The News

US consumer prices rose 2.9% in August compared with the same month a year earlier, official data showed Thursday, a faster increase than in July but still unlikely to prevent the Federal Reserve from making its expected cut to interest rates next week.

The increase, which was broadly in line with economists’ expectations, is the highest rate since January and above the Federal Reserve’s 2% target, the figures from the Bureau of Labor Statistics showed.

The central bank is still widely expected to lower interest rates at its much-anticipated September meeting, however, after recent data pointed to a cooling labor market.

It comes as Trump continues his pressure campaign on Fed chair Jerome Powell to lower borrowing costs, following an unexpected decline in wholesale inflation.

Separately, the European Central Bank kept interest rates unchanged for a second consecutive meeting Thursday.

Know More

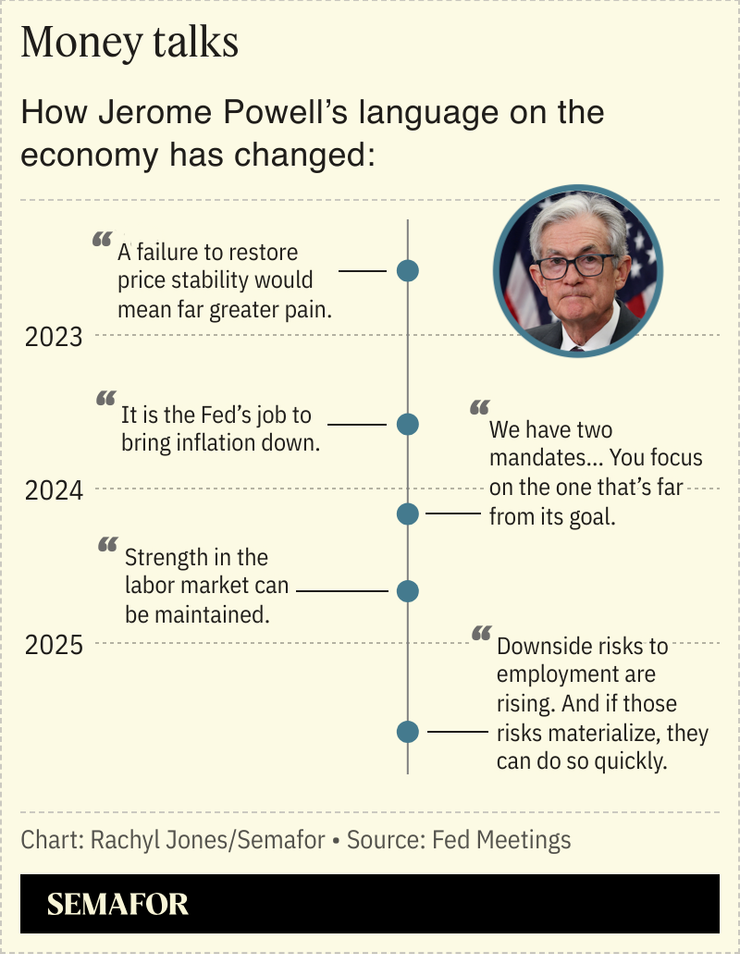

The Fed’s focus has shifted over the past year from one part of its job (keeping prices stable) to the other (keeping unemployment low). That “dual mandate” has been increasingly in tension, and solving one problem tends to exacerbate the other.

Here’s how Fed Chair Jerome Powell’s language has evolved as the risks to the economy have changed.