The News

The grocery aisles are getting crowded. Activist Elliott Management’s $4 billion stake in PepsiCo is the latest bit of corporate drama and potential dealmaking in the food sector — at a time when tariffs, shifting tastes, and the uptake of GLP-1 drugs make the outlook for how and what consumers eat murkier than ever.

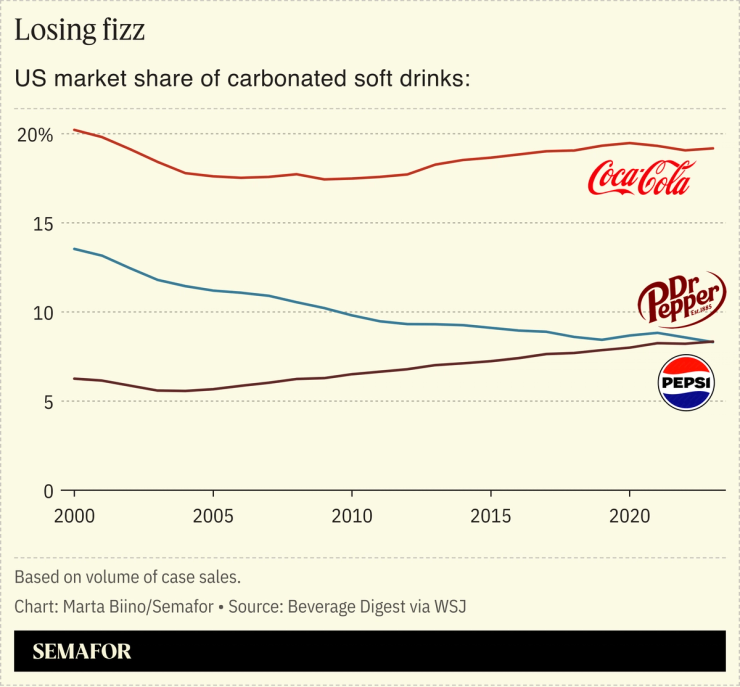

Pepsi, long No. 2 to industry leader Coca-Cola, slipped behind Dr Pepper last year in beverage sales, which Elliott blames partially on its insistence on owning its bottling operations while others outsource. Its food business, which includes Lay’s chips, Quaker, and Rice-A-Roni, is no longer strong enough to paper over its beverage weakness; Elliott suggests some pruning.

“PepsiCo maintains an active and productive dialogue with our shareholders and values constructive input on delivering long-term shareholder value,” the company said in a statement.

That could add momentum to an already hot stretch of dealmaking that includes Mars buying Kellanova, Keurig Dr Pepper’s coffee machinations, and the long-awaited split-up announced today of Kraft Heinz that unwinds its 2015 megamerger.

Know More

Meanwhile, the American pantry is a fast-changing jumble of contradictions and politics. Protein is everywhere. So are GLP-1s, coming soon in pill form. RFK Jr. has extracted real concessions on food dyes that will require companies to revamp their supply chains and hit the lab. Pinched consumers are embracing white-label products over brands, “turning a short-term inflation response into a more permanent consumer mindset,” one marketing firm notes worryingly for the PepsiCos of the world.