goal cheaper and more accessible for more countries than ever. Beside their climate benefits, the best thing about most alternative energy sources is that they don’t require an ongoing supply of fuel. So the energy transition is becoming both a solution to and a contributor to new bifurcations in traditional energy-based political alliances, the report argues.

The transition, they acknowledge, is driving its own new trade dependencies, the most obvious being China’s iron grip on the supply chains for critical minerals, solar, and batteries. Kapnick and Chollet also point to energy research spending and patent innovation, areas where the US and China lead, as increasingly valuable for competitive advantage. And then there’s “grid diplomacy,” relating to cross-border electricity infrastructure and trading, increasingly a strategic necessity in a more electrified world.

All of these trends have important implications for where and how businesses can expect to make money, Kapnick said, which in turn carries implications for where and how banks like JPM should extend financing. North America, by virtue of its natural and financial resources, is well positioned to continue to dominate global energy markets in this future, the report argues. But “recent policy shifts from Washington… could halt that development and risk investor capital already deployed,” especially in the wind sector, which has come in for a special hammering by Trump.

Room for Disagreement

In an interesting new pair of essays, longtime energy analyst and Bloomberg New Energy Finance founder Michael Liebreich makes a similarly compelling and detailed argument for why “rumors of the death of the transition have been greatly exaggerated.” The pace at which the transition will happen depends on a “reset” of climate politics, Liebreich argues, that moves past unrealistic and puritanical expectations for a rapid shift to net zero, but invests more in the huge volume of emissions reductions that are readily available.

But in an interview with Semafor, Liebreich took a shorter view than JPMorgan of fossil fuel longevity, arguing that peak oil and gas demand still appears imminent. And he went further in questioning whether the US can retain power in the new energy economy, given how much it has already sat out the clean energy race and the fickle way it has cut deals for LNG.

“Asian countries don’t give a shit about this culture war stuff. They’re just doing what makes sense,” he said. And when it comes to forming energy alliances, he said, the Trump administration’s erraticism “makes me much more willing to tolerate reliance on China than I would be otherwise.”

Notable

- The European Union is making progress toward approving a new package of sanctions on companies in India and China involved in buying Russian oil. Hungarian officials are privately hoping nothing comes of the plan — but are simultaneously workshopping new import options, according to Bloomberg.