The News

NAIROBI — When Kenya’s Safaricom set up shop in Ethiopia last October, it looked set to make a big splash in a long underserved market in Africa’s second most populous nation.

While it started off well enough, signing up 5 million customers by August, it soon became apparent that Safaricom’s lofty ambitions have exposed managerial, operational, and domestic challenges. Its problems have included the sudden exit of its top Ethiopia executive and an uncertain rollout of its mobile money service, M-Pesa, against stiffer-than-expected competition from the former local monopoly.

Serious concerns about ongoing hostilities in Ethiopia have added to the company’s problems, fueling questions about whether it will be able to meet its ambitious growth targets — it expects to have 10 million subscribers by March. It was forced to shut down its sites in Ethiopia’s second largest region, Amhara, after a state of emergency was declared by the federal government last month.

Besides the security headache, the telco is also dealing with a boycott campaign in Ethiopia’s largest region, Oromia. The campaign dubbed #BoycottSafaricomEthiopia is led by activists protesting what they consider to be unfair hiring practices and the company not using the local Afaan Oromo language in its operations in the region.

In this article:

Know More

The unexpected exit of Safaricom Ethiopia’s launch CEO Anwar Soussa in July, after less than two years — and just weeks before the all-important launch of M-Pesa — was the first obvious sign of trouble. His replacement, former MTN Uganda CEO Wim Vanhelleputte, took over on Sept.1. The Belgian is one of the continent’s most experienced telecom executives having also run MTN Côte d’Ivoire and before that Bharti Airtel’s Francophone Africa operations.

Safaricom’s entry into Ethiopia signaled the end of state-owned Ethio Telecom’s decades-long monopoly. Ethio Telecom has 72 million subscribers and has a two-year headstart on mobile money with its Telebirr service because Safaricom had to spend time pitching regulators for a local license for M-Pesa, which ended up costing $150 million.

Safaricom spent nearly $400 million (55.6 billion Kenyan shillings) capitalizing the new Ethiopia venture, in the financial year ended March 2023. It plans to spend another $300 million in the current financial year which ends in March 2024.

Safaricom Ethiopia did not immediately respond to queries from Semafor Africa.

Martin’s view

In Ethiopia, Safaricom has a unique opportunity to cement itself as a regional behemoth. But in order to tap into a market of over 119 million people, the company must maintain a long-term view while navigating political hurdles and cultural nuances in a complex market. At the same time, it needs to streamline hiring practices and labor relations for all workers, including those recruited through third-party firms.

Analysts see the combination of market challenges in Ethiopia, coupled with macroeconomic factors, posing a threat to the company’s prospects, and some question its grasp of emerging issues in a new market. Ken Gichinga, chief economist at Mentoria Economics said Safaricom hasn’t shown a “very deep understanding” of the situation in Amhara. “It seems like they’re playing catch up, yet with that scale of investment one would expect that they would have near perfect intelligence.”

Security challenges, however, threaten to limit M-Pesa’s reach, particularly in rural communities outside the capital Addis Ababa. Safaricom must also brace for the toll of macroeconomic factors including hyperinflation, which threatens to erode value for shareholders.

Hyperinflation is a “key operational concern” for Safaricom Ethiopia, said Wesley Mambo, a research analyst at Nairobi-based Genghis Capital. He said it affects “both the disposable income responsible for healthy topline numbers, and the return on investments from the repatriation of earnings.”

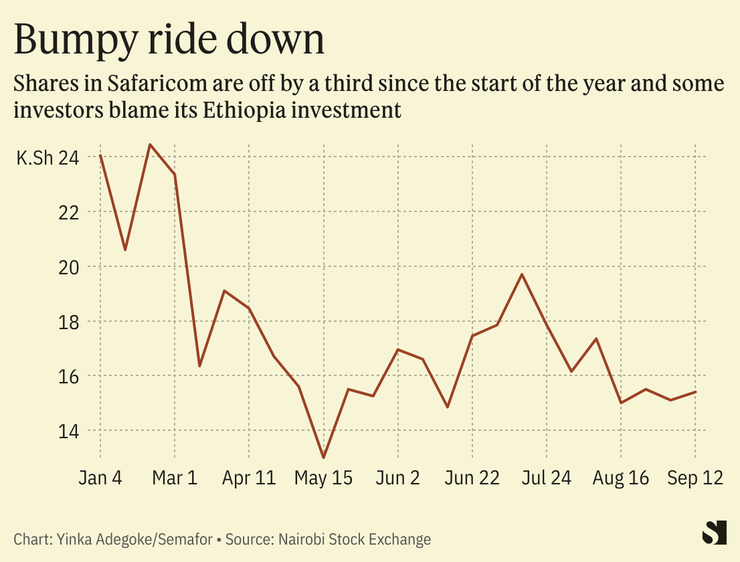

In the meantime, Safaricom’s shares have fallen by more than a third since the start of the year as investors worry about the level of capital investment needed to compete with Ethio Telecom.

Even its longest serving board member has raised concerns about the financial impact. “The big issue with Safaricom, if you look at the earnings and the share price, is Ethiopia; this is really the big risk for Safaricom,” said Michael Joseph, Safaricom’s founding CEO and current chairman of Safaricom Ethiopia, in an interview with Business Daily last month.

Room for Disagreement

Marshel Nyangor, a fund manager at Zimele Asset Management, a Nairobi-based investment firm, argued Safaricom is well-positioned to succeed in Ethiopia especially with M-Pesa despite the early challenges. “I think Safaricom’s expansion in Ethiopia has been handled well because Safaricom was very strategic. They didn’t go in alone. Their partners have both experience and financial muscle,” he stated, noting that Safaricom also reduced its risk exposure in Ethiopia by bringing in partners such as the International Finance Corporation (IFC), Vodafone and Sumitomo.

Notable

- Safaricom’s founding CEO Michael Joseph is set to take up a more active role in Safaricom Ethiopia. In an interview with Business Daily he said he wanted to focus on his role as chairman of Safaricom Ethiopia.